Below is an excerpt from ISS-Corporate’s recently released paper “Korea Proxy Season Review: Examining the Value-Up Transition”. The full paper is available for download from ISS-Corporate’s resources page.

Introduction

South Korea’s Value-Up Program has emerged as the country’s most ambitious attempt in two decades to bridge the “Korea discount” and modernize corporate governance. Since its February 2024 launch and subsequent 2025 expansion, the initiative has spurred measurable shifts—from improved capital distribution to rising levels of investor engagement. Yet as the 2025 proxy season closed, the spotlight turned to durability: will these initial reforms solidify into lasting frameworks that can support long-term value creation?

Investors are now monitoring execution, scrutinizing board effectiveness, pay alignment, capital return policies, and the quality of disclosure surrounding Value-Up strategies. This review unpacks key data trends across KRX-listed companies and assesses how Korean corporates compare to global peers in this unfolding chapter of reform.

Return to Shareholders is Rising but Still Lags Major Global Markets

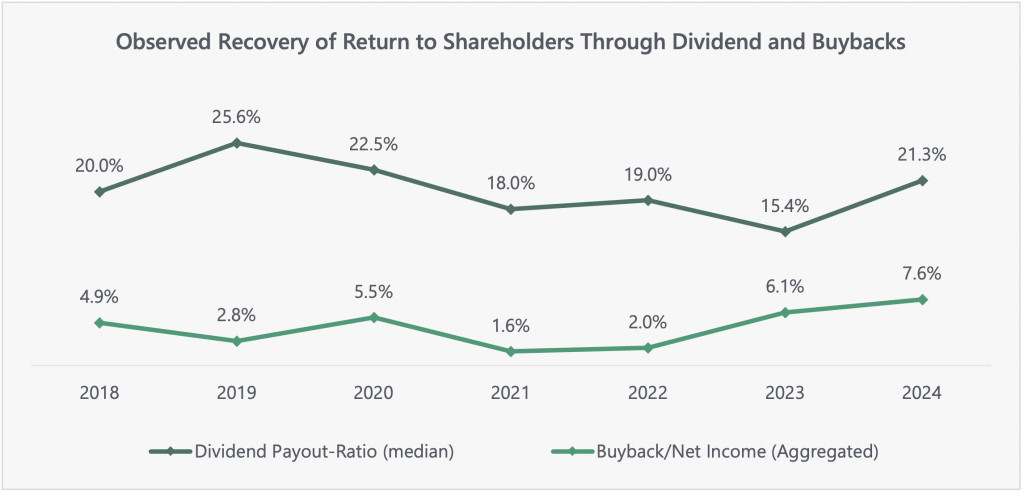

South Korea is making encouraging progress in terms of shareholder returns, with recent increases in dividends and share buybacks signaling a growing recognition of the importance of capital distribution. Following a steady decline since the pandemic, the median dividend payout ratio rebounded sharply to 21.3% in FY2024 following the launch of the Value-Up program. Companies repurchased shares equivalent to 7.6% of net income in 2024, the highest level in the past seven years and nearly quadruple the 2021 figure.

Source: Alphasense, based on Jun 19,2025 for KRX100; Note: Based on fiscal years.

Yet, the mechanics of these buybacks remain a point of contention. While global investors expect repurchased shares to be promptly canceled, many Korean firms continue to hold them as treasury stock, delaying the realization of returns. This practice, often justified as preserving financial flexibility, risks being perceived as an entrenchment tool that consolidates insider control rather than benefits long-term shareholders.

Cases of misuse, such as reissuing or donating treasury shares to friendly parties or using them to thwart shareholder proposals, have deepened skepticism. As a result, investors continue to discount buyback announcements, unless they are accompanied by clear cancellation commitments. This shows deep-rooted doubts about the credibility of capital return strategies in the absence of structural governance reforms.

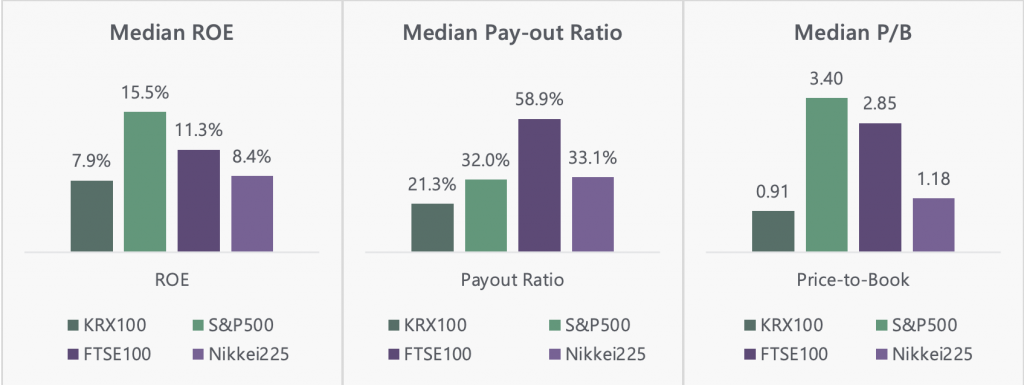

Despite the recent uptick, Korea’s Return on Equity (ROE) at 7.9% remains below the global norm, where the S&P 500 posts 15.5%, FTSE 100 stands at 11.3%, the Nikkei 225 at 8.4%. The median dividend payout ratio of 21.3% significantly trails the S&P 500’s 32.0% and Nikkei’s 33.1%, reinforcing concerns that capital returns still lack the structural depth seen in advanced economies. Investors remain cautious, and Korea’s low Price-to-Book (P/B) ratio could signal continuing skepticism over adequate and sustainable shareholder returns.

Source: AlphaSense, based on Jun 19, 2025 for KRX100; Note: Based on fiscal years

By:

Ingo Tietböhl, Associate Vice President, Senior ESG Advisor APAC, ISS-Corporate

Herman Choi, Vice President, Head of APAC Advisory, ISS-Corporate