Nickel has become an important focus of the Green Transition. For most of the past few decades, nickel was arguably a metal with relatively few uses and a price that changed little. Its primary use was stainless steel and alloys. With the advent of battery production, however, demand has been put on its head.

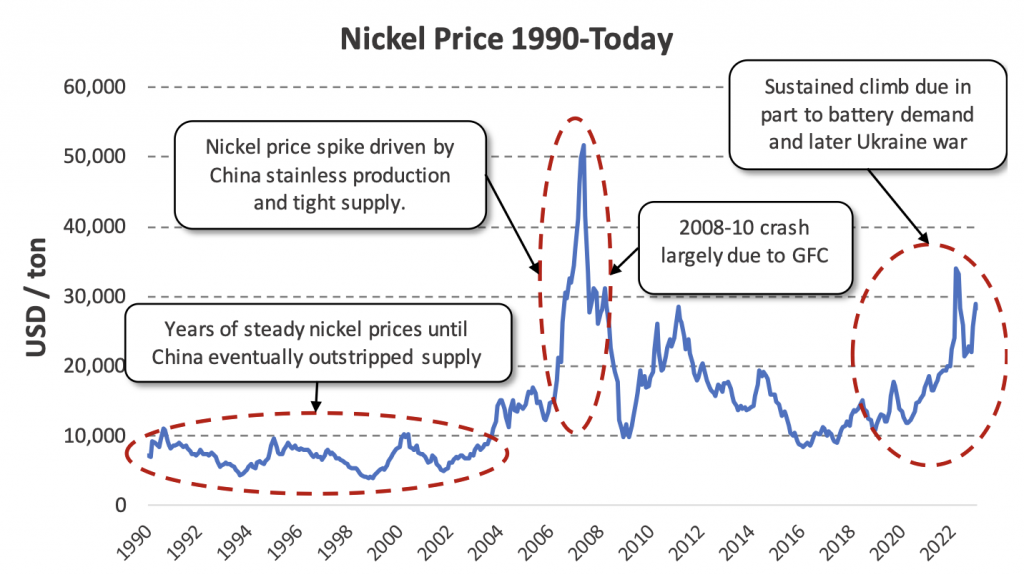

Most nickel demand now is for batteries. In the International Energy Agency (IEA)’s Sustainable Development Scenario, batteries and renewables demand are forecast to constitute over 60% of nickel demand by 2040, up from less than 10% in 2020. Nickel’s price has increased by almost 3x since 2016, as shown in Figure 1. This is evidence of tightening supply, as EVs and other battery applications require ever-greater amounts of nickel.

Figure 1: Nickel Price History since 1990: Despite Recent Global Slowdown, Elevated Price

Source: St. Louis Federal Reserve, ISS ESG

Concerns about nickel might not be as acute as those about other metals, but some are significant. Nickel mining raises concerns about pollution, indigenous rights, GHG emissions, and working conditions. Dominance of nickel production by certain countries may also present problems: for example, the world’s largest producer is Indonesia, a situation that presents both ESG and single-source risks.

Demand Drivers and Battery Types

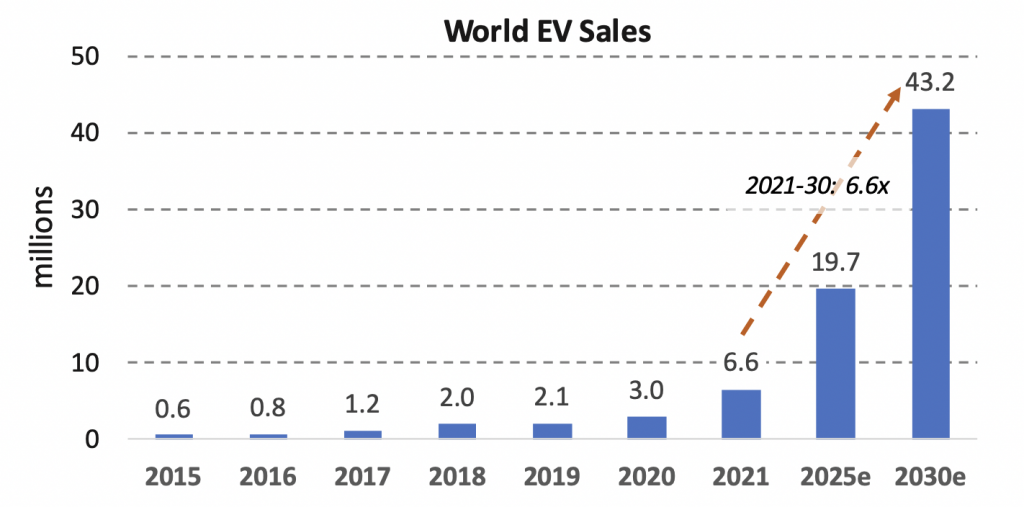

Electrification of the transport system, particularly EVs, drives future nickel demand. Figure 2 shows the IEA’s forecast of new electric vehicle (EV) sales through 2030. EV sales are projected to grow by a factor of 6.6x from 2021 to 2030. Bans on internal combustion engine (ICE) vehicles—such as the bans set to take effect in the U.K. in 2030 and the EU, California, Canada, and China in 2035—help to accelerate EV sales.

Figure 2: EV Growth Over the Coming Years

Source: IEA, ISS ESG

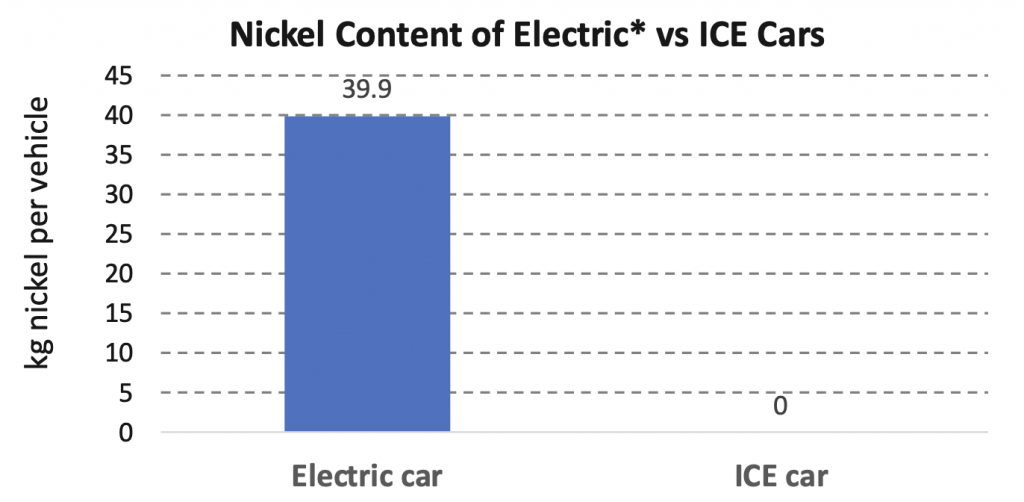

EVs use significantly more nickel than ICE vehicles. Most EV batteries include nickel due to the higher energy storage capacity and therefore longer driving range that it provides. (For smaller cars that do not require significant range, however, lithium iron phosphate [LFP] batteries are a cheaper alternative to nickel-based EVs.) The main nickel battery is the nickel, manganese, cobalt (NMC) composition used in numerous EV models, particularly in the west.

Figure 3 shows that EVs utilize roughly 40kg more nickel per car relative to ICE vehicles. This represents significant new demand over the coming years. If 100% of global car sales (80 million cars globally) were replaced with EVs, it would represent 3.2 million tons of incremental annual nickel demand, which is larger than current estimated annual nickel production of 2.5 million tons. This is in line with the IEA’s estimate of future nickel demand.

Figure 3: EVs Use Considerably More Nickel than ICEs

Note: ICE = internal combustion engine. *for an EV with a 75 kWh NMC battery

Source: USGS, IEA, ISS ESG

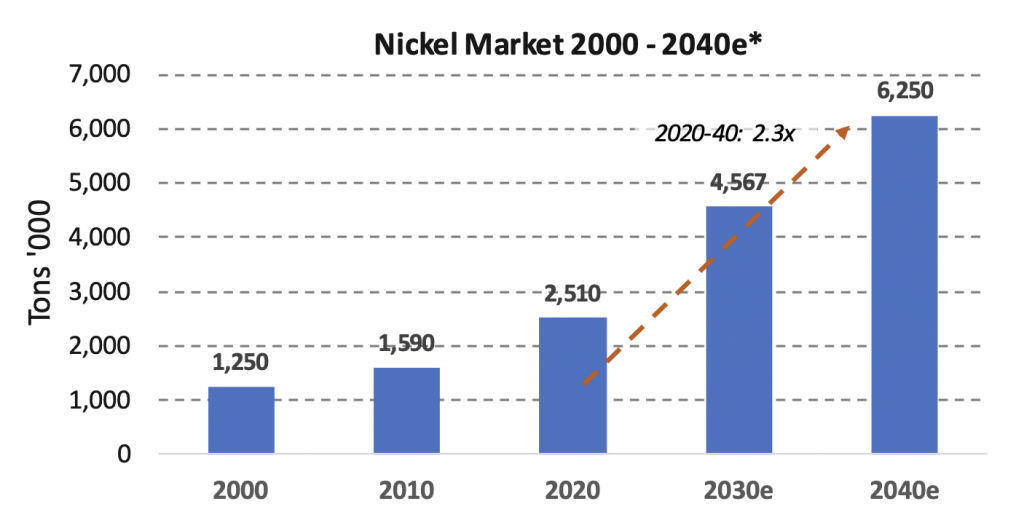

IEA predicts nickel demand rising by about 2.1 million tons per annum (mtpa), or 82%, by 2030 and 3.7 mtpa, or 149%, by 2040 (Figure 4), according to its Sustainable Development Scenario.

Figure 4: IEA Nickel Demand Rises by 2.3x from 2020 to 2040

* estimates are IEA Sustainable Development Scenario

Source: USGS, IEA, ISS ESG

The Supply Side: Indonesia and the Rest

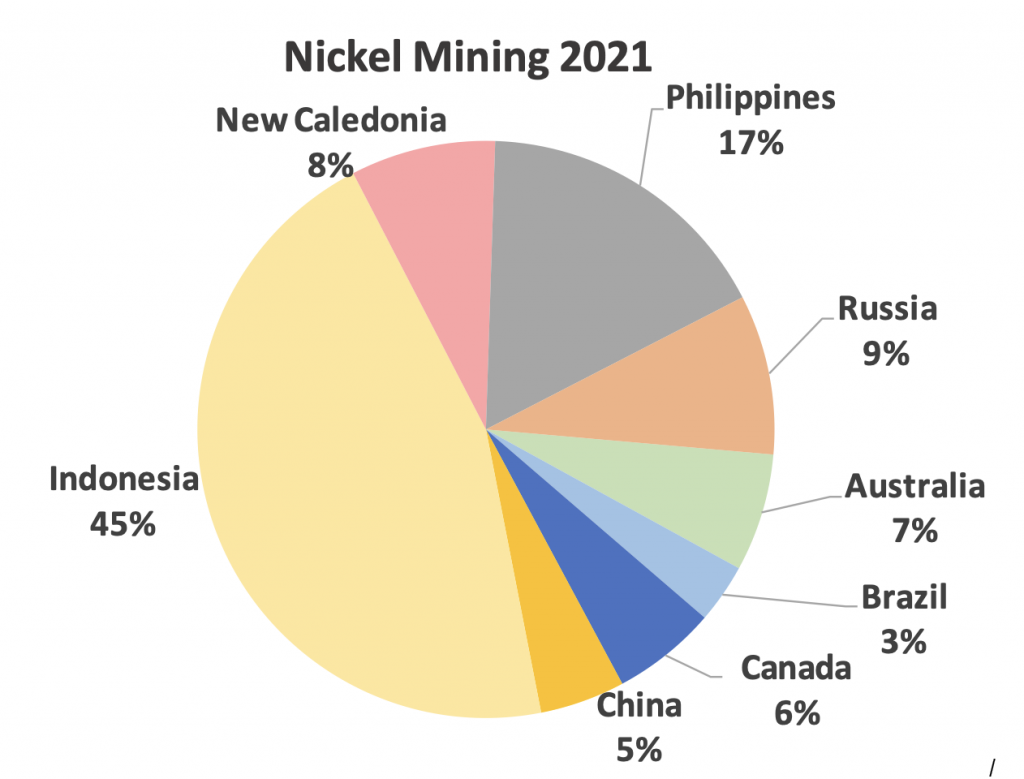

Overreliance on certain countries can pose substantial ESG risks for the future. Indonesia accounts for almost half the global market when it comes to nickel mining (Figure 5). This situation represents single-source risk and raises concerns about the country’s controversial 2020 mining law, identified by Human Rights group Komnas HAM as potentially problematic for human rights.

Figure 5: Indonesia Accounts for Almost Half of Global Nickel Production

Source: USGS, ISS ESG

The Net Zero transition will likely require nickel from countries such as Indonesia and Russia, with all their existing risks and controversies, at least in the short-term, until the new nickel projects get through lengthy and uncertain exploration and feasibility study processes.

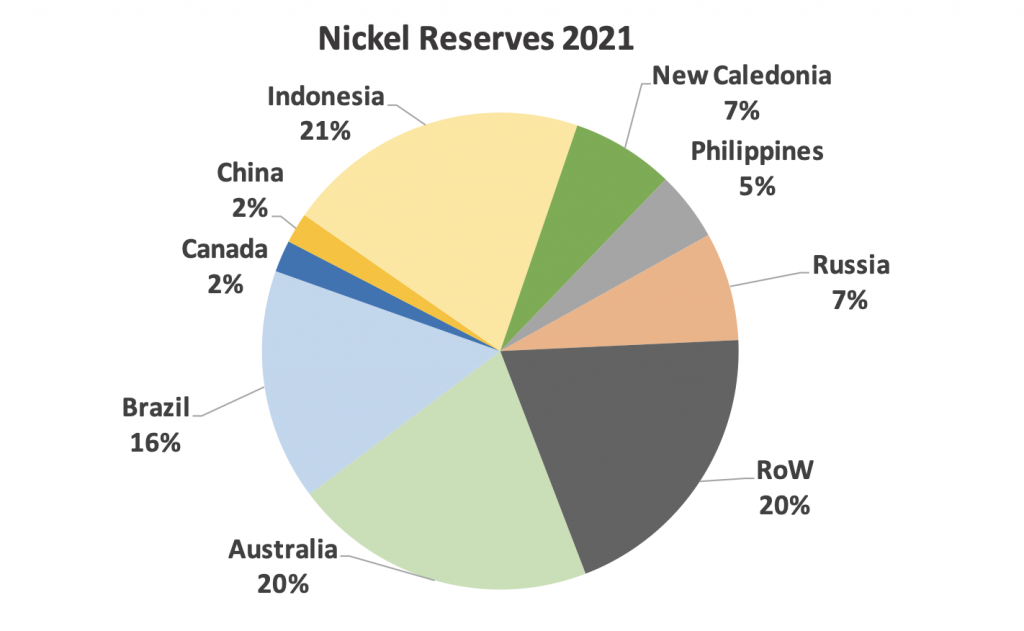

While one country accounts for almost half of world nickel production, the reserves picture is quite different. Indonesia has only 21% of global reserves, slightly ahead of Australia at 20%. Brazil also has meaningful nickel deposits, at 16% of global reserves (Figure 6). These Australian and Brazilian nickel reserves provide the opportunity to diversify nickel supply and minimize overreliance and some ESG risks.

Figure 6: Reserves Picture Indicates Opportunity to Diversify Production

Source: USGS, ISS ESG

ESG Concerns: Tailings, Environmental Pollution, and Working Conditions

As with the mining industry overall, nickel mining and processing presents serious ESG concerns. These include air and water pollution, destruction of ecosystems, indigenous rights, GHG emissions, energy use, and working conditions. Nickel mining’s ESG risks are very closely related to the situations in the biggest producing countries, due to specific policies and controversies, weaker labor and environmental standards, and legislative tools.

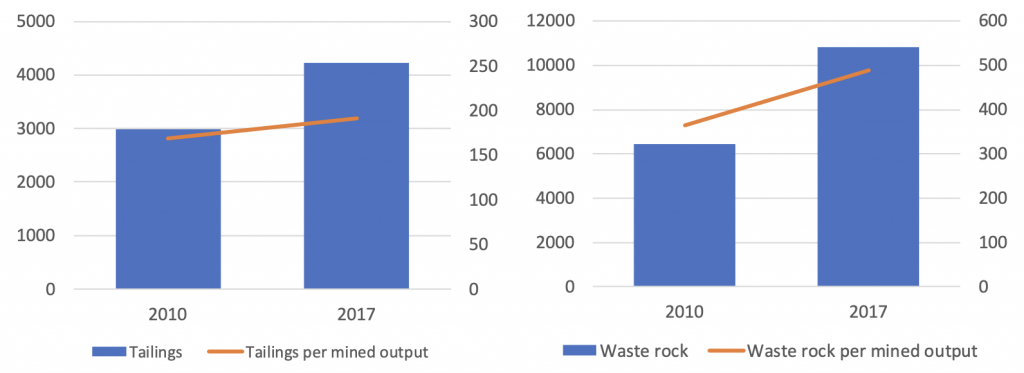

Waste management is extremely important, especially when it comes to tailings. According to the IEA, the copper and nickel mining industries have seen an increase in tailings and waste rock per mined output from 2010 to 2017 (Figure 7).

Figure 7: Tailings and waste rock generation from copper and nickel mining

Source: IEA

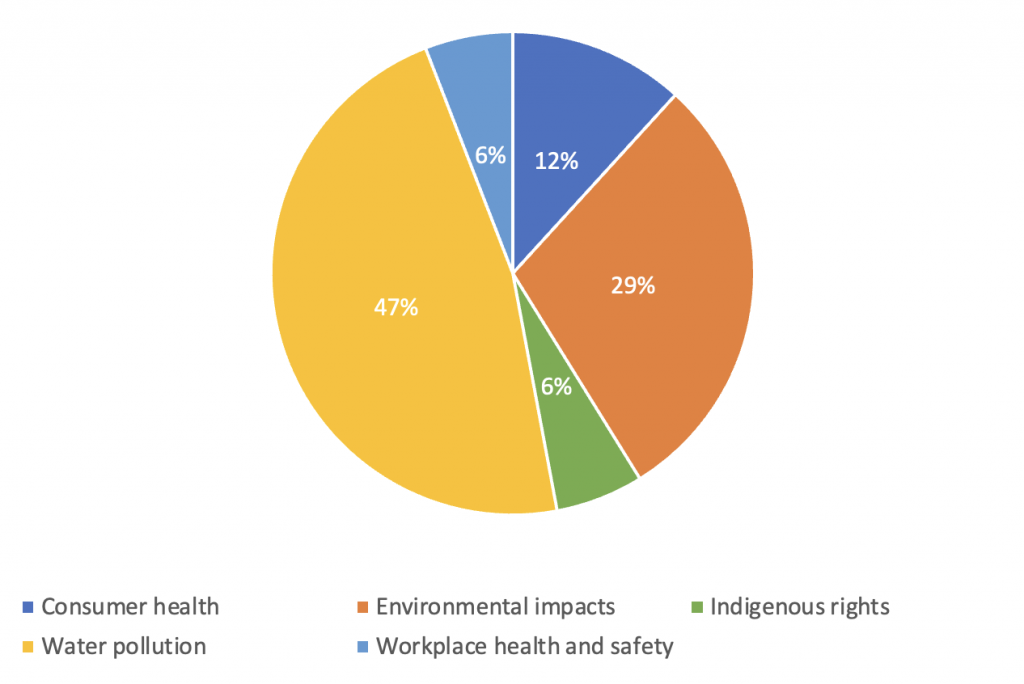

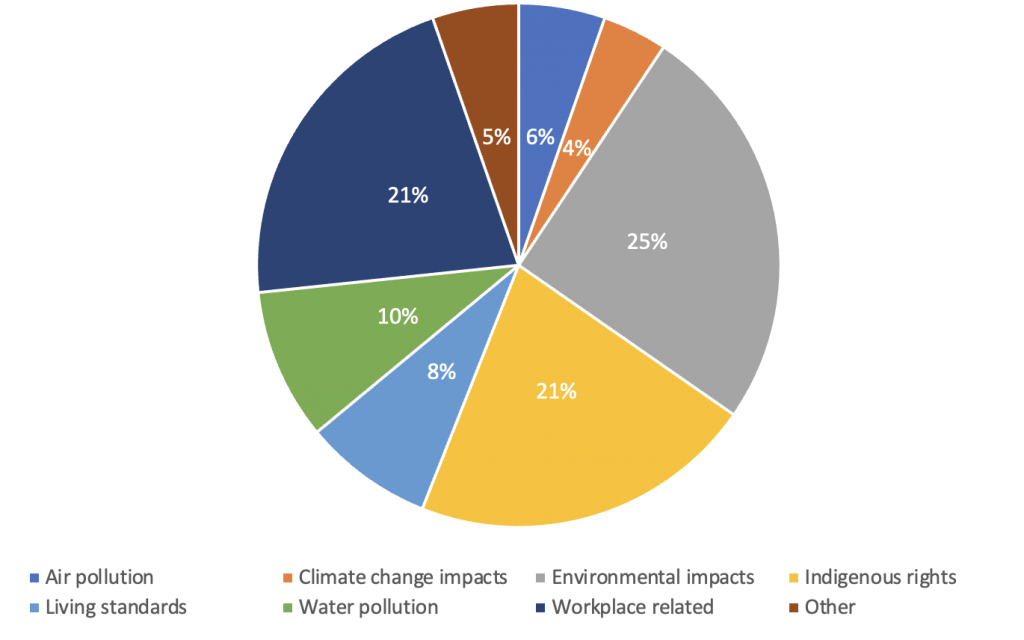

Good tailings and waste management is essential to avoid soil and water pollution. ISS ESG’s Norm-Based Research shows that water pollution is the most common controversy in nickel mining (Figure 8).

Figure 8: Norm-Based Research Controversies Related to Nickel by Key Theme

Note: Data as of 13/03/2023

Source: ISS ESG

In Indonesia, Deep-Sea Tailings Disposal (DSTD) is a common practice due to it being a cheaper tailings management method. DTSD can lead to disastrous environmental effects, however, such as water pollution. In 2019, the local government of the Obi Islands in Indonesia approved a DSTD plan for the company Trimegah Bangun Persada (Harita Nickel), which resulted in several protests by the local population. This area had already experienced the disappearance of fish in surrounding waters, water turning red, and traces of heavy metals in various marine species. These protests resulted in Trimegah backing down from this plan, but instead requesting permission to deforest an area to build a tailings dam. This alternative comes with its own negative impacts, from deforestation and ecosystem destruction to potential leaks, soil pollution and subsequent water pollution, erosion, and flooding.

In addition, tailings storage facilities are at risk from seismic activity, as Indonesia is located in one of the most seismically active areas in the world (the “Ring of Fire”). The Philippines (e.g., Rio Tuba) and New Caledonia (e.g., Goro) face similar problems due to limited space, poor waste management, and legacy issues.

Indigenous peoples and their traditional livelihoods are substantially damaged by these examples of poor waste management. In Indonesia, a lot of the local population near nickel operations rely on farming and fishing, and water pollution can have a direct impact on local health through food and drinking water. Mass fish deaths are also associated with DSTD due to spills, as happened at the Ramu nickel project in Papua New Guinea and Goro nickel project in New Caledonia. Ambarnaya river in Russia, which was polluted by a major spill in 2020, is one of the main sources of food for indigenous people, who fish there.

According to ISS ESG’s Norm-Based Research, Indigenous Rights is among the most common mining-related controversies in the largest nickel-producing countries (Figure 9). However, Workplace Related controversies, including working conditions, workplace discrimination, and workplace health and safety, are also critical issues for nickel mining. According to JATAM, Indonesia’s Mining Advocacy Network, there have been 10 deaths since 2020, including deaths by suffocation and falling into a hot slag. There have been concerns and protests over poor working conditions and safety issues, which resulted in two workers killed.

Figure 9: Controversies Related to Mining in the Largest Producing Countries, by Theme

Note: Data as of 13/03/2023

Source: ISS ESG Norms-Based Research (NBR)

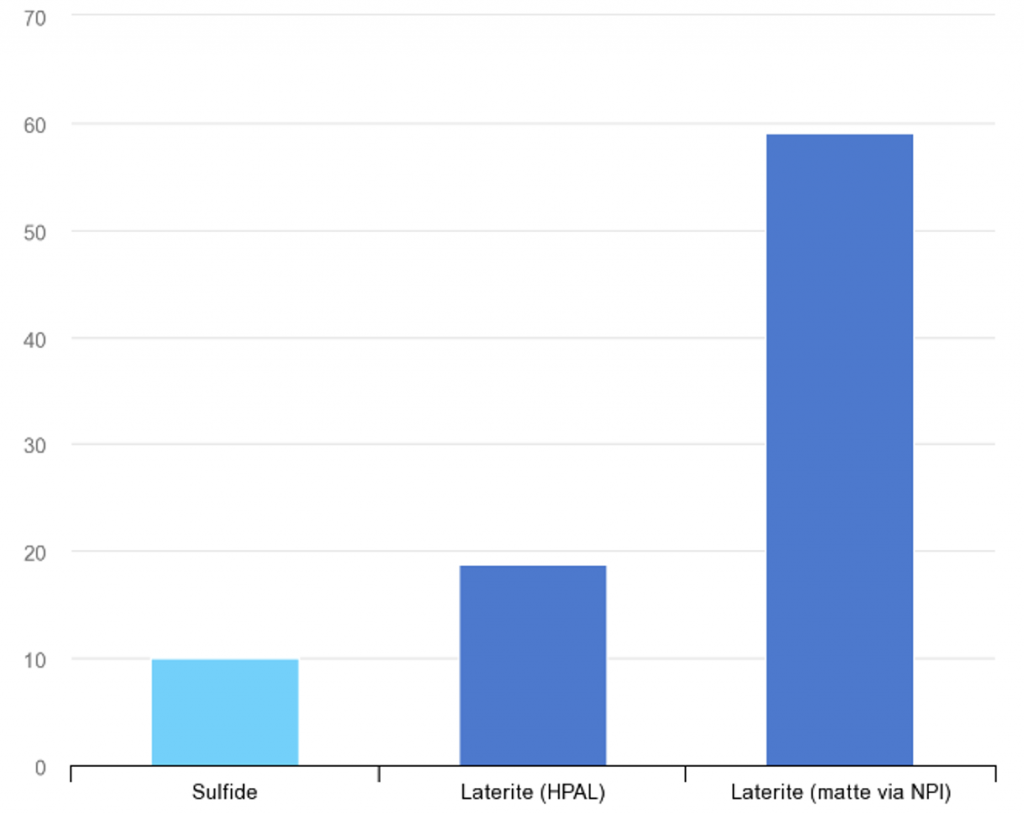

Nickel production is a GHG- and energy-intensive process. GHG intensity for battery nickel (Class 1) is lowest when nickel is extracted from sulfide deposits, which usually are a higher grade and easier to process than nickel from laterite deposits (Figure 10). Sulfide deposits, however, are harder and more expensive to explore and mine. Indonesia does not have any sulfide deposits and therefore produces nickel only from laterite deposits, which is more GHG intensive. Most existing projects use High Pressure Acid Leaching (HPAL), but with the rising demand for battery grade nickel, some nickel producers, such as Tsingshan, have started producing nickel matte from Nickel Pig Iron (NPI), which is more than three times more GHG intensive than HPAL.

Figure 10: GHG emissions intensity for Class 1 nickel by resource type and processing route

Source: IEA

ESG Ratings for Top Nickel-Producing Nations and Companies

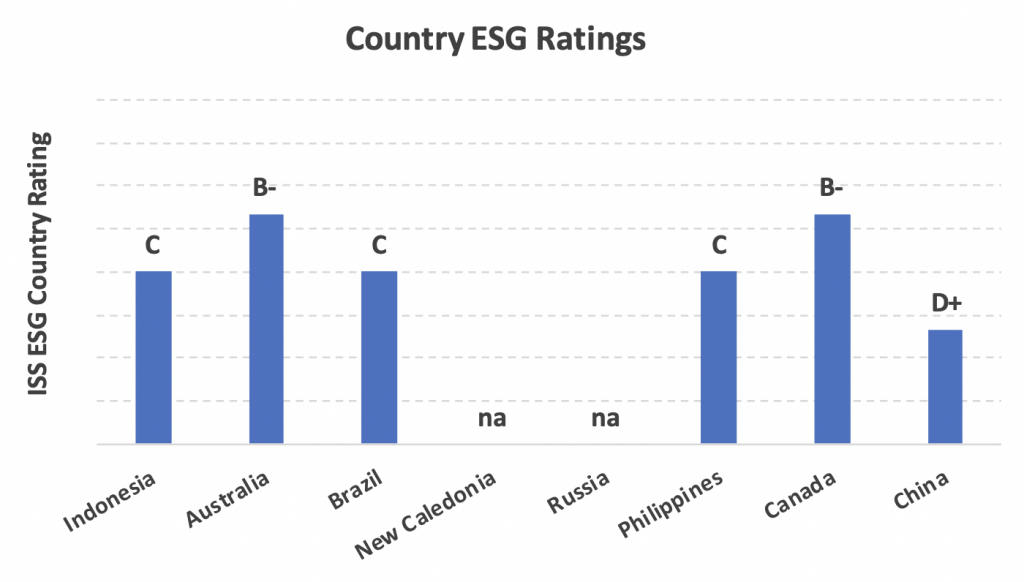

Nickel-producing countries have middling-to-strong ESG ratings. Figure 11 shows ISS ESG’s Country Rating (which can range from A to D) for the top nickel-producing countries. While most of these countries have middling ESG grades, Australia and Canada stand out with strong grades of B-. Australia particularly stands apart when considering its significant reserves, highly developed mining code, and strong ESG grade.

Figure 11: Several Producing Nations Have Solid ESG Ratings

Note: na = not applicable – these countries are not rated by ISS ESG

Source: ISS ESG

However, it is interesting to note that Australia reports a higher number of controversies than its nickel-producing peers (Figure 12). While this may seem counter-intuitive, countries with greater political freedom and an independent press will sometimes show higher controversy counts, because of greater transparency levels. The low number of controversies in places such as Indonesia and Russia do not necessarily indicate an absence of environmental and labor rights issues but may mean that controversies are not being reported or cannot be verified. Nevertheless, the high number of environmental controversies in Australia does indicate the high impact of mining in that country.

Figure 12: Australia Shows a Higher Number of Controversies, Partly Due to Transparency

Source: ISS ESG

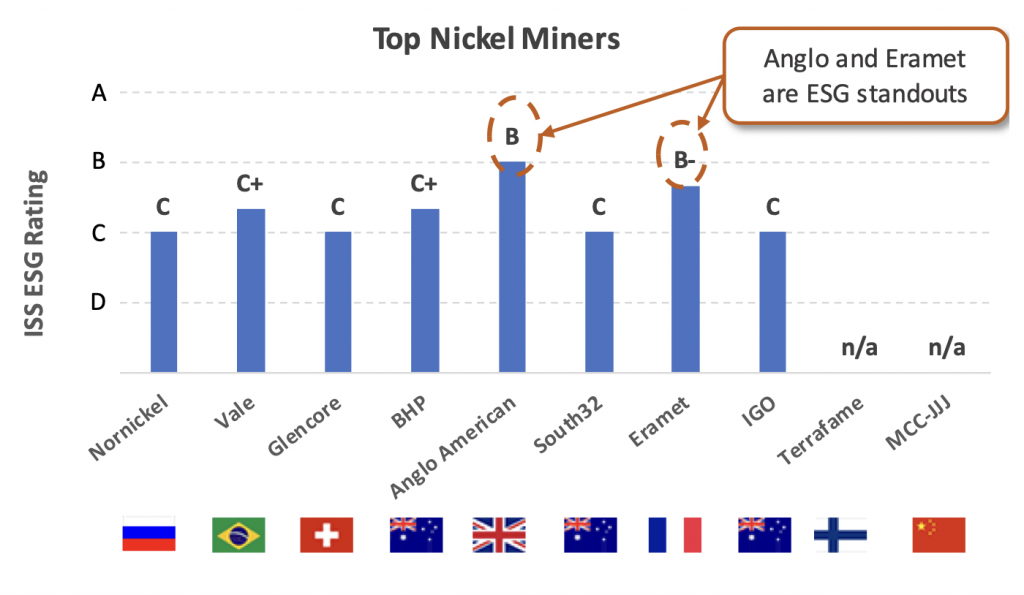

At corporate level, two nickel mining companies stand out as ESG leaders. Figure 13 shows the ISS ESG Corporate Rating for the world’s top 10 nickel miners. The UK-headquartered Anglo American and the French company Eramet score above their peers. BHP in Australia and Vale in Brazil also exhibit slightly-above-average scores.

Figure 13: Nickel Miners Have Mostly Middling ESG Ratings

Source: ISS ESG

For investors looking for exposure to this critical input to the green economy, a range of choices for positive ESG performance are already available. Unlike the supply-chain risk and related concerns identified in an earlier report on cobalt, there is a significant opportunity to diversify nickel production while also investing in solid ESG performers located in countries with respectable ESG profiles. Growth in this sector could therefore be relatively better for the environment than other metals critical for Net Zero.

Explore ISS ESG solutions mentioned in this report:

- Access to global data on country-level ESG performance is a key element both in the management of fixed income portfolios and in understanding risks for equity investors with exposure to emerging markets. Extend your ESG intelligence using the ISS ESG Country Rating and ISS ESG Country Controversy Assessments.

- Identify ESG risks and seize investment opportunities with the ISS ESG Corporate Rating.

- Assess companies’ adherence to international norms on human rights, labor standards, environmental protection and anti-corruption using ISS ESG Norm-Based Research.

By: Nicolaj Sebrell, CFA, Head of Energy, Materials, & Utilities, ISS ESG

Filip Veintimilla Ivanov, Analyst, Metals & Mining, ISS ESG