Introduction

As the world tries to reduce greenhouse gas emissions, a growing coalition of countries, cities, businesses, and other institutions are pledging to achieve Net Zero emissions. More than 70 countries, including the biggest emitters – China, the United States, and the European Union – have set a Net Zero target, covering about 76% of global emissions.

In Europe, the European Union (EU) has set an ambitious target, under its European Green Deal and Fit for 55 initiatives, of reaching Net Zero emissions by 2050. European countries, including the United Kingdom and Germany, have laid out climate strategies to reach their national ambitions. These strategies include domestic investments in areas such as carbon capture technology, hydrogen projects, efficient energy consumption initiatives, and expansion of renewable projects. In the private sector, many companies operating in Europe have made their own commitments to achieving Net Zero emissions.

This analysis assesses the pledges of companies in Europe that have committed to Net Zero emissions, examining the scope and nature of these commitments. While many companies have made commitments to achieving Net Zero emissions, the progress towards achieving these targets varies widely. Whether Europe makes the transition to a Net Zero economy may depend on governments, businesses, and civil society organizations working together to create an enabling environment that supports such a transition.

ISS ESG Assessments of Net Zero Commitments

As mentioned in the Insights post “Net Zero Pledges in Asia Pacific,” ISS ESG assessed 2,650 publicly traded top companies worldwide from high greenhouse gas (GHG)-emitting sectors (as defined by the NZAOA) such as Energy, Materials, Utilities, and Industrials. The companies assessed also included all companies in the Climate Action 100+.

The evaluation of these firms considers their publicly declared commitments to achieving Net Zero, their targets for reducing GHG emissions in the short term, and their plans for decarbonization. The assessment covers the entirety of a company’s emissions: Scope 1, Scope 2, and Scope 3, including sector-specific relevant Scope 3 categories under the Net Zero target, as well as intermediate GHG reduction targets.

Net Zero Commitments in the Europe Region

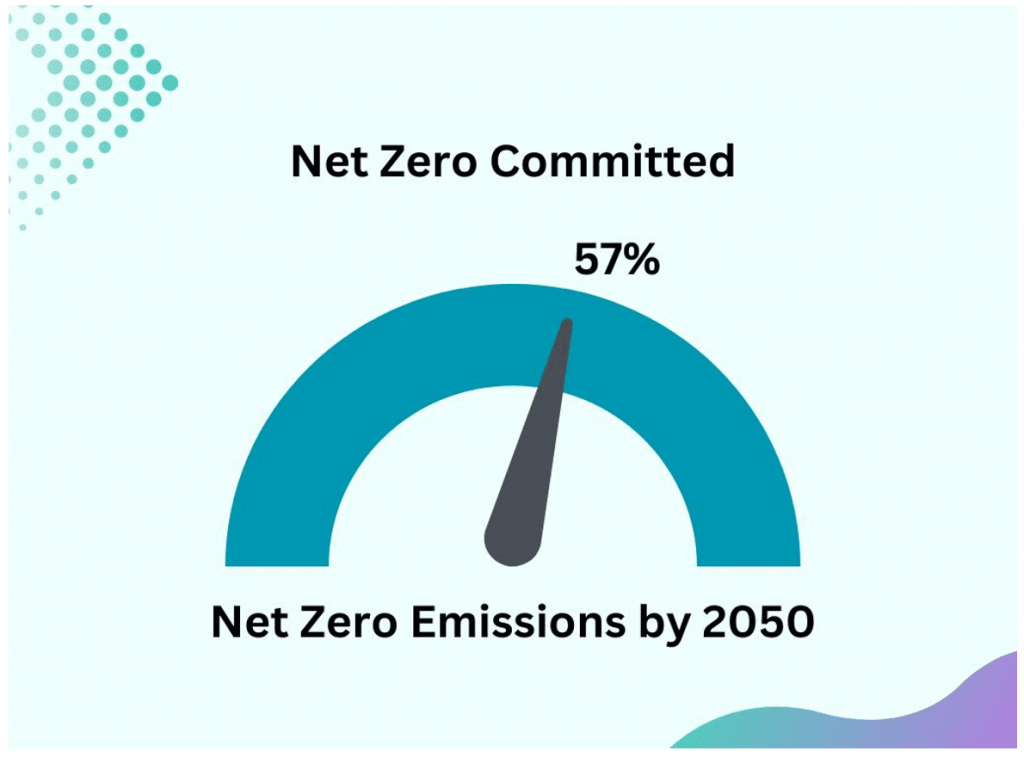

According to the analysis of 500+ companies from high-emissions, or “priority,” sectors in the Europe region, about 57% of companies have declared commitments to reach Net Zero emissions by or before the year 2050. The remaining companies are still to form such commitments (Figure 1).

Figure 1: Net Zero Commitment Declarations among Companies in Europe (%)

Source: ISS ESG

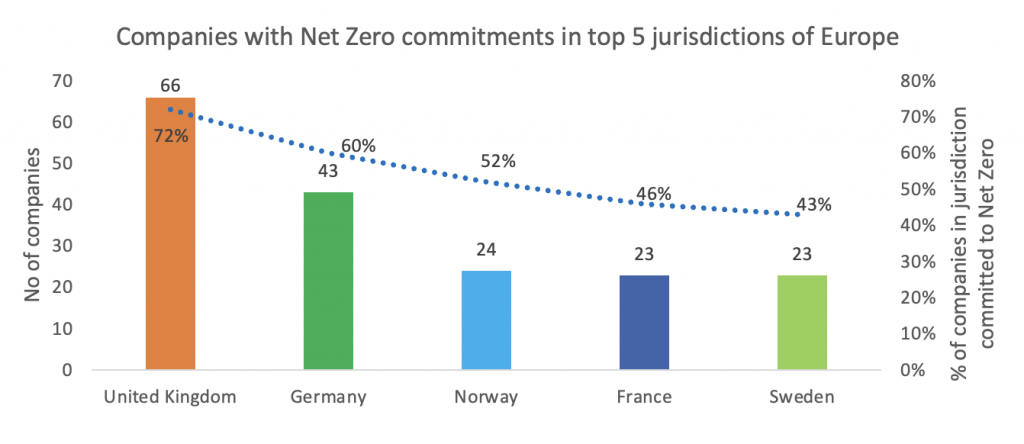

All the companies analyzed, which come from 25 European countries, are ones that have committed to achieving Net Zero emissions by or before 2050. The United Kingdom, Germany, Norway, France, and Sweden are the countries in the assessment that account for the majority of companies with such Net Zero commitments (Figure 2).

The analysis suggests that, of the high-emitting European countries, the United Kingdom and Germany account for the majority of the Net Zero-committed companies. This may be due to these countries’ national commitments to Net Zero and their related policy frameworks, which could encourage companies to have Net Zero ambitions. As shown in Figure 2, 72% of the UK companies evaluated had pledged to achieve Net Zero, while 60% of the German companies assessed had committed to this goal.

Figure 2: Assessed Companies with Commitments to Net Zero, by Jurisdiction

Source: ISS ESG

Italy and Switzerland are also in the top list of European countries with high GHG emissions, occupying the 7th and 8th positions. The assessment showed that about 54% of companies in Italy and 36% in Switzerland have committed to Net Zero.

Net Zero Commitments among Priority Sector Companies

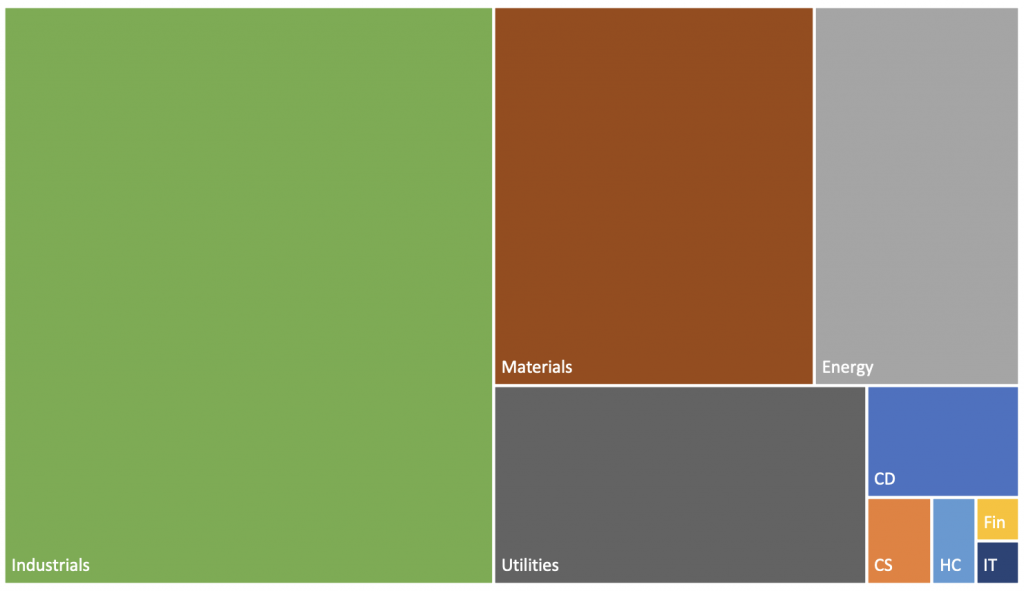

ISS ESG assessed top companies from priority sectors/industries, which include Energy, Materials, Utilities, Industrials, Transportation, Cement, Aluminum, Steel, and Chemical. ISS ESG also assessed companies in Capital Goods and Financials.

The assessment determined that, of Net Zero-committed companies in Europe, 48% belong to Industrials, 21% to Materials, 13% each to Utilities and Energy, and 5% each to other sectors such as Consumer Discretionary/Staples, Financials, Health Care, and Information Technology (Figure 3).

Figure 3: Companies with Net Zero Commitments, by Sector

Note: CD (Consumer Discretionary), CS (Consumer Staples), IT (Information Technology), Fin (Financials), HC (Health Care).

Source: ISS ESG

Net Zero Commitment Coverage

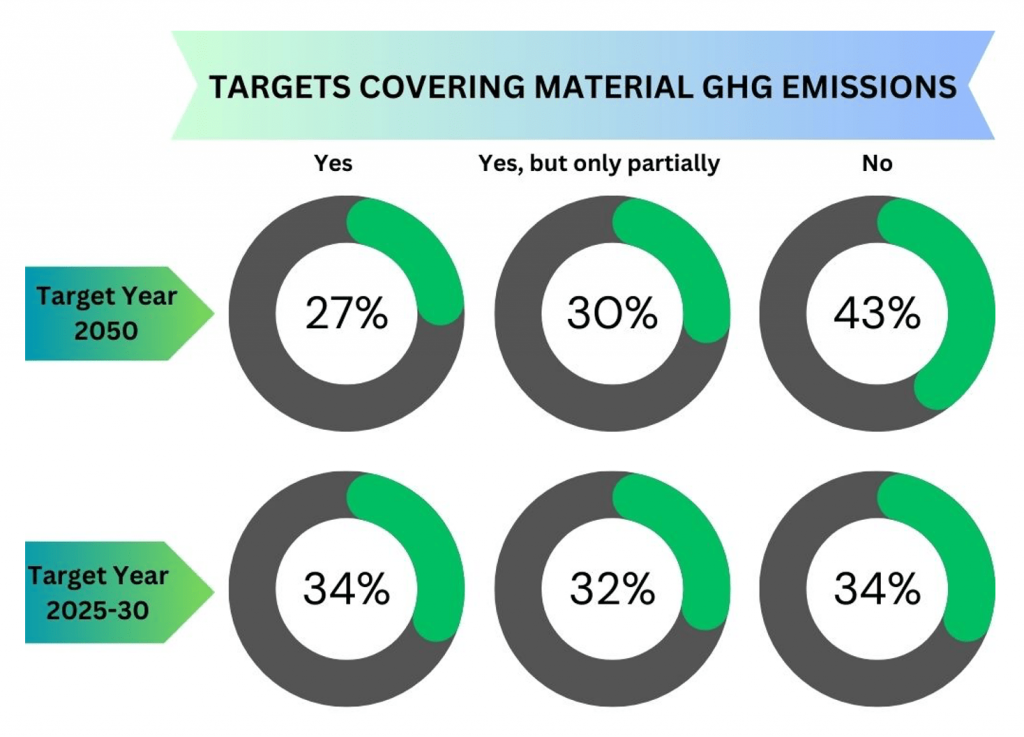

A Net Zero target is considered ‘comprehensive’ if it covers more than 95% of the Scope 1 and 2 emissions, along with those categories of Scope 3 that are material for the sector in which the company is involved. Such a target is in line with the Climate Action 100+ methodology benchmark. The Science Based Targets initiative also recommends including a company’s Scope 3 emissions in certain sectors.

The analysis found that around 27% of companies that have committed to achieving Net Zero emissions in the target year 2050 have included material GHG emissions related to both their own operations and their supply chain; that is, these companies’ Net Zero targets cover Scope 1, 2, and 3 emissions. These companies are represented by the “Yes” responses in Figure 4. Another 30% of companies committed to Net Zero do not cover most material emissions (“Yes, but only partially” in Figure 4).

Figure 4: Companies with Net Zero Targets Covering Material GHG Emissions

Source: ISS ESG

A similar trend was noted in the interim GHG reduction targets of these companies (Target Year 2025–30 in Figure 4), with a slightly higher percentage of companies fully covering material emissions.

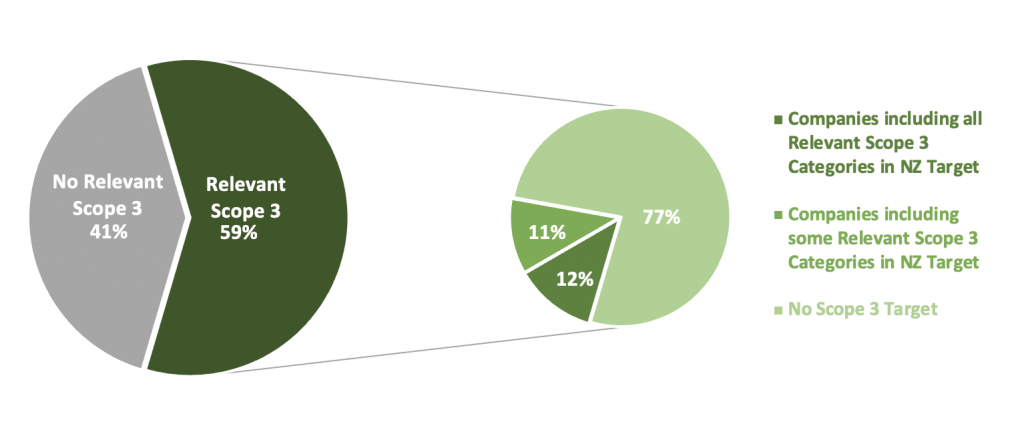

Net Zero Commitments for Relevant Scope 3 Emissions

After assessing the applicability of Scope 3 emissions for these 500+ companies, the analysis shows that about 59% of the total assessed companies in the region have ‘relevant’ Scope 3 emissions (i.e., Scope 3 categories that are material for the company’s sector). Of these, only 12% of companies included all relevant Scope 3 categories in their Net Zero targets (Figure 5), while about 11% included some of the relevant Scope 3 categories in their Net Zero targets. The remaining companies did not include any categories of Scope 3 emissions in their Net Zero targets. As mentioned earlier, a target without the inclusion of these Scope 3 emissions is not considered to be comprehensive.

Figure 5: Coverage of Relevant Scope 3 GHG Emissions within Companies’ Net Zero Commitments

Note: NZ = Net Zero.

Source: ISS ESG

Decarbonization Strategy to Achieve Net Zero Commitment

Decarbonization is a critical component of achieving the Net Zero goal. Decarbonization involves reducing carbon emissions across all sectors of the economy and transitioning to a low-carbon and sustainable economy.

More than 80% of the European Net Zero-committed companies assessed in this analysis disclosed their decarbonization efforts aimed at achieving both interim and Net Zero targets. These decarbonization efforts include strategies and actions related to expanding renewable energy use, reducing fossil fuel use, identifying energy-efficient projects for process innovations, and using carbon capture projects and carbon offsets.

For example, companies from the Industrials sector base their decarbonization strategy on complete conversion of their electricity consumption to renewable sources and switching their motor vehicle fleet entirely to electric vehicles. This strategy involved joining initiatives like RE100 and EV100.

To decarbonize Scope 3 emissions specifically, companies are making a collaborative effort across the entire supply chain, which includes suppliers, customers, and other stakeholders. The companies are promoting low carbon practices, use of renewable energy at supplier level, more sustainable production methods, as well as policies and practices to reduce the environmental impact of transportation and distribution.

Incorporating climate risk into companies’ financial planning is important in formulating capital expenditure and business transition plans, and in enabling execution of decarbonization strategies. The assessment revealed that only about 22% of the companies, according to their public disclosure of their decarbonization efforts, had incorporated climate-related risks into their financial accounts.

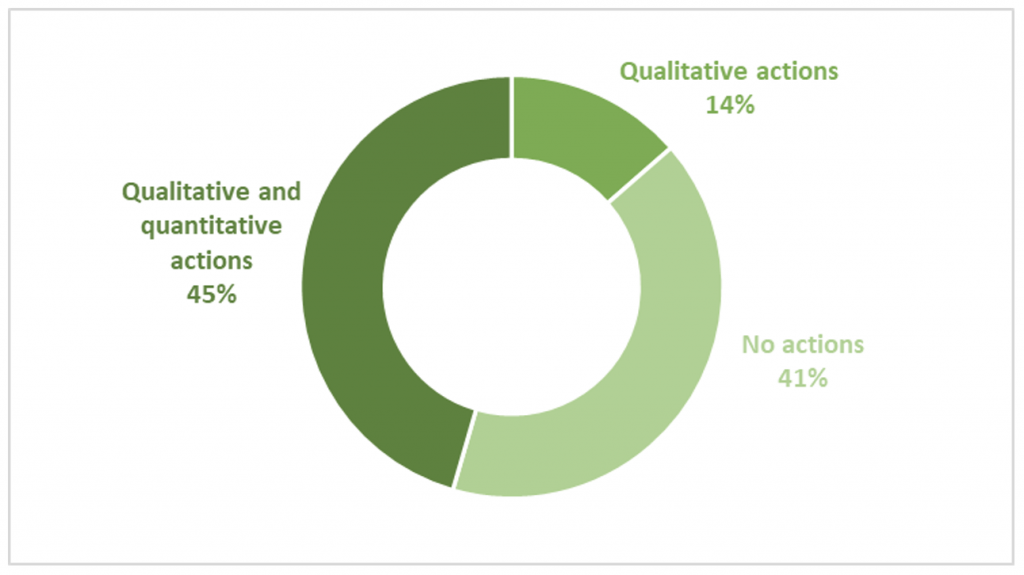

Of the 500+ European companies from priority sectors assessed, 248 (45%) reported various GHG emissions reduction measures (Figure 6). These companies qualitatively described the reduction measures and provided some quantitative details of their strategies. Another 74 companies (14%) disclosed a few GHG reduction measures and provided only qualitative details related to their strategy. Another 223 companies (41%) had no decarbonization plans at all, even though a small portion of such companies have a Net Zero commitment in place.

Figure 6: Net Zero-Committed Companies, by Decarbonization Strategy Status

Source: ISS ESG

Net Zero Alignment Status

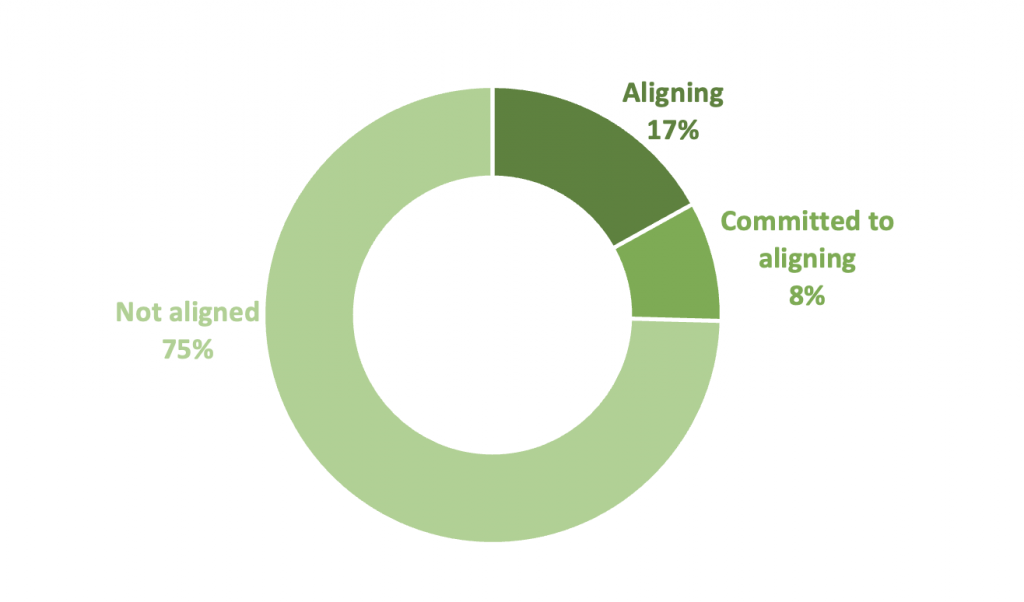

ISS ESG developed its Net Zero Alignment Criteria, as explained in a previous Insights piece on the Asia-Pacific region, using the Net Zero Investment Framework Implementation Guide (NZIF). The NZIF assesses a company’s material GHG emissions disclosure, its 2050 Net Zero ambition, its interim emissions reduction target, and its decarbonization strategy to determine whether the company aligns with the Net Zero criteria. Companies that do not meet these criteria will be designated as Not Aligned by the NZIF.

Out of the 500+ European companies from priority sectors analyzed in this piece, 17% of the companies are Aligning, while 8% of the companies are Committed to Aligning. Notably, most of the companies with Aligning status are based in the United Kingdom, Germany, and France. The remaining 75% of the companies were found to be Not Aligned (Figure 7).

Figure 7: Europe: Net Zero Alignment Status of Companies

Source: ISS ESG

Conclusion

Analysis of 500+ European-based companies from high GHG-emissions priority sectors shows notable company action to achieve Net Zero. More than half of the assessed companies are committed to Net Zero, with 45% having detailed strategies for reducing emissions.

Such widespread action on Net Zero is likely a result of the EU placing energy and climate policies at the forefront of its political agenda through the proposed European Climate Law and National Energy and Climate Plans (NECPs). This pattern shows gradual yet perhaps significant progress towards Net Zero in Europe.

ISS ESG supports investors in navigating this evolving business environment through detailed assessments of companies’ Net Zero pledges. These assessments are made available through tools such as ISS Net Zero Solutions, which clients can integrate into their investment-related decision-making processes.

Explore ISS ESG solutions mentioned in this report:

- Use ISS ESG Climate Solutions to help you gain a better understanding of your exposure to climate-related risks and use the insights to safeguard your investment portfolios.

Authored by:

Aastha Agarwal, Analyst, Climate Research

Shruti Sharma, Analyst, Climate Research