Fallout from the David vs. Goliath battle that pits retail traders led by the WallStreetBets Reddit group against several hedge funds and others that had shorted GameStop and other “meme stocks” could carry into the 2021 proxy season. The dizzying heights reached by these companies’ stocks won’t last as short squeezes subside, but the timing of share price spikes may complicate boards’ deliberations on executive compensation at impacted firms.

The stock price spikes are epic in scope. Poster-child GameStop reached an all-time closing high of $347.51 on January 27 after opening the year under $19. WallStreetBets traders also targeted other highly shorted companies in the retail sector including Express and Bed Bath & Beyond. Express shares rocketed from under $1 at the start of 2021 to reach a closing high of $9.55 on January 27. Bed Bath & Beyond shares peaked at $52.89 on January 27 after starting the year under $18.

The timing of these price surges may impact compensation programs at the targeted firms. Many retail sector companies close their fiscal years at the end of January, like GameStop and Express, or February, as Bed Bath & Beyond does. With a precipitous rise in share price in the final days of the fiscal year, GameStop will be able to headline an annual TSR of over 8,000% and a three-year TSR of over 1,800%. Paltry by comparison, Express was pushed to an annual TSR of over 40%, although three-year TSR remains negative. Finally, while Bed Bath & Beyond has not reached its fiscal year end, its current trading price would yield strongly positive one- and three-year TSR.

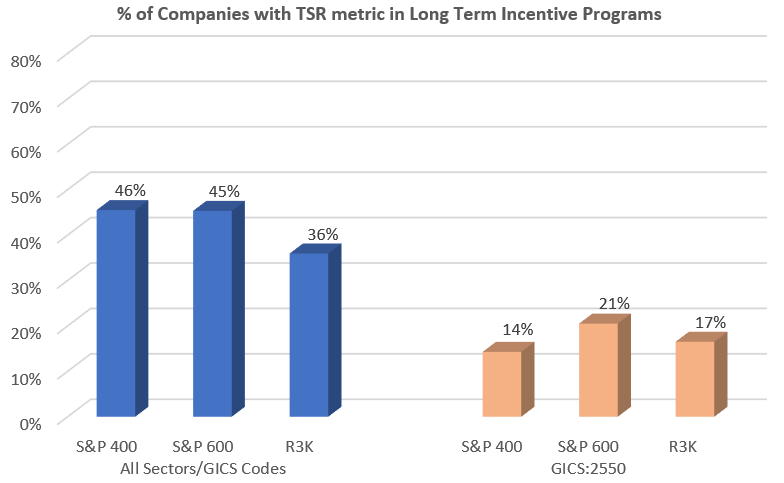

The significant upswing in prices of each company at the proverbial eleventh-hour of the fiscal year would have ramifications on closing cycle incentive payouts if TSR was included as a metric in any long-term incentive programs. According to ISS data, for grants disclosed in their most recent proxy statements, approximately 36% of R3K companies included a TSR metric, most commonly a modifier, in their long-term incentive programs. Rates of inclusion are slightly higher in the small-cap S&P 600, of which Express and GameStop are a part, and the mid-cap S&P 400 where Bed Bath & Beyond is a component.

A deeper look at just the retail sector (2550 GICS code classification) shows that only approximately 17% of retailers in the R3K included a TSR metric in their most recent long-term incentives. Both Express and Bed Bath & Beyond were part of a small group of retailers to include a TSR metric in their most recent grants. At Express, three-year TSR performance relative to the Dow Jones U.S. Retail Apparel Index will be used to modify payouts, if any, for adjusted EPS achievement, while a portion of performance shares granted at Bed Bath & Beyond will vest based on relative TSR performance against peers. The same TSR modifier was used in the closing cycle performance period at Express, while no closing cycle awards at Bed Bath & Beyond utilize a TSR metric. GameStop, on the other hand, has not used a TSR metric in its long-term incentive program since the inception of the say-on-pay proposal.

Other companies outside of the retail sector have also seen parabolic rises in share price over a matter of days as WallStreetBets traders expanded their focus. The table below shows the increases in certain impacted companies.

| Company | Closing Price Dec. 31, 2020 | January 2021 Closing High | % Change |

| GameStop, Inc. | $18.84 | $347.51 | 1,744.5% |

| Express, Inc. | $0.91 | $9.55 | 949.5% |

| Bed Bath & Beyond, Inc. | $17.76 | $52.89 | 197.8% |

| Koss Corporation | $3.44 | $64.00 | 1,760.5% |

| AMC Entertainment Holdings, Inc. | $2.12 | $19.90 | 838.7% |

| iRobot, Inc. | $79.38 | $161.16 | 103.0% |

| Blackberry, Inc. | $6.63 | $25.10 | 278.6% |

| Naked Brand Group Limited | $0.19 | $1.65 | 768.4% |

While share prices for these impacted companies are now well below their January highs, most nonetheless remain significantly above their 2021 starting points. As we look ahead, new incentive grants which utilize a share price or TSR metric may wind up starting from an elevated share price point in a period of volatility. Given the potential for ongoing volatility, many investors may also want to closely scrutinize closing performance cycles to determine whether payouts were based on such inflated TSR results.

By Robert Kalb, Associate Vice President, US Research, ISS Governance Solutions