Around the globe, regulators are taking active steps to protect retail investors in navigating the growing market of sustainable investment products and to prevent “greenwashing” through enforcement action and new regulatory proposals. The regulatory proposals involve a toolkit of measures, including introducing standardized disclosure requirements and guardrails for which financial products can be marketed as sustainable.

The most broadly used policy measures relating to investment products include

- standardized product disclosures, in pre-contractual and periodic reporting materials, on sustainability credentials (including simplified disclosures directed at retail investors);

- naming rules, which restrict firms’ ability to name and market their products as “sustainable” (or other synonymous terms); and

- product classifications, which serve to differentiate between different types of sustainability-focused products and those with no sustainability focus.

Being intended to provide flexibility, the naming, labelling, and reporting regimes (both those proposed and those already in effect) leave room for interpretation on what can be counted as a sustainable asset within an investment product. This leads to a lack of clarity for both retail investors and fund managers, while often placing the burden on fund managers to define exact criteria for such subjective terminology. Further complicating the regulation landscape, the sustainability standards vary significantly across jurisdictions, making comparability of related disclosures and products a further challenge for retail investors.

Moreover, where quantitative asset allocation thresholds for sustainable investment are being considered, they are nonetheless coupled with vague terminology. The (proposed) regimes in the U.S., Singapore, and Hong Kong involve minimum asset allocation requirements whereby 80, 67, and 70% of the value of assets, respectively, must be invested in line with the fund’s sustainable investment focus or strategy. In contrast to the EU and U.K. regimes, these jurisdictions do not attempt to provide a definition of what counts as a sustainable asset but leave it to the funds to define their sustainable investment strategies and require that the resulting asset selection criteria or strategies be applied across the vast majority of assets to avoid misleading consumers.

Even where a definition is provided, however, a credible terminology standard remains elusive. ISS ESG analysis revealed that as much as 84% or as little as 13% of the STOXX Europe 600 could be considered “sustainable” within the parameters of the European Union’s Sustainable Finance Disclose Regulation (SFDR), depending on the interpretation chosen by the product provider. A similar finding was reached for the proposed “Sustainable Focus” label in the U.K., which also leaves it to product manufacturers to decide which “credible standard of sustainability” assets are evaluated against to demonstrate that at least 70% are sustainable or aligned with an environmental or social theme.

Given that most investment products are offered in more than one market and the largest fund managers operate globally, navigating the emerging regimes will remain a challenge for the foreseeable future and the quest for interoperability will continue. Some regulators have attempted to provide guidance on how their regime compares to others, but regulatory fragmentation remains high.

For example, the U.K. Financial Conduct Authority (FCA) consultation paper, the Hong Kong Securities and Futures Commission (SFC) Circular, and the Monetary Authority of Singapore (MAS) Circular all include references to the European Union’s SFDR requirements. In Hong Kong, the ESG funds that operate within the Undertakings for the Collective Investment in Transferable Securities (UCITS) regulatory framework and that provide disclosure in line with EU SFDR Article 8 or Article 9 are deemed to have generally complied in substance with the disclosure requirements of SFC’s circular. However, SFC may, where appropriate, request enhanced disclosures. Similarly, in Singapore, while an SFDR Article 8 or 9-compliant ESG fund is deemed to have complied with the MAS Circular’s Section C disclosure requirements, such a fund must still comply with the Circular’s Section B to be marketed to retail investors in Singapore as an “ESG Fund.” This high level of regulatory fragmentation may prove, in some instances, counterproductive to regulators’ own aims, retail investors’ understanding, and fund managers’ global operations.

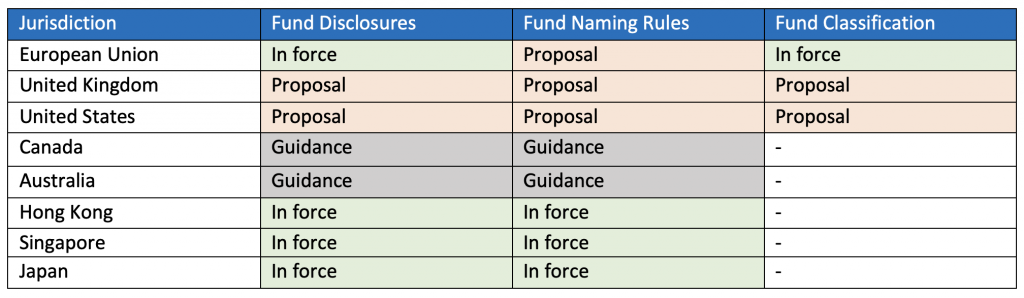

This chapter provides a status update and an overview of the various disclosure, naming, and classification rules – both applicable and emerging – in the European Union, the United Kingdom, the United States, Canada, Australia, Hong Kong, Singapore, and Japan, including a summary table of key developments (Figure 1).

Figure 1: Status of Key Regulatory Developments Globally Targeting ESG-Branded Funds

Source: ISS ESG

European Union

The SFDR has established three investment product categories, known as Article 6 (products without a sustainability focus), Article 8 (products which promote, among other characteristics, environmental or social characteristics), and Article 9 (products which have sustainable investment as their objective), each with corresponding disclosure requirements. Providers of Article 8 and 9 products are required to report on the sustainability credentials of their products using comprehensive pre-contractual and periodic disclosure templates.

While the SFDR was originally conceived of as a pure disclosure regulation to be complemented with a new EU Ecolabel for retail financial products (development is currently on hold), the above-mentioned product categories are perceived as quasi-labels in the market. In fact, beyond the disclosure obligations, SFDR also introduces some requirements that products need to fulfill to classify as Article 8 or 9. In particular, the expectation for Article 9 products is that (almost) all their assets qualify as sustainable within the meaning of Article 2(17) of SFDR.

In addition to the SFDR requirements, the European Securities and Markets Authority (ESMA) has proposed fund naming rules whereby funds with the word “sustainable” or any derived term in their name must allocate at least 50% of their investments to sustainable investments as defined by SFDR. Along with quantitative thresholds, the proposal contemplates applying exclusion criteria as an additional safeguard.

ESMA received strong pushback from the European and global fund industry on its proposal, including requests to delay guidelines until there is clarity on what constitutes a “sustainable investment” and until interoperability issues are resolved between SFDR and other EU regulations, such as the Markets in Financial Instruments Directive (MiFID) and the Insurance Distribution Directive (IDD). The consultation period on this proposal ended in February 2023 and final guidelines are still pending.

Further changes to the SFDR regime are to be expected. While the SFDR (level 1 text) began to apply in 2021 and related technical standards (level 2 text) have been applicable since January 2023, both level 1 and level 2 are up for review in the fall of 2023.

Figure 2: Overview of EU Disclosures, Naming, and Classification Rules

| Product disclosures | Products with environmental and/or social characteristics or objectives must be accompanied with comprehensive pre-contractual and periodic disclosures using specific templates. |

| Naming | ESMA has proposed a fund naming rule introducing minimum requirements for any product using the word “sustainable” or any derived term in its name. |

| Classification | SFDR introduces three categories of products: Articles 6, 8, and 9. Work on the EU Ecolabel for financial products is on hold. |

Source: SFDR, ESMA, ISS ESG

United Kingdom

The U.K. Financial Conduct Authority (FCA) published its consultation paper for Sustainability Disclosure Requirements (SDR) and investments labels (CP22/20) in October 2022. The consultation period ended in January and final rules are expected to be set in a Policy Statement (PS) released as early as Q4 2023.

The FCA proposal for SDR contains several measures, including Product Disclosures, Naming Rules, and Classifications, to be implemented progressively from 30th June 2024 to 2026. In order to help consumers navigate the complex landscape of investments products, three sustainable investment labels are proposed. ‘Sustainable Focus’ products shall invest in assets that already comply with sustainability requirements and shall consist of a minimum of 70% of assets that either meet a credible environmental and/or social sustainability standard or align with a specific sustainability theme. ‘Sustainable Improvers’ products shall invest in assets which may not be sustainable today but aim to improve their sustainability performance over time, including through stewardship activities. ‘Sustainable Impact’ products shall aim to achieve a pre-defined, positive, and measurable environmental and/or social impact, including through investments in solutions to environmental or social challenges in underserved markets.

The FCA further proposesnaming and marketing rules to restrict the use of sustainability-related terms in product names targeting retail customers, unless the products use a sustainable investment label. In addition, the FCA has proposed a general “anti-greenwashing” rule, which would come into effect immediately on publishing the PS, that reiterates existing requirements for all regulated firms that sustainability-related claims must be clear, fair, and not misleading.

While no template is provided in the FCA proposal, standardized disclosures tailored to different types of audiences are prescribed. Consumer-facing disclosures are to be provided as a standalone new document to help consumers understand the key sustainability-related features of a product. More detailed disclosures shall be included in pre-contractual and sustainability reports targeted at a wider audience. Pre‐contractual disclosures of products with sustainability-related features or a sustainable investment label shall include the product’s sustainability-related features. Sustainability reports for products with a sustainable investment label shall include ongoing sustainability‐related performance information such as key sustainability-related performance indicators and metrics. Finally, the FCA proposal also includes requirements for distributors to ensure that product-level information (including the labels) is made available to consumers.

While the final rules may change the effective dates, the FCA originally envisioned that consumer-facing disclosures, detailed pre-contractual disclosures, and naming and marketing rules would apply one year after PS publication; the ongoing performance-related disclosure would apply a year after that.

Figure 3: Overview of U.K. Disclosures, Naming, and Classification Rules

| Product disclosures | Proposal asks product providers to provide standardized disclosures, tailored to different audiences, through pre-contractual and periodic reports. |

| Naming | Restrictions on using sustainability-related terms in product names have been proposed. |

| Classification | Three distinct labels are proposed for different types of investment products with sustainability objectives. |

Source: U.K. FCA, ISS ESG

United States

In May 2022, the U.S. Securities and Exchange Commission (SEC) proposed new disclosure and naming requirements for funds and advisers that incorporate ESG factors into their investment funds and strategies.

The companion proposals aim to promote consistent, comparable, and reliable information for investors concerning funds’ and advisers’ incorporation of ESG factors, in addition to expanding the scope of names covered under the Names Rule. The changes would apply to certain registered investment advisers, advisers exempt from registration, registered investment companies, and business development companies.

The first proposal would require additional disclosures in prospectuses and annual shareholder reports for three new categories of registered funds that use ESG factors in investment strategies:

- ESG-Integrated: Funds that integrate ESG factors alongside non-ESG factors into investment decisions would be required to provide limited disclosures, in both their summary prospectuses and the management discussion and analysis (MD&A) portion of their annual reports (Form 10-K), that describe how ESG factors are incorporated into their investment processes.

- ESG-Focused: Funds for which ESG factors are a significant or main consideration would be required to provide more detailed disclosures in their summary prospectuses and Forms 10-K, including information on investment processes and methodologies, metrics, and thresholds within a proposed, standardized ESG Strategy Overview Table.

- ESG-Impact: A subset of ESG-focused funds that seek to achieve a particular ESG impact, impact funds would, in addition to the disclosures required of ESG-focused funds, be required to disclose how they measure progress on their specific impact objectives. Likewise, the proposal would require funds that use proxy voting or engagement with issuers as a significant means of implementing their ESG strategy to provide additional information about their proxy voting or ESG engagements.

In addition to ESG disclosures in fund prospectuses and annual reports, as well as adviser brochures, the proposal would require certain ESG reporting on Forms N-CEN and ADV Part 1A, which are forms on which funds and advisers, respectively, report census-type data. The proposal would also require ESG-focused funds that claim to consider environmental factors to include greenhouse gas (GHG) emissions disclosures associated with their portfolio company investments, unless the fund discloses that it does not consider GHG emissions to be part of its investment strategy.

Finally, investment advisers who consider ESG factors under their advisory services would be required to include specific disclosures regarding their ESG strategies. In this context, the observations based on the SEC staff’s examinations are also worth noting.

The second proposal would expand the scope of the Investment Company Act’s “Names Rule,” a rule that dictates that, if a fund’s name suggests a focus on a particular type of investment, at least 80% of the value of its assets should be invested accordingly. The expanded rule would, among other things, now cover funds with names that reflect portfolio-level characteristics, including those indicating that a fund’s investment decisions incorporate one or more ESG factors. In addition, a fund cannot use ESG or similar terms in its name unless ESG factors play a “central role in the fund’s strategy.”

The proposals may be finalized in 2023. The compliance timelines may be updated in the final rules; the transition periods were originally proposed to last 12-18 months, depending on the requirements

Figure 4: Overview of U.S. Disclosures, Naming, and Classification Rules

| Product disclosures | Proposal requires certain ESG reporting in fund prospectuses, annual reports, adviser brochures and on Forms N-CEN and ADV Part 1A. |

| Naming | Proposed fund “Names Rule” requires funds with ESG language in their names to invest 80% of their assets in holdings that align with that language. |

| Classification | The SEC’s proposed rule places ESG funds into three categories: ESG-Integrated, ESG-Focused, and ESG-Impact Funds. |

Source: SEC, ISS ESG

Canada

In January 2022, the Canadian Securities Administrators (CSA) staff released guidance on ESG-related fund disclosures. The guidance provides clarity on disclosures and marketing practices of investment funds that use ESG considerations as part of their investment objectives or strategies.

The CSA has notably stated that the guidance “does not create any new legal requirements or modify existing ones.” Rather, it clarifies and explains how the current securities regulatory requirements apply to ESG-related investment funds disclosures and provides best practices for such funds. While many of the recommendations in the guidance are consistent with existing regulation, several go beyond what industry participants may have expected.

CSA Staff provided guidance on how existing securities regulatory requirements apply to investment funds as they relate to ESG considerations, and to ESG-related funds, in the following areas:

- Investment objectives and fund names

- Fund types

- Investment strategies disclosure

- Proxy voting and shareholder engagement policies and procedures

- Risk disclosure

- Suitability

- Continuous disclosure

- Sales communications

- ESG-related changes to existing funds

- ESG-related terminology

Regarding the use of sustainability-related terminology in fund names and objectives, the guidelines stress that, to prevent greenwashing, fund names and objectives shall “accurately reflect the extent to which the fund is focused on ESG.” The guidelines further note that where a fund name references ESG, the fund’s investment objectives are also required to reference the ESG aspect included in the name. Conversely, a fund with no ESG objectives should not use an ESG term in its name.

Figure 5: Overview of CSA Disclosures, Naming, and Classification Rules

| Product disclosures | Guidance is provided on how existing securities regulatory requirements apply to investment funds as they relate to ESG considerations. |

| Naming | Both a fund’s name and its objectives should “accurately reflect the primary focus of the fund,” including the extent to which a fund is focused on ESG, where applicable, and the particular aspect(s) of ESG that the fund is focused on. |

| Classification | Different types of ESG products are not differentiated. A mutual fund that includes ESG in its fundamental objectives may characterize itself as a fund that is focused on ESG in addition to its primary fund type. |

Source: CSA, ISS ESG

Australia

One of the top 2023 Enforcement Priorities for the Australian Securities and Investments Commission (ASIC) is protection against misleading conduct in relation to sustainable finance, including greenwashing. ASIC’s June 2022 Information Sheet on “How to avoid greenwashing when offering or promoting sustainability-related products” (INFO 271) provides labelling and product disclosure guidance for funds.

ASIC does not intend to restrict the use of sustainability-related terms in product names or descriptions, but rather stipulates that chosen labels shall reflect the substance of the financial product and align with the product’s underlying investment strategy. Furthermore, adequate explanations must be provided for sustainability-related terminologies used in the labels.

In addition, funds should disclose and clearly explain their methodology or policy for integrating sustainability-related considerations into investment decisions and stewardship activities, as well as investment screening criteria and details on reference benchmarks, if any.

Figure 6: Overview of Australia Disclosures, Naming, and Classification Rules

| Product disclosures | Guidance is provided on key elements to be included with regards to sustainability-related considerations. |

| Naming | Labels should reflect the product’s underlying investment strategy, and the use of sustainability terms should be explained. |

| Classification | None. |

Source: ASIC, ISS ESG

Hong Kong

The Securities and Futures Commission (SFC) monitors ESG funds’ compliance in Hong Kong, setting out requirements in the June 2021 Circular that has been applicable since January 2022 to Management Companies of SFC-Authorized Unit Trusts and Mutual Funds — ESG Funds. The Circular defines ESG funds as those which “incorporate ESG factors as their key investment focus and reflect such in the investment objective and/or strategy.”

The Circular includes naming rules,where ESG fund names should reflect and align with their primary ESG investment objective and/or strategy. In the SFC FAQs it is further clarified that funds categorized as ESG should invest at least 70% of their net asset value (NAV) in accordance with the fund’s ESG investment objective and/or strategy. Moreover, funds which are not ESG funds by the SFC’s definition shall in general not name or market themselves as ESG.

The circular also includes specific product disclosure requirements, asking for pre-contractual documents to incorporate detailed information on the fund’s ESG focus; investment strategy; asset allocation; reference benchmarks, where applicable; and any additional information on risks and limitations. Furthermore, Funds must disclose in their periodic reporting the proportion of their underlying investments aligned with the fund’s ESG focus.

Figure 7: Overview of Hong Kong Disclosures, Naming, and Classification Rules

| Product disclosures | Pre-contractual disclosure should include detailed information, while periodic reporting should disclose the proportion of the fund’s underlying investment aligned with its ESG focus. |

| Naming | The ESG fund’s name should reflect its investment objective and/or strategy and at least 70% of the fund’s net asset value should be invested in accordance with the ESG investment objective/strategy the name refers to. |

| Classification | Different types of ESG products are not differentiated. Funds are considered ESG funds if their key investment focus is ESG-related. |

Source: SFC, ISS ESG

Singapore

To mitigate the risk of greenwashing, the Monetary Authority of Singapore (MAS), in July 2022, issued a Circular on Disclosure and Reporting Guidelines for Retail ESG Funds, which came into effect on 1st January, 2023. MAS has also released an FAQ document related to this circular.

MAS defines ESG funds as those where ESG factors significantly influence the selection of investment assets, and which represent themselves as ESG focused. The Circular stipulates that fund names should be appropriate and non-misleading. Concretely, this means that at least two-thirds of the product’s NAV should be aligned with the ESG investment strategy reflected in the fund name.

Product disclosures guidance is provided as well, recommending that ESG funds’ prospectuses include elements such as narratives on the extent to which the ESG focus criteria have been met during the financial period, the actual proportion of investments that meet the scheme’s ESG focus, or stakeholder-engagement activities.

Figure 8: Overview of Singapore Disclosures, Naming, and Classification Rules

| Product disclosures | Pre-contractual disclosure should include detailed information, while periodic reporting should display the proportion of the fund’s underlying investment aligned with its ESG focus. |

| Naming | At least two-thirds of the product’s net asset value should be aligned with the ESG investment strategy reflected in its name. |

| Classification | Different types of ESG products are not differentiated. Funds are considered ESG funds if they include ESG factors as a key investment focus/strategy and represent themselves as ESG-focused. |

Source: MAS, ISS ESG

Japan

The Financial Services Agency (FSA) in Japan made effective its Comprehensive Supervisory Guidelines on ESG public funds on 31st March 2023. The new guidelines follow a previous consultation and resulted from the FSA’s survey of 225 publicly offered ESG Investment Trusts (highlighted in the Progress Report on Enhancing Asset Management Business released in May 2022).

The guidelines prohibit the use of ESG-related terms, including “SDGs,” “green,” “impact,” and “sustainability,” in a fund’s name or nickname in all cases where such a fund does not fall into the category of “ESG Investment Trusts,” i.e., funds that consider ESG factors as “key factors” in the process of selecting investments. Such funds must disclose themselves as such in the “Objective and Characteristics of the Fund” section of their prospectuses.

Furthermore, the FSA has set up product disclosure requirements for such ESG funds. The prospectus must provide details on investment strategy; portfolio construction; the rationale for a reference benchmark, if any; outsourcing arrangements relating to investment management, if any; etc. Periodic disclosures should include, where the fund has a target or guideline ratio of investment assets selected with the use of key ESG factors, details on the actual proportion; the status of achievements on the above; the impact achieved against targets; actions taken in accordance with the stewardship policy; etc.

Figure 9: Overview of Japan Disclosures, Naming, and Classification Rules

| Product disclosures | Pre-contractual disclosure should include detailed information, while periodic reporting should assess the fund’s ESG-related performance and impact. |

| Naming | ESG-related names are restricted to products categorized as ‘ESG Investment Trusts.’ |

| Classification | Different types of ESG products are not differentiated. Products qualify as ESG Investment Trusts if they consider ESG factors as key factors in the selection of investment assets and describe such ESG factors in their prospectuses. |

Source: FSA, ISS ESG

Explore ISS ESG solutions mentioned in this report:

- Financial market participants across the world face increasing transparency and disclosure requirements regarding their investments and investment decision-making processes. Let the deep and long-standing expertise of the ISS ESG Regulatory Solutions team help you navigate the complexities of global ESG regulations.

- Identify ESG risks and seize investment opportunities with the ISS ESG Corporate Rating.

- Assess companies’ adherence to international norms on human rights, labor standards, environmental protection and anti-corruption using ISS ESG Norm-Based Research.

- Understand the impacts of your investments and how they support the UN Sustainable Development Goals with the ISS ESG SDG Solutions Assessment and SDG Impact Rating.

By: Ronja Wöstheinrich, ESG Methodology Lead – Regulatory Solutions & Fixed Income, ISS ESG

Mathilde Krief, Team Lead of ESG Regulatory Solutions – Product Manager, ISS ESG

Devansh Kumar, ESG Specialist, Client Success, ISS ESG

Navaneet Desai, ESG Regulatory Solutions – Product Manager, ISS ESG