Lithium: Tech Revolution, Oversupply, and Now EV Enabler

The advent of lithium batteries catapulted electrical device technology to a new level. Initially invented in 1970 by Exxon ahead of the first oil crisis, lithium (Li) batteries became commercially viable in the early 1990s, enabling the development and ubiquity of small-form mobile phones by the late 1990s.

Lithium allowed batteries to be lighter, smaller, longer lasting, and low maintenance. They can be charged thousands of times before needing replacement. By the mid-2000s, lithium battery prototypes were being developed for electric vehicles (EVs).

It would be difficult to overstate the importance of lithium for the energy transition and Net Zero. Without Li, the EV revolution would arguably be impossible. As a result, demand is expected to grow significantly as the world shifts from internal combustion engines to EVs.

Lithium security has become a top priority for nations, companies, and investors. To supply battery production, companies have entered into agreements and in many cases taken equity stakes in supply (for example, Tesla’s involvement in a US lithium deposit). Supply security has become more important than price as the market tightens.

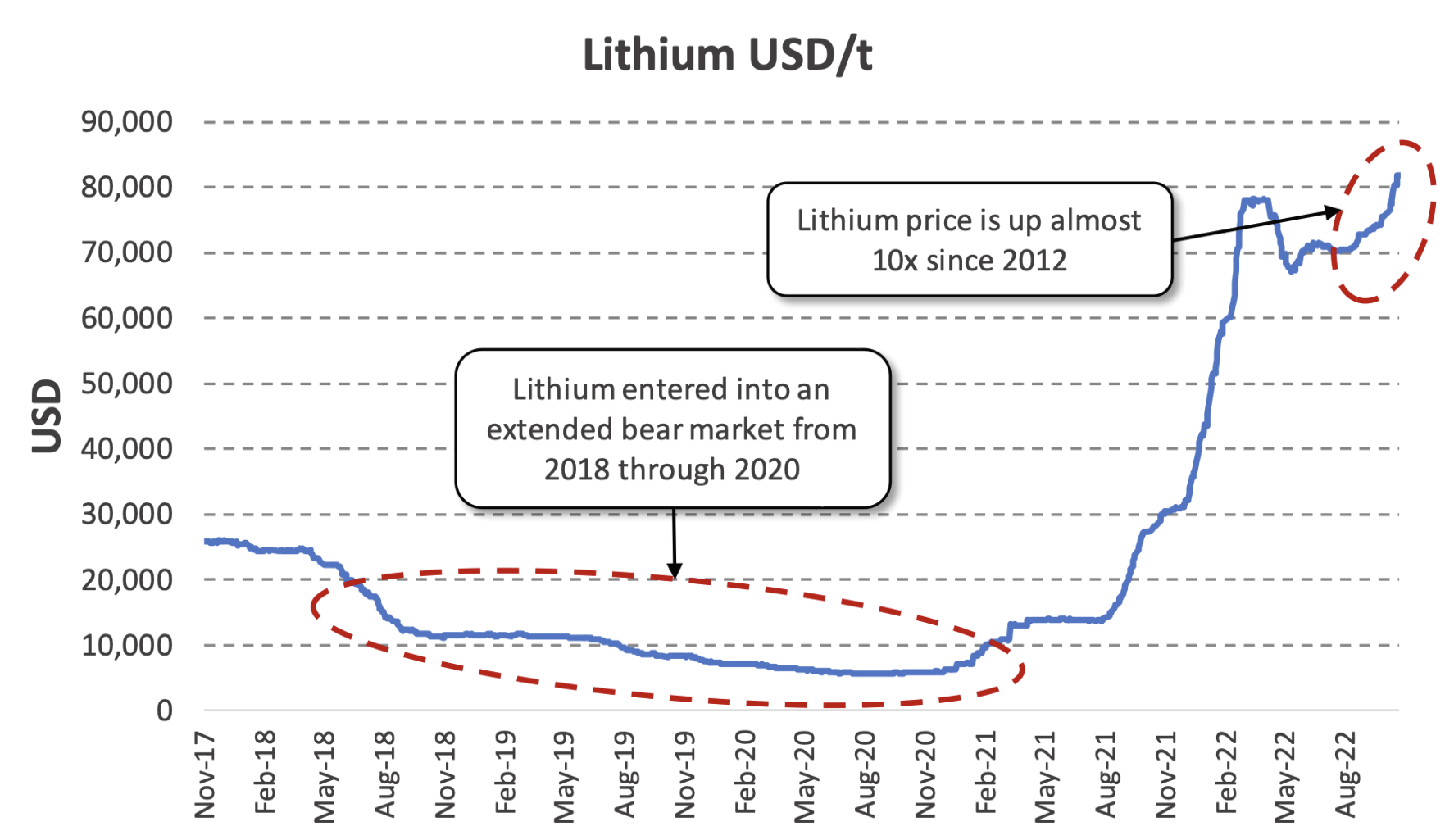

This situation explains the price dynamics shown in Figure 1, where lithium went from a period of relative tightness in 2017 to oversupply through 2020 and then became impressively tight in 2021. The trend of tight supply and high prices continued into this year, as EV production growth requires an estimated 2-3kg or more of lithium per vehicle.

Figure 1: Lithium Price Shows Supply Has Become Tight

Source: tradingeconomics.com, ISS ESG

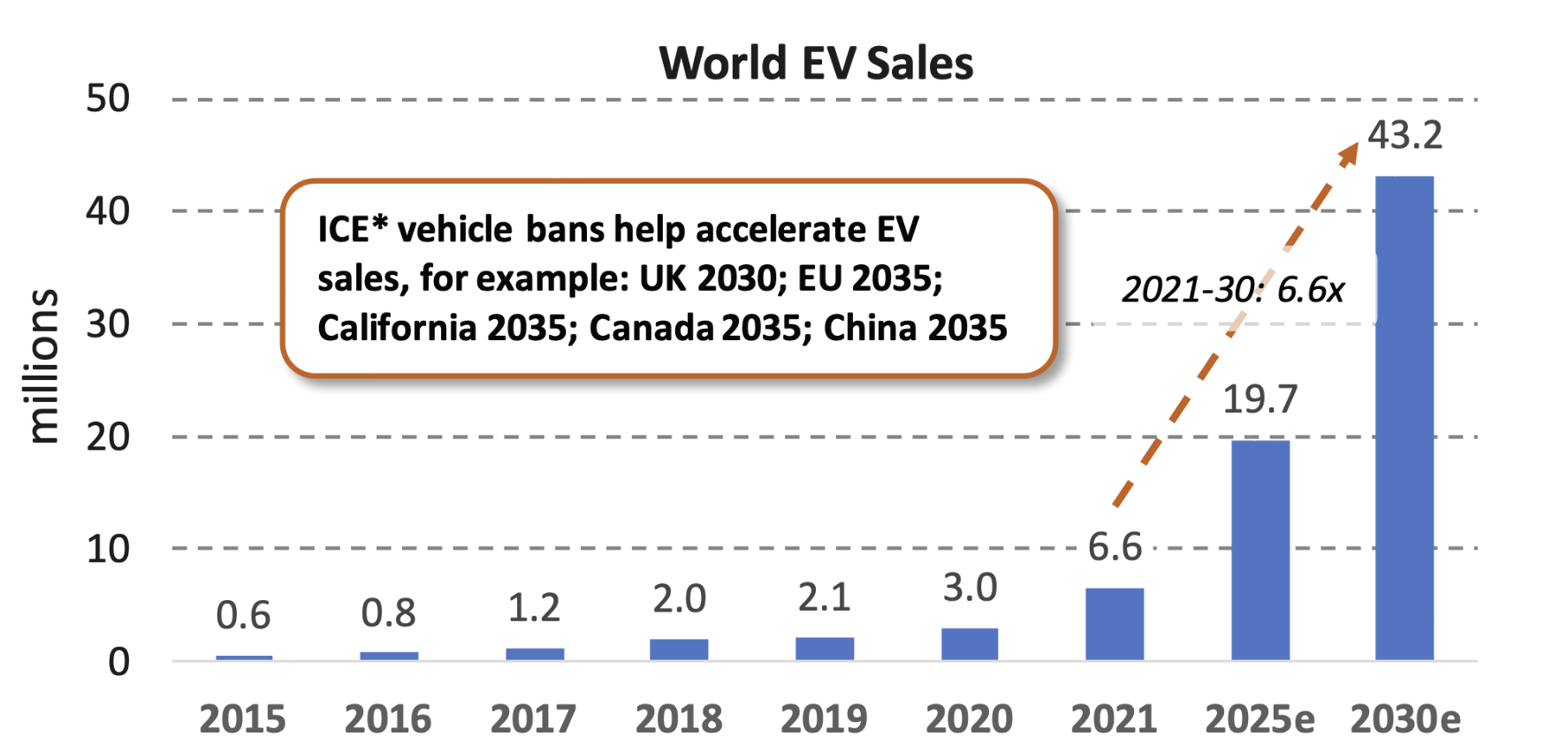

As shown in Figure 2, EV sales are growing rapidly, which drives lithium demand. EV sales more than tripled from 2019 to 2021. The IEA forecasts sales to increase by more than 6.6x from 2021 to 2030. EVs in this graph include both battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs), with the ratio of BEVs growing over time. We see further EV production growth beyond 2030, with production likely to double again, as EVs continue to substitute for internal combustion light vehicle sales that currently run at circa 80 million per annum.

Figure 2: Electrical Vehicle Sales Growth Drives Lithium Demand

Note: e = IEA estimates; *ICE = internal combustion engine

Source: IEA, ISS ESG

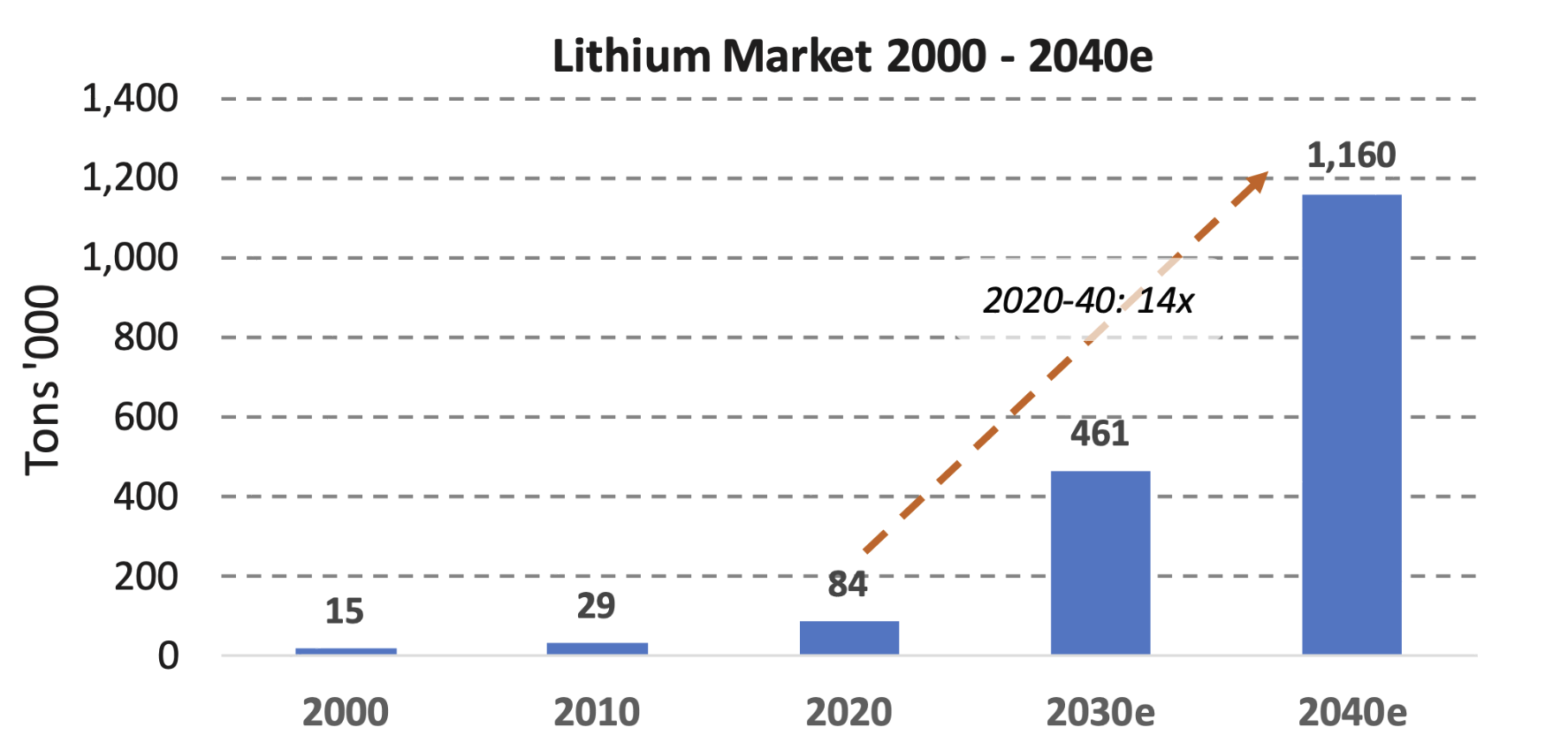

Lithium Demand Projected to Grow 14x

In its Sustainable Development Scenario, the IEA expects lithium demand to grow from less than 100 kt in 2020 to over 1 mt by 2040. Figure 3 shows historical lithium demand through 2020 and the International Energy Agency’s demand forecast in its Sustainable Development Scenario (SDS). SDS is consistent with maintaining a long-term temperature increase that is well below 2.0°C but somewhat higher than the agency’s Net Zero scenario.

Figure 3: IEA Sustainable Development Scenario Forecasts >10x Lithium Demand Growth by 2040

Note: e = IEA lithium demand Sustainable Development Scenario estimates

Source: United States Geological Survey (USGS), IEA, ISS ESG

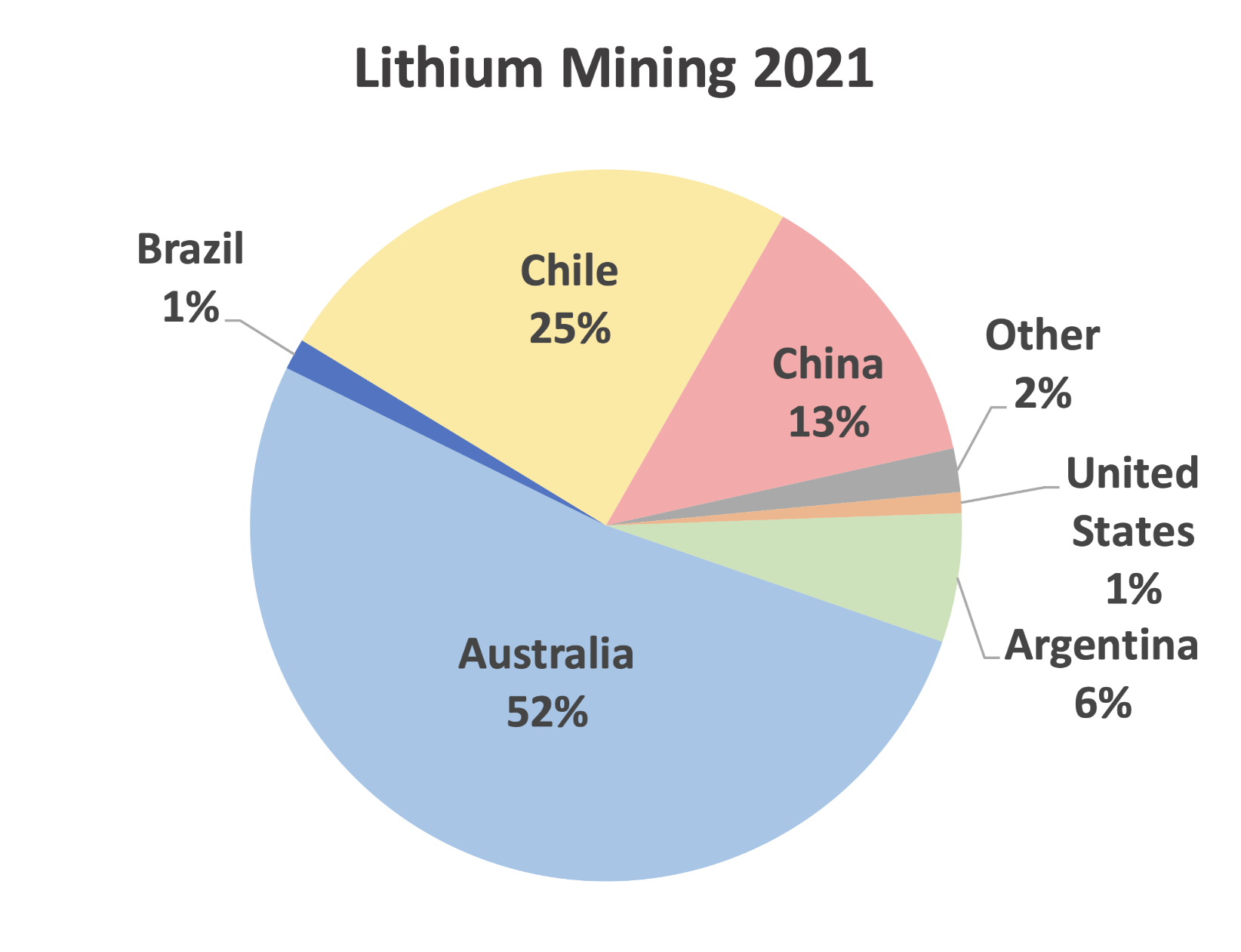

Lithium Mining: Concentrated but Ample Supply

Three countries comprise 90% of lithium production, as shown in Figure 4. Such market concentration raises concerns. Mitigating this risk is the fact that 77% of global supply is produced by OECD countries Australia and Chile, both with well-developed mining codes, worker protections, and enforcement. Nevertheless, the concentrated market represents some risks: for example, there may be a disruption of shipping lanes from Australia or another major earthquake in Chile.

Figure 4: Current Global Lithium Production (by Country)

Source: USGS, ISS ESG

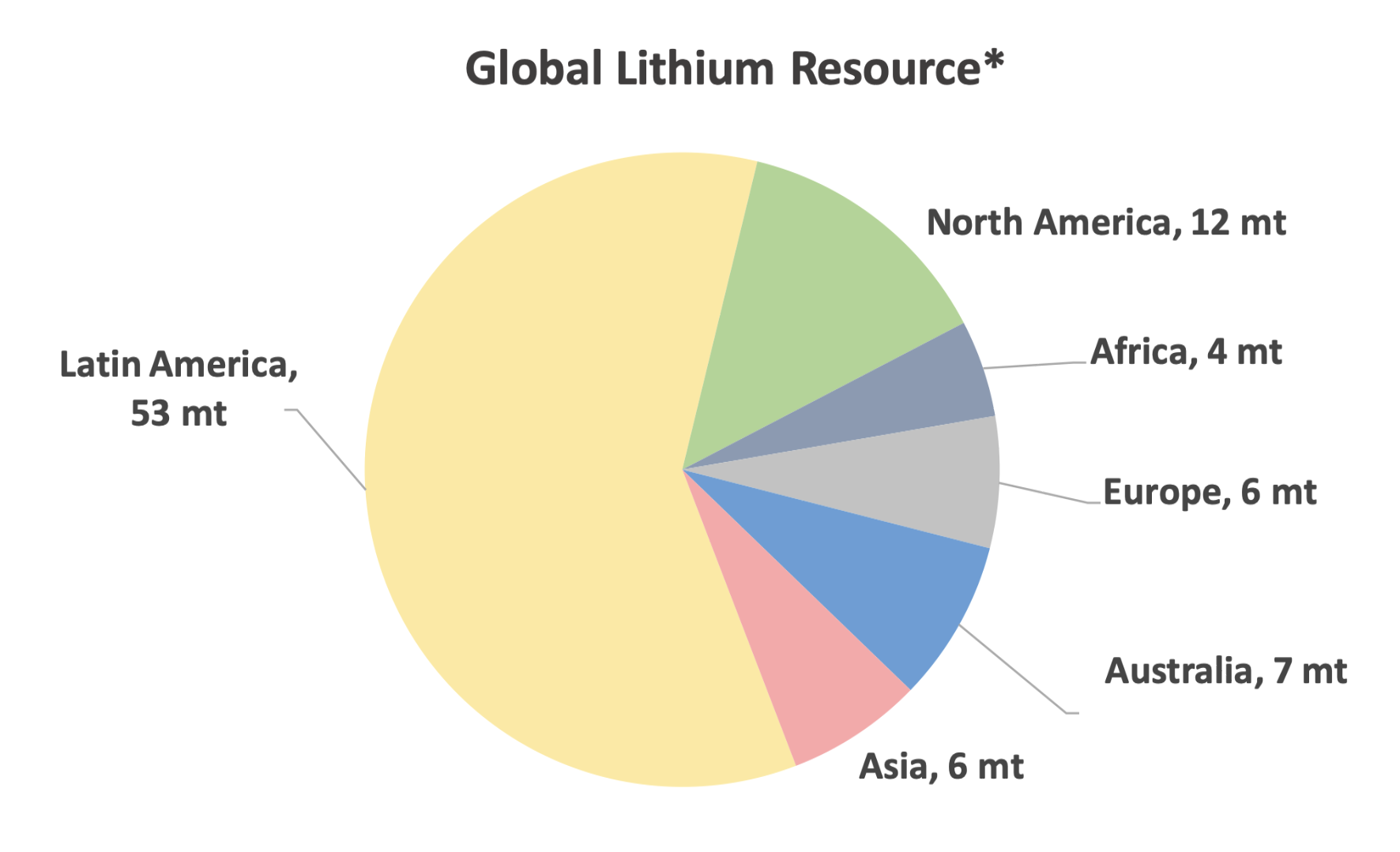

There are ample resources to be developed for future supply. Figure 5 shows total lithium resources around the world. The picture is markedly different from Figure 4 due to untapped deposits in Latin America (mainly brine in the Bolivian salt flats, but also additional Chilean and Argentinian resources) and North America (primarily Thacker Pass, a large lithium deposit in Nevada).

Figure 5: Lithium Resources Largely in the Americas

* includes inferred, indicated, and measured reserves

Source: USGS, ISS ESG

Ample resources, but also resistance. Estimated global lithium resources total over 80 million tons relative to current annual consumption of about 106 ktpa and forecast 2030 consumption of 1.2 mtpa, indicating ample resources relative to future needs. Of course, some deposits may never achieve production status. Local resistance to lithium mining has had an impact. For example, in 2022 the Serbian government pulled the plug on the Jadar lithium project, predicted to be one of the largest in the world, following protests from environmentalists and local communities. Even in lithium-exporting countries such as Australia, new projects have faced civil and legal scrutiny in recent years, and large-scale integrated projects such as in Thacker Pass, Nevada, US, have been fiercely opposed by local communities.

Lithium Mining Companies: Concentrated without ESG Stand-Outs

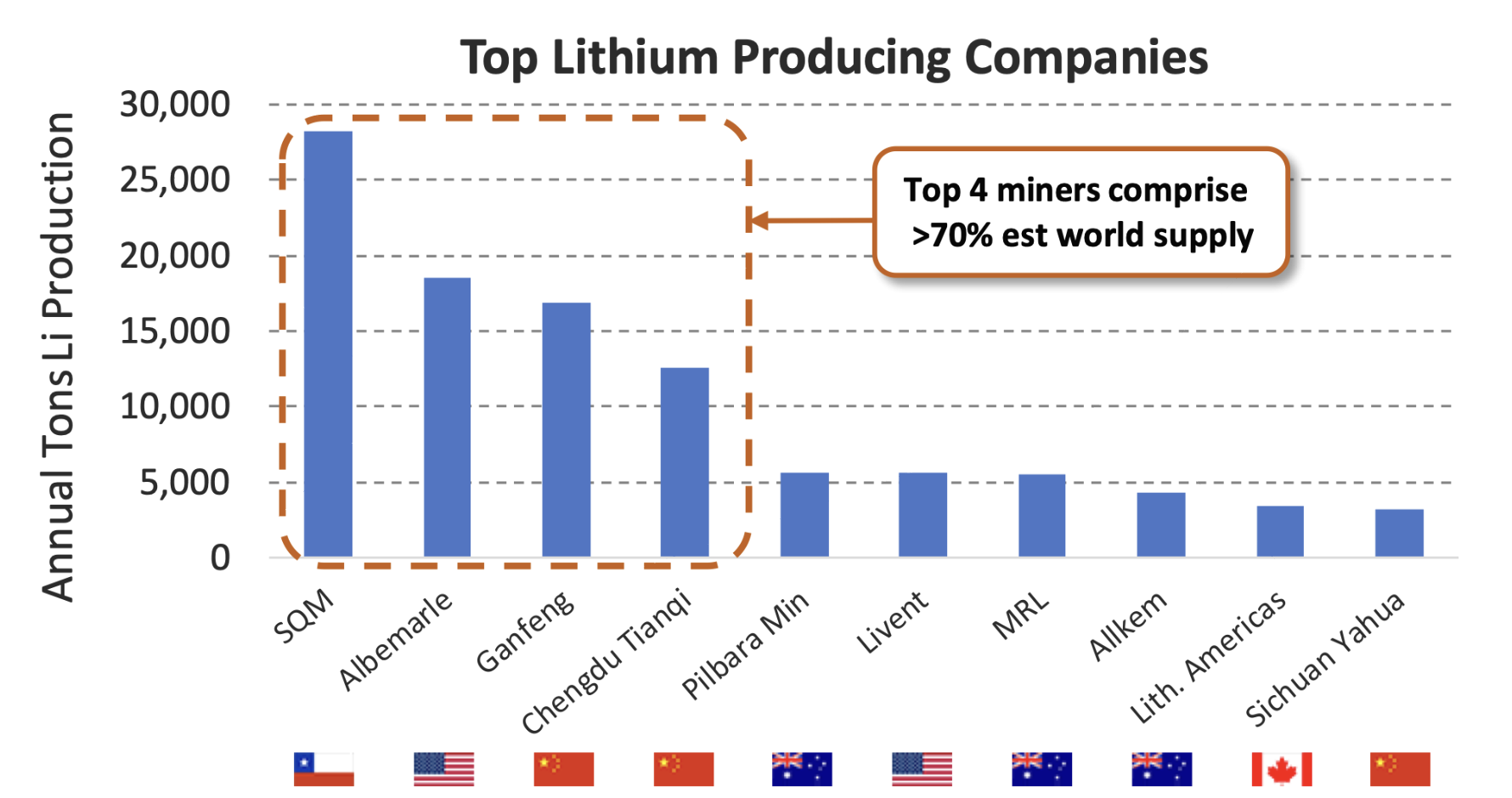

Similar to country output in Figure 4, we see concentration among lithium mining companies in Figure 6. The top four miners comprise >70% of estimated world supply. The largest, SQM, is Chilean, and the second, Albemarle, is an American firm. Australian and Chinese firms are also well-represented in the top 10. We look at country ESG performance below.

Figure 6: Lithium Production is Concentrated among a Small Number of Companies

Source: Company reports, ISS ESG

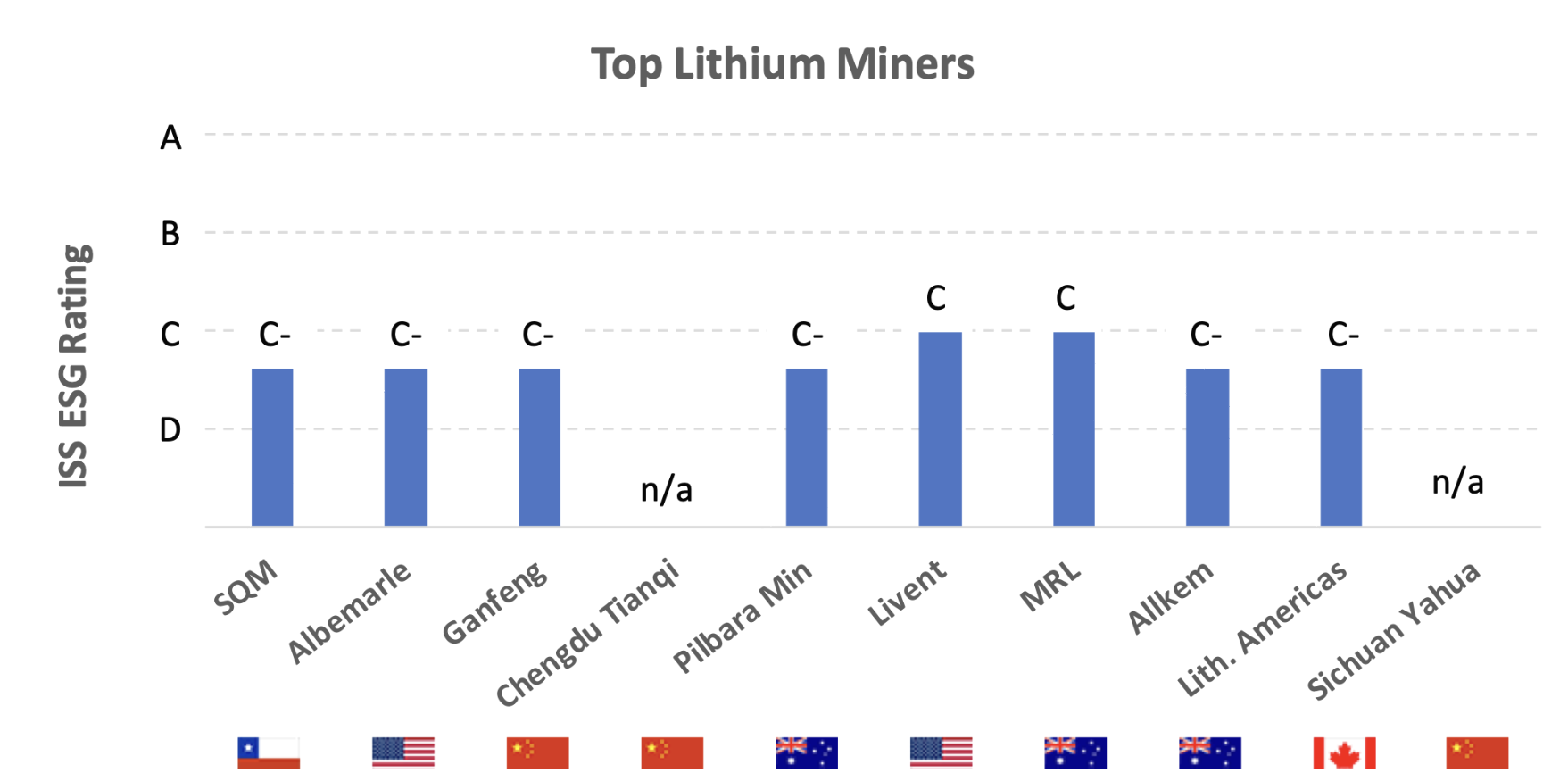

Lithium miners’ current ESG performance is not great but offers opportunities, as shown in Figure 7. ISS ESG Corporate Rating results for lithium miners are concentrated around C and C-. Other mining subsectors have a significantly greater spread of results. A review of individual company ratings shows no consistent drivers for this clustering.

Figure 7: No Standout ESG Scores among the Lithium Miners

Source: ISS ESG

While most companies make a reasonable effort to disclose their policies and environmental footprints, significant opportunities for improvement exist in a range of sustainability-related topic areas, including:

- more ambitious environmental policies;

- net zero targets; and

- better indigenous rights enforcement.

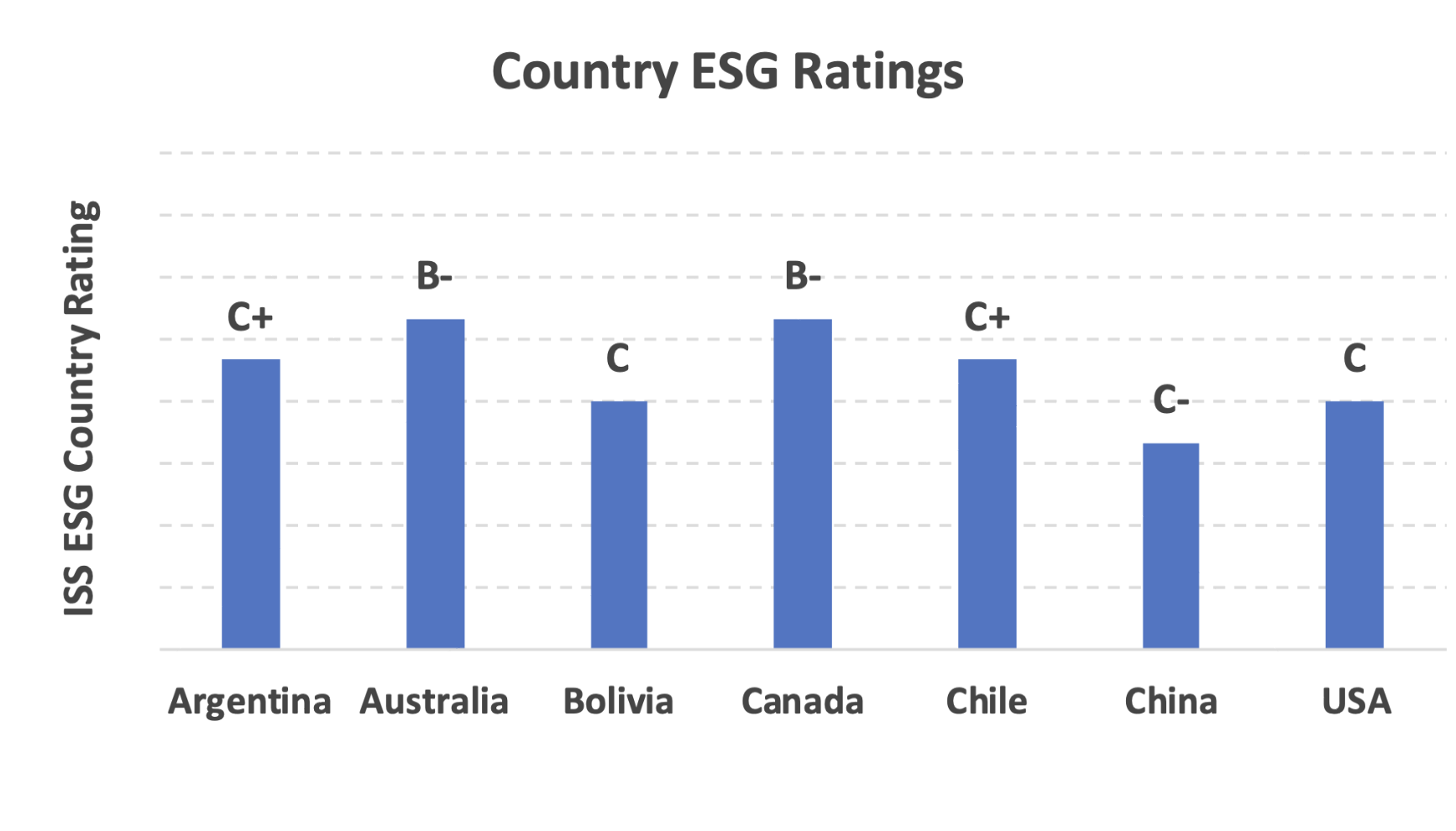

Several companies have been involved in severe controversy cases identified by ISS ESG’s Norm-Based Research (NBR) team, mainly related to failures to observe environmental impacts and indigenous rights. Figure 8 shows that among those countries with a significant presence in either lithium or lithium-ion battery production, Australia and Canada have the best ISS ESG country scores.

Figure 8: Australia and Canada Highest among Lithium Supply Chain Countries

Source: ISS ESG

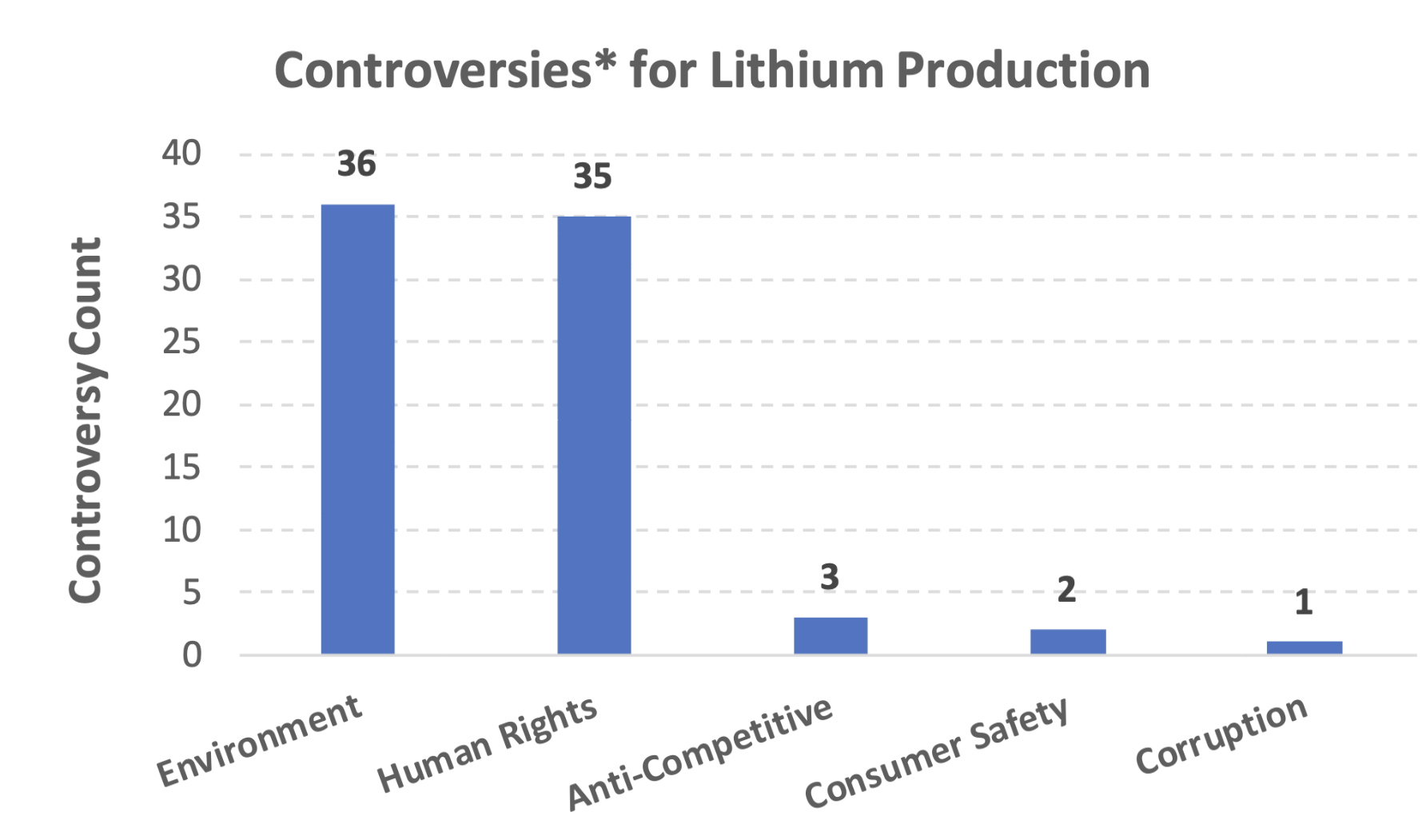

Lithium production controversies center on the environment and human rights, as shown in Figure 9. In contrast to ISS ESG’s recent note on cobalt (Insights: Cobalt Conundrum), fewer labor rights controversies and more environmental controversies can be observed. Corruption controversies are also relatively rare.

Figure 9: Lithium Controversies Center on the Environment and Human Rights

Source: ISS ESG Norm-Based Research

* ISS ESG Norm-Based Research assesses companies’ adherence to international norms on human rights, labor standards, environmental protection, and anti-corruption, as set out in the UN Global Compact and OECD Guidelines.

Water: A Primary Lithium ESG Concern

Depending on the form of extraction, producing a ton of lithium can consume over 2 million litres of water. The two primary forms of lithium extraction are hard-rock mines (common in Australia) and brine evaporation (often found in Latin America). While hard-rock mines (producing mainly spodumene, a lithium-bearing mineral) use moderate amounts of water, almost half of lithium production comes from lithium brine deposits. Lithium brine mining is a water-intense process, using an estimated 2.1 million litres of brine water to produce one ton of lithium.

Complicating issues, brine mines are generally located in arid basins such as Chile’s Atacama Desert where water scarcity is already a problem. Indeed, three of the world’s highest lithium reserve countries, Chile, Argentina, and Bolivia, exhibit medium to high levels of baseline water stress, according to the WRI Water Risk Index. These three South American countries form the ‘Lithium Triangle’ and contain 56% of the world’s known reserves, according to the US Geological Survey. Investors interested in examining company-level risks in this area can utilize ISS ESG’s new Water Risk Rating. The rating determines the risk exposure of a particular company, and then assesses practices and efforts taken to mitigate that risk.

Lithium brine mines may impact water levels in arid areas. While lithium brine is suitable for neither human consumption nor agriculture, its extraction from the groundwater system may well have knock-on impacts on freshwater supplies. It has been linked to the lowering of groundwater levels and desertification. Chilean government studies have identified a water balance deficit in the Atacama region. Key stakeholders have stated that lithium demand represents a wave of ‘green extractivism’.

Lithium extraction areas are often situated in or near indigenous communities. Failure to consult indigenous communities when planning or operating these mines has resulted in several severe NBR controversies (a human rights category presented in Figure 8 above). Formal negotiation processes with local communities are yet to be established as a regulatory requirement for operators in many countries (Chile is an exception, having adopted the global accord on indigenous rights).

As for most metal processing, failure to control toxic chemicals in the processing phase can lead to water pollution, biodiversity loss, and air emissions. Such environmental impacts have inevitably generated conflict with local communities. For example, in Argentina’s Salar de Hombre Muerto region, communities claim that lithium operations contaminated water sources used for humans, livestock, and crop irrigation. Elsewhere, a toxic chemical leak from the Ganzizhou Rongda Lithium mine in Tibet poisoned the local river and sacred grasslands, leading to widespread protests in the region in 2016.

A Key Concern in the Supply Chain: Battery Production

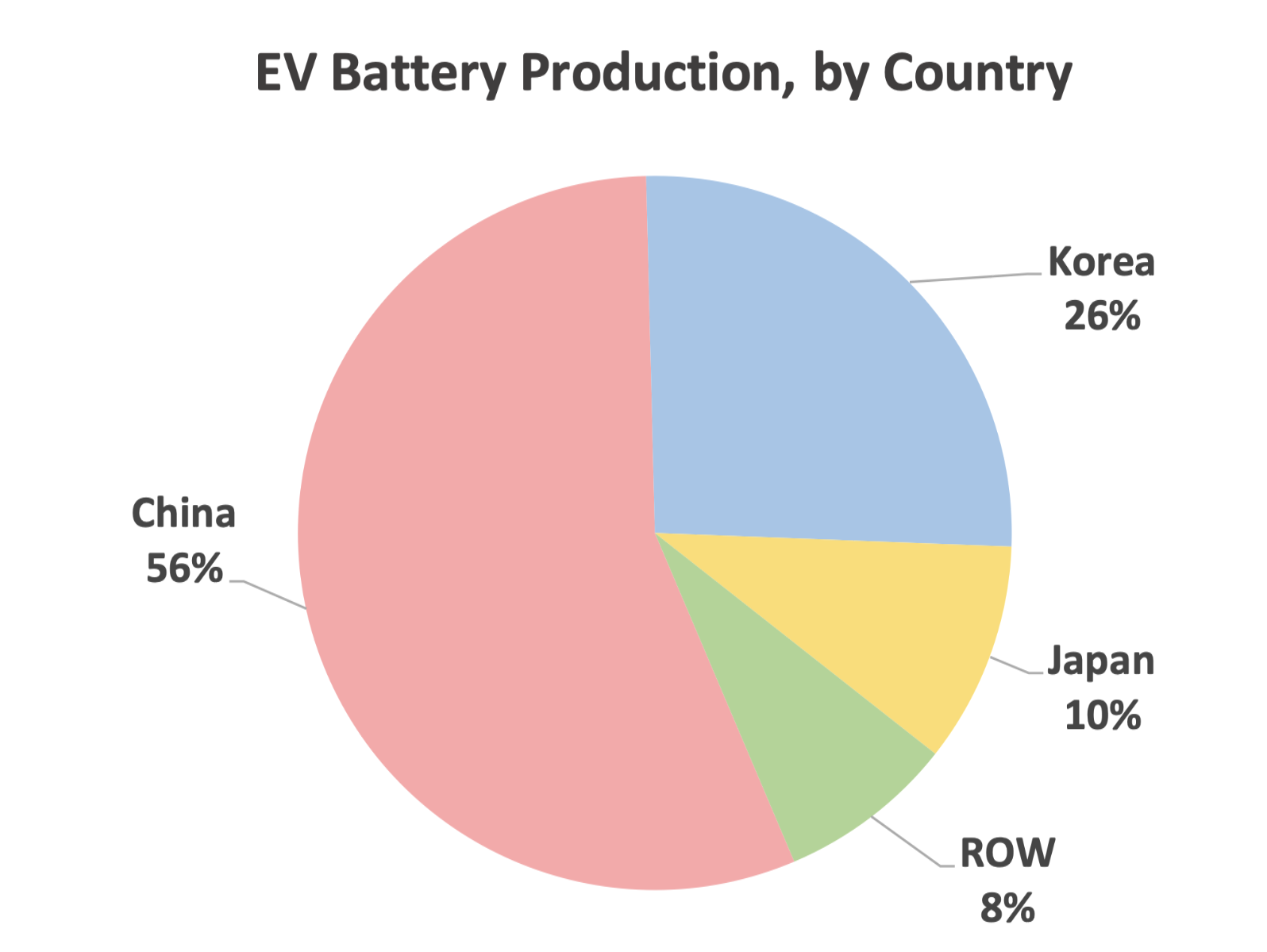

In contrast to lithium mining, lithium-ion EV battery production is dominated by a single country, China. Figure 10 shows that 56% of global EV battery production capacity is concentrated in China, with South Korea in second place at 26%. Asia thus accounts for over 90% of global EV battery production capacity.

Single-country dependence risk for any material is of societal concern, as highlighted by the energy and food crises of recent years, as well as the ongoing US/China trade conflict, which has led to restrictions in access to advanced integrated circuitry and other technologies.

Figure 10: China Dominates EV Battery Production

Source: VisualCapitalist

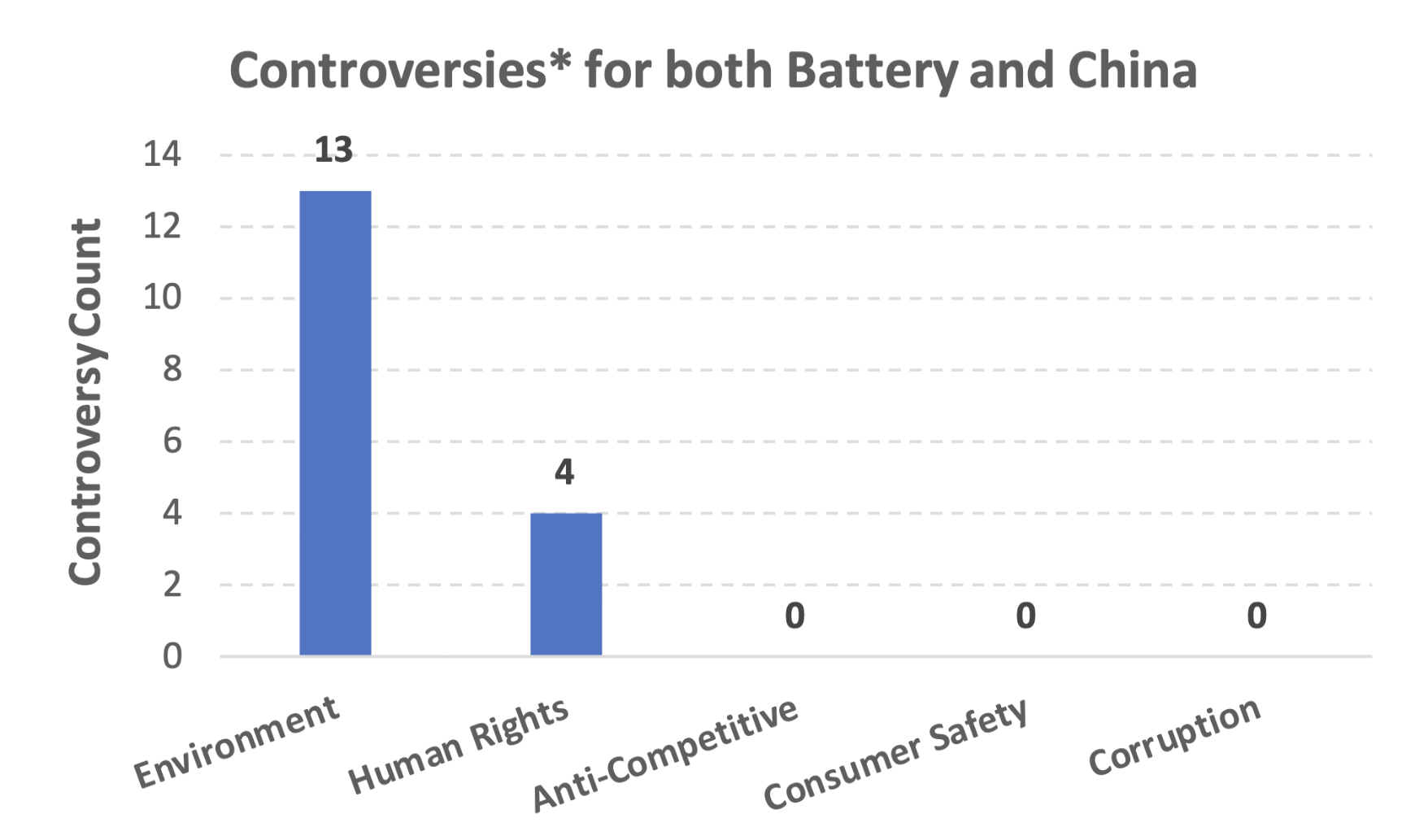

ISS ESG sees significant environmental controversies involving battery manufacturing. Figure 11 shows ISS ESG-identified controversies involving “China” and “Battery” search terms. Interestingly, our search produced only four human rights controversies, despite ongoing controversy regarding labor conditions in western China.

Figure 11: Battery and China Controversies Center on the Environment and Human Rights

Source: ISS ESG Norm-Based Research

* ISS ESG Norm-Based Research assesses companies’ adherence to international norms on human rights, labor standards, environmental protection, and anti-corruption, as set out in the UN Global Compact and OECD Guidelines.

The good news is that while lithium deposits are fixed, battery production can be located almost anywhere. Lithium-ion battery production capacity has grown from less than 30 GWh in 2015 to over 1 TWh today, and is expected by some to exceed 6 TWh by 2030. Where that capacity is located can be shaped by governments, companies, and investors. The environmental and human rights risks of these facilities are easier to manage than those in mining, as battery production can be located in areas that are already established with existing infrastructure and strong labor laws.

The Role of Active Asset Ownership

Stakeholder-focused investors have an important role to play. Single-source supply chain risk, environmental impact, human rights abuses, and labor practices are all significant concerns present in the lithium mining and battery production industries.

Investors and active asset owners can demand greater transparency in the lithium supply chain. Capital can be channeled to those regions and companies with the best sustainability records, or alternatively active owners can demand better practices from companies with poor ESG performance.

Last but not least, investors seeking to generate real-world outcomes can explore opportunities to finance new production in jurisdictions with better worker and environmental protections. ISS ESG products such as the ESG Country Rating, ESG Corporate Rating, Water Risk Rating, and Norm-Based Research, can assist investors as they pursue these opportunities.

Explore ISS ESG solutions mentioned in this report:

- Identify ESG risks and seize investment opportunities with the ISS ESG Corporate Rating.

- Assess companies’ adherence to international norms on human rights, labor standards, environmental protection and anti-corruption using ISS ESG Norm-Based Research.

- Access to global data on country-level ESG performance is a key element both in the management of fixed income portfolios and in understanding risks for equity investors with exposure to emerging markets. Extend your ESG intelligence using the ISS ESG Country Rating and ISS ESG Country Controversy Assessments.

- Access a holistic assessment of companies’ exposure to freshwater-related risks using the ISS ESG Water Risk Rating.

By: Nicolaj Sebrell, CFA, Head of Energy, Materials, & Utilities, ISS ESG

Arthur Kearney, Associate, Metals & Mining, ISS ESG