The Circular Economy (CE) is not new. It is becoming increasingly urgent, however, that circularity thinking be more fully adopted in corporate business models today, to protect not only their profitability, but also the future of the planet.

Through 2021 and at the start of 2022 there have been dramatic price increases for ‘virgin’ materials. Nickel, Aluminum, and Copper increased between 20% and 40% while Energy prices were up over 50% last year. Plastic prices also increased by over 40%. Supply chain shortages across industries have added to the lack of material availability. Some companies have been able to offset input inflation through price hikes, but margins are increasingly under pressured, as noted recently by the Chinese National Bureau of Statistics. By reducing waste and keeping materials in use, the opportunity for an improvement to profitability and margins over the long run is real.

As measured by the Circle Economy’s Circularity Gap Report, global material consumption amounts to 100 billion tons annually, with only 8.6% of the current economy being circular. This circularity metric is defined as the number of cycled materials divided by the overall worldwide material input, and the result clearly shows that there is room for improvement for governments as well as businesses.

This report sets out ISS ESG’s understanding of what makes a truly circular product, examines some relevant scientific concepts, and explores best practice using exemplars from the automobile industry.

According to the Ellen MacArthur Foundation (EMF), building a circular economy relies on three principles:

1.) Designing out waste by configuring products for disassembly and reuse

Creating circular products is not only about closing the loop at the product’s end of life (for example take-back systems), but also about taking the product’s next life into consideration during the initial design phase. Knowing about the next use phase is key in order to select the right, non-toxic materials in the first place. This in turn encourages upcycling because it mitigates against the use of (for instance) composites that impede the reuse or remanufacturing of the product. For example, the inability to remove a device’s battery could make the whole product hazardous and unrecyclable.

2.) Keeping products in the material cycle after the use phase by differentiating between consumable and durable materials

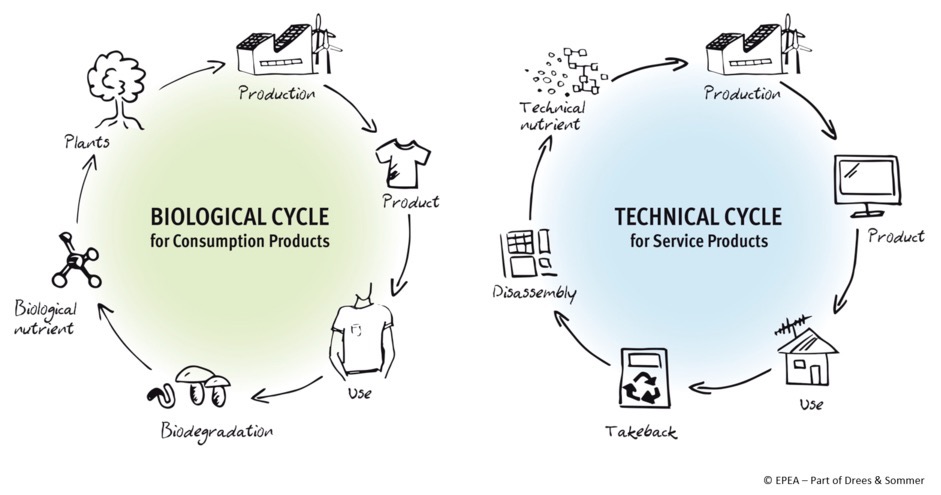

When designing circular products, designers should consider the use scenario for the material components and therefore distinguish between the biosphere and the technosphere (see Figure 1 below). The green, biological cycle stands for the life cycle of consumables, such as natural textiles and food. These biodegradable, eco-friendly materials are either composted or reused for new products. The blue, technical cycle shows the life cycle of durables such as electronic devices. After the use phase, take-back systems allow companies to access valuable materials, separate the product components and reintegrate them for the next use phase.

Figure 1: The distinction between biosphere and technosphere

Source: Cradle to Cradle, EPEA

Designing products for a circular economy does not simply mean prolonging the use phase of durables, as this may be harmful to the environment and innovation. For example, car tires are more durable today, but still release micro plastic particles into the environment as they wear down, resulting in the release into the environment of material which does not belong into the biosphere.

Designing circular products is also about defining the use phase for every product. For instance, if what consumers actually want is to be mobile and drive a car, they may not need to own the car. This offers an opportunity for a circular business model through offering the product as a service. The consumer purchases mobility, but the car itself remains the property of the car producer and is collected at the end of the defined use phase. Consequently, the producer knows when to expect the return of the materials and can plan its production processes accordingly. Some parts of the car may be reused in a new car, others may be exchanged with technologically more innovative or efficient parts. Additionally, a product-as-a-service business model can be an incentive for the producer to use high quality materials.

3.) Enhancing instead of depleting natural systems

An example of depleting a natural system is can be found in conventional agricultural practices, in cases where these exhaust the soil resulting in erosion and reduced productivity. Regenerative agricultural measures exist with the potential to enhance, for instance, the amount of humus in the soil. This in turn can lead to more fertile land, the repair of depleted soil, and the storage of carbon dioxide.

Product circularity can only be achieved when taking the whole product lifecycle into consideration. Thus, different aspects need to be considered for different product types in the design phase:

Figure 2: Different Aspects of Product Circularity in ISS ESG’s Corporate Rating

| Aspects | Description | Examples |

| Repairability | The products are designed and made to be easily repairable. | The Lovesac Co. uses modular designs for most of its furniture products so that the products can be easily repaired, and individual pieces replaced. |

| Reusability | Extending the product’s life span as the product can be used in the same/similar way multiple times. | Brødrene Hartmann A/S produces egg trays which can be reused 5-10 times before the packaging is returned to the company’s molded fiber production. |

| Separability | Building materials that are easy to separate after use. | DIRTT Environmental Solutions Ltd. designs interior construction materials for disassembly. |

| Recyclability | Products are designed to be easily recycled and use recyclable materials. | ASUSTek Computer, Inc. strategically designs its computer and consumer electronic products to facilitate recycling and disassembly. |

| Upgradeability | Products can be upgraded, so that the product can be used longer, and it is not necessary to purchase a new version of a product. | ABB Ltd. offers extensions, upgrades and retrofits for its electronic devices and software products. |

Source: ISS ESG

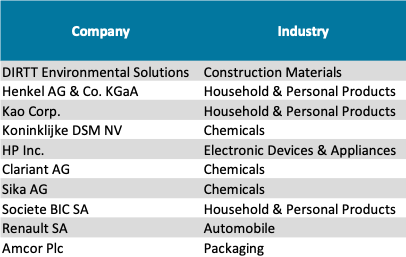

ISS ESG assesses whether a company takes the product lifecycle into consideration during the design phase. This can be an important way of addressing product circularity in not only closing the loop, but also in how to most effectively close the loop. The assessment is incorporated into the rating structure of each of the 20 industries covered, including the industries with the highest CE related impact: Automobiles, Auto Components, Chemicals, Electrical Equipment, Packaging, and Textiles. At this stage very few companies demonstrate product circularity commitments or actions, only referring to the topic as a general commitment. The top ten companies listed in Figure 3 are the best performing firms that are considering relevant product lifecycle aspects:

Figure 3: Performance of Product Lifecycle

Source: ISS ESG; Data as of October 2021

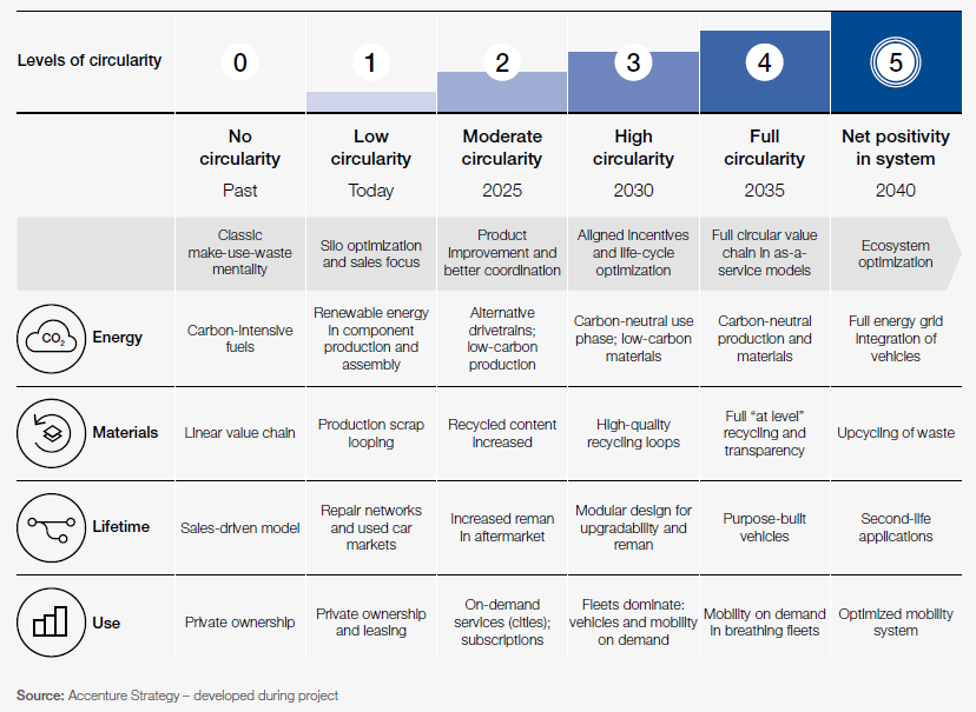

economy by the EMF and the United Nations Environment Programme (UNEP), and is a good example of an industry that requires significant changes to align with product circularity in the future. The table below from the World Economic Forum’s Circular Cars Initiative (CCI) shows the timeline of the five levels to achieve full circularity, with the ultimate aim being becoming a net positive contributor to the environment. Each level can be determined based on characteristics of both the product and its use.

Figure 4: The Five Levels of Circularity for the Automobile Industry

Source: Circular Cars Initiative

Today, roughly half the cost of producing a new vehicle comes from manufactured materials, according to the CCI. At end of life, little of this value is recoverable, due to non-circular design practices, and a lack of circularity-focused business models. Just as vehicles consume non-renewable fuel and produce pollution and GHG emissions, they also consume vast quantities of currently non-renewable materials that result in large volumes of liquid and solid waste. These are usually landfilled, processed or downcycled at end of life.

The term “circular car” refers to a theoretical vehicle that has maximum material efficiency. The vehicle would produce zero material waste and zero pollution during the manufacturing process, utilization, and end disposal. While cars may never be fully “circular,” the automotive industry can significantly increase its degree of circularity. Doing so has the potential to deliver economic, societal, and ecological benefits.

The ISS ESG circular economy task force has identified specific topics and themes for investors to focus on when assessing an industry. One of the most relevant topics when looking at the Automobile industry from a product circularity perspective is the extension of the useful product life. This incorporates the design aspect by assessing the commitment and the procedures of the company to extend the useful life of products. To achieve a high grade, the company must have a strategic approach to integrating longevity, repairability, and recyclability, in the product design.

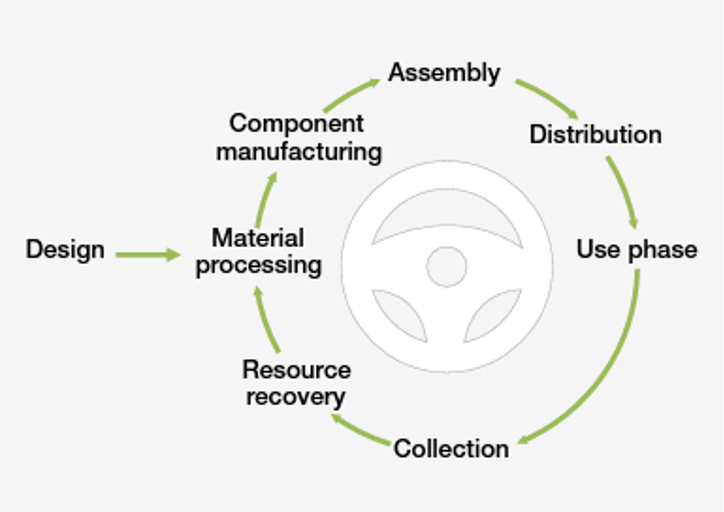

Designing a vehicle with full life-cycle value optimization in mind (including end-of-life disposal) is not an easy task.

Figure 5: A Car’s Life Cycle

Source: CCI

The Ford Motor Company created the Model U concept back in 2003, hailed as the Ford Model T (one of the first mass produced cars released in 1908) for the 21st century. It is described as a cradle-to-cradle car with its use of polyester body panels, the fabric designed to be a technical nutrient. The bodywork can be recycled into base elements and reprocessed into material fiber again and again without losing any performance qualities, and is made from eco-friendly substances. The fact that there had until recently been little progress in real world development shows the difficulty in designing a car with product circularity fully incorporated.

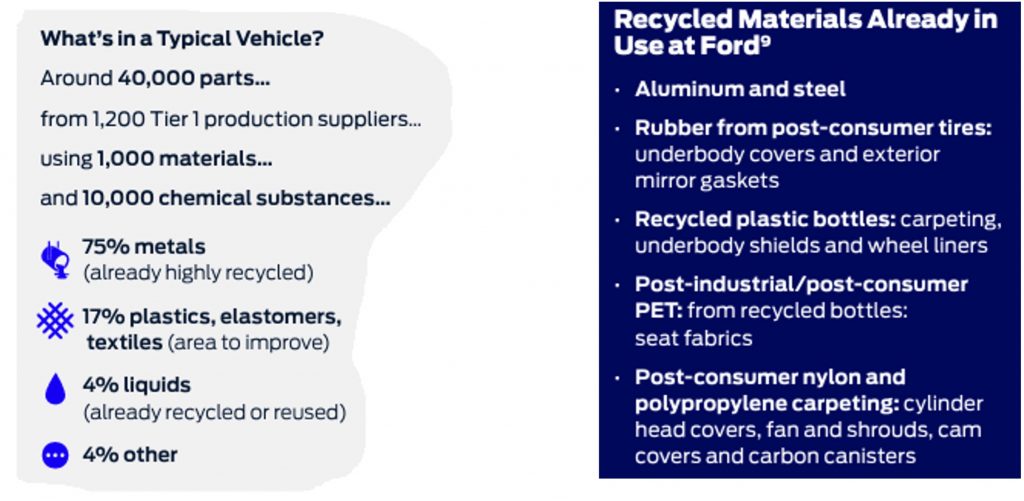

New platform and power train development through the adoption of Electric Vehicles (EV) gives a significant opportunity for auto manufacturers to incorporate product circularity at the design phase. One option here is through increased modularity, making it easier for a vehicle to be taken apart and its parts reused. In line with the CCI’s ‘moderate circularity’ stage, Ford’s ambition for 2025 is to use 20 percent recycled and renewable plastics in new vehicle designs for North America and Europe.

Figure 6: Ford’s Circularity Ambition for 2025

Source: Ford Motor Company

As an example of a real world product, in 2020 the Ford Otosan team implemented a 50 percent recycled plastic fan shroud on the Transit van and launched the Re3 project within the assembly plant, aimed at reducing, reusing and recycling waste. The fan shroud cut CO2 emissions by 2.2 kg per vehicle at the same time as achieving a 17 percent materials cost reduction.

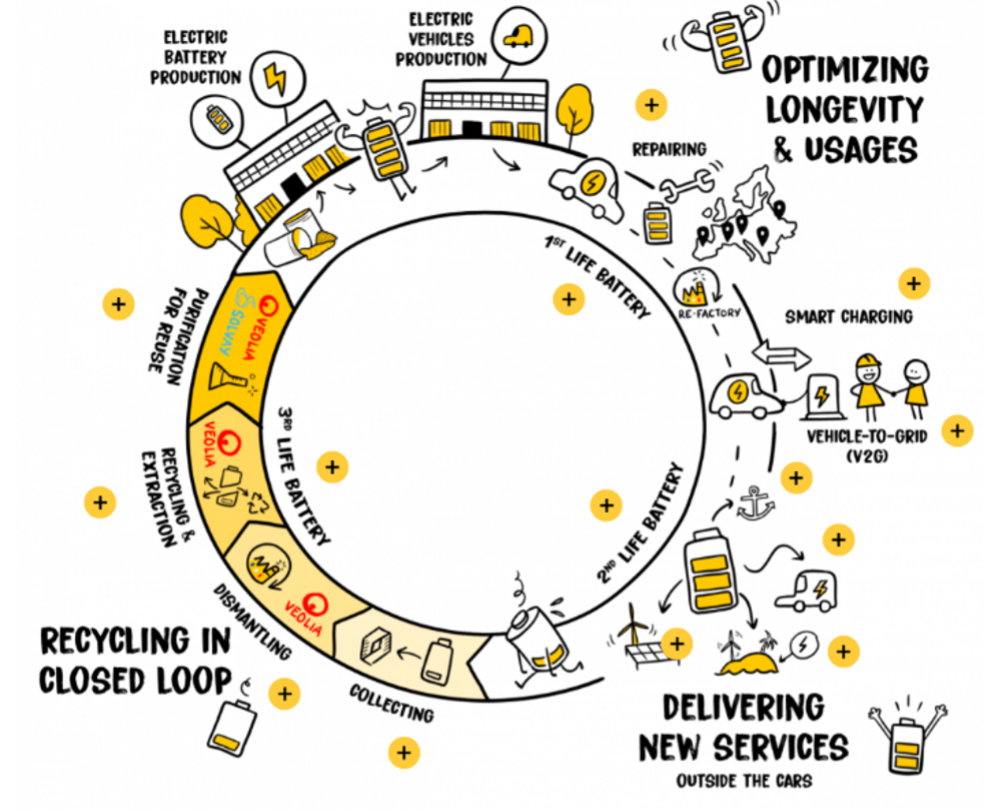

Figure 7: Renault’s Life Cycle of an Electric Vehicle

Source: Renault Group

Renault is the only auto company in the top 10 of our lifecycle performance table (see Figure 3 above). This is evidence of Renault being the first carmaker to directly deploy capital into the development of a CE. The company earlier this year also started a dedicated CE factory for reuse and mobility. Renault is a signatory to the French government’s circular economy roadmap.

One of the latest auto manufacturers to outline their CE strategy is BMW, with the BMW i Vision Circular. BMW is looking to launch a compact BMW in 2040 that is focused squarely on sustainability and luxury. The focus for the i Vision Circular was to create a carbon-neutral EV through the application of ‘circular economy’ principles, with the design brief of “rethink, reduce, reuse and recycle”. The concept vehicle was produced using 100% recycled materials, all of which can subsequently be recycled, including its solid-state battery. Battery recycling and reuse will be one of the key initiatives to be addressed for the auto industry.

The car industry is transitioning through a revolution from internal combustion engine powered platforms to zero emission vehicles, with many European OEM’s committed to full EV product lineups. This gives companies an almost clean sheet of paper to rethink the design of vehicles. Whether through the incorporation of modularity or alternative materials, the opportunity is there for the industry to significantly improve product circularity.

Looking at all sectors, ISS ESG research identifies very few companies that have fully addressed the issue of product circularity. Investors should be aware of the risks and opportunities for investee companies arising from product circularity and the circular economy. And thinking beyond risk, the opportunity to examine links between improvements in profitability and product circularity will be an interesting future topic.

Explore ISS ESG solutions mentioned in this report:

- Identify ESG risks and seize investment opportunities with the ISS ESG Corporate Rating.

By Hanna Taya, ESG Rating Analyst, ISS ESG. Gavin Thomson, Head of Integrated Portfolio Management, ISS ESG.