Tick tock

The challenge with fund launches, and one which kept this former product developer and manager up at night, was that the clock starts ticking for a fund as soon it is launched. While funds are built to last decades, few ever do. To last, a fund requires scale. Scale allows a fund to be both competitively priced and profitable. A fund that misses on either of these goals is at risk of either losing hard-won assets or never winning assets in the first place. A closure or merger is never far away. Once launched, the race for assets is on!

With this in mind, we have analysed our Simfund dataset to discover what percentage of funds reach scale, defined in this exercise as €100 million in assets under management (AUM), and how long it took funds to reach that mark.

Our analysis candidates consisted of 3,177 long-term investment funds launched between 2020 and 2022 in Ireland and Luxembourg. None were harmed.

On target

Percentage of funds launched between 2020-2022 that reached the €100 million AUM level and the number of quarters required on average to do so

In our sample, 1,029, or 32%, of the funds reached the €100 million AUM mark by the end of 2022. And most of those that did, did so fairly quickly. On average, it took only 2.5 quarters for funds to hit this metric. A full 15% of the 3,177 funds launched, in fact, reached or surpassed the €100 million AUM level in their first quarter of existence. Opportunity knocked then throughout the pandemic-driven investment euphoria of 2021, as well as the resultant hangover of 2022. Novelty, it seems, commands favour.

Navigating choppy waters

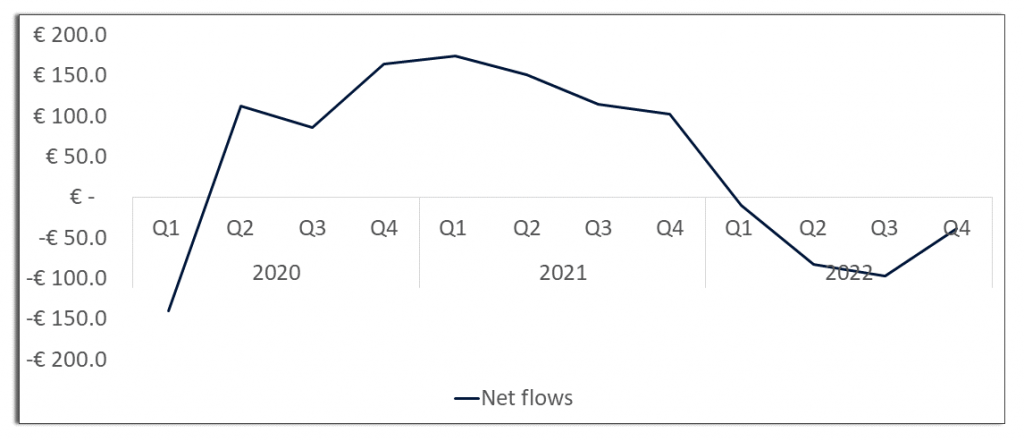

Net flows of Irish- and Luxembourg-domiciled investment funds from 2020 to 2022

In billions of Euros

Fund flows between 2020 and 2022 were nothing short of a rollercoaster, as investors navigated multiple market moving events, including a pandemic, a war and dramatically rising interest rates. Fund flows started off 2020 deep in the red as the scale of the pandemic and the impact of lockdowns were digested. Flows, however, did not lurk in the cellar for long, bouncing back in Q2 2020 and reaching new heights in 2021 as government and central bank interventions lifted investor sentiment—and lined both household and institutional coffers with liquidity. Lockdowns also fed the investment surge, as many investors had few other uses for their cash beyond saving and investing. Mix in the rise of meme- investing during the pandemic, a phenomenon which admittedly crashed soon after, and the revival of crypto, and the lockdown period of the pandemic can be categorized by bullishness, if not mania, among certain investor types. This frenzy, however, would not persist: 2022 saw a distinctly negative shift in fund flows, as inflation, interest-rate hikes and recession predictions dominated the headlines. Pricing revaluation, on the downside, became the topic du jour in security markets.

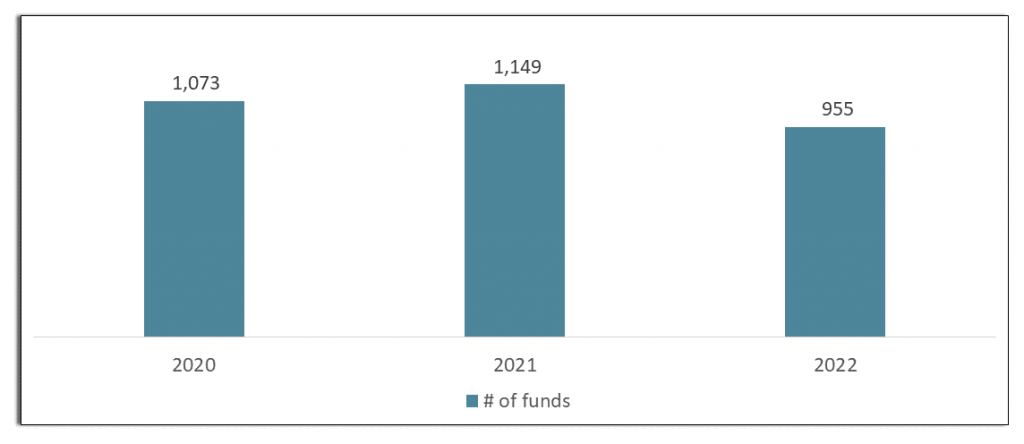

With the yo-yoing of investor sentiment, oscillating between bouts of bullishness and pessimism among investors, fund managers have not had a stable environment in which to launch funds. Fund managers, nonetheless, kept to the script, with total fund launches varying only slightly throughout the three years. 2022, a seemingly particularly challenging year in which to launch funds, saw a decline in fund launches of only 11% from 2021.

Funds launched in Luxembourg and Ireland between 2020-2022

If you build it, will they come?

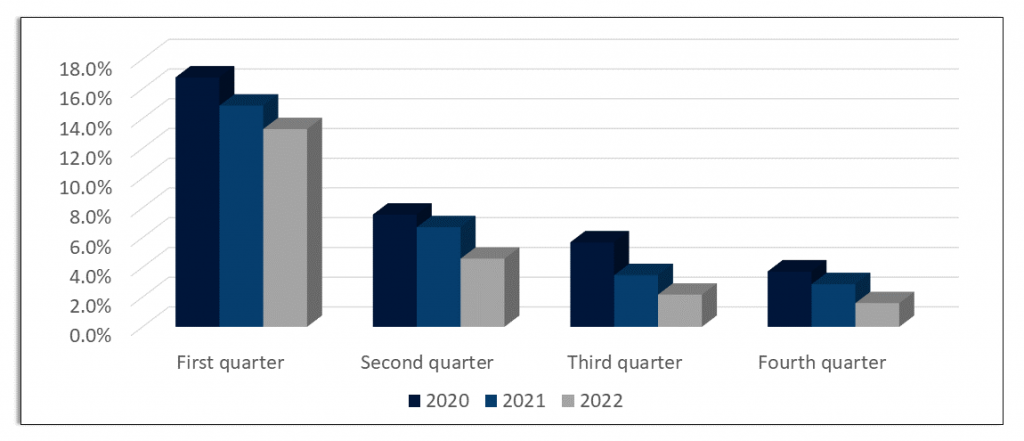

The turbulence of 2022, however, does appear to have negatively impacted the chances of funds hitting the €100 million AUM mark in the first four quarters after launch, at least in the near-term. Compared to 2020 and 2021, a new fund’s chance of hitting the €100 million mark in the first four quarters fell significantly. The chances of the fund reaching this level of AUM in the first quarter after launch averaged 15.8% between 2020 and 2021, but only 13.3% in 2022. For quarters two to four after launch, the chances of a fund hitting the target dropped between one third to one half. Funds slow off the mark in 2022, therefore, faced a steeper hill to climb than in the previous two years.

Percentage of funds reaching €100 million in AUM by numbers of quarters after launch

May the odds be ever in your favour

Anyone who has launched a product, be it a fund or another product, knows the stress of waiting for that first sale, and this is a stress that appears to be magnified for funds. Based on our sample, a fund’s early success is tied to its launch and that first quarter is a critical one. Between 2020 and 2022, 15.0% of funds passed the €100 million goalpost in their first quarter of existence. That figure declined to 6.4% in the second quarter and continued to trail off from there. That first quarter, therefore, tends to determine the pace of growth.

This is not to say, however, that a fund’s only chance of success is determined at birth, only to say that the launch and following few months may be a fund’s first significant opportunity to drive flows. First impressions matter: Funds failing to make an early impression may have to wait until they hit their 3-, 5- or 10-year anniversaries to make their next one. This is when rating agencies and other fund selectors may reconsider their value propositions and drive the decision-making of investors who rely on such data points. At that time, a fund’s value proposition will be judged heavily on performance, a variable that is not entirely within a fund manager’s control.

Launching funds is a risky business, but the rewards are there. Consider that over 50% of assets in Irish- and Luxembourg-domiciled funds are in funds that launched in 2012 or prior. Successful funds can, the record shows, drive revenue for a long time. Look out for an in-depth reflection on this topic from the ISS MI team in the near future. Do not forget to blow the trumpets loudly on Day 1.

Talk to us today to learn more about how ISS Market Intelligence can help your business.

Commentary by ISS Market Intelligence

By: Benjamin Reed-Hurwitz, Vice President, EMEA Research Leader ISS Market Intelligence