Decarbonization and the voyage to Net Zero require many changes to the energy sector, including the electrification of transport and buildings. Economies around the world are transitioning from running on fossil fuels for energy to using metals and minerals, including cobalt, copper, lithium, nickel, rare earths, and graphite.

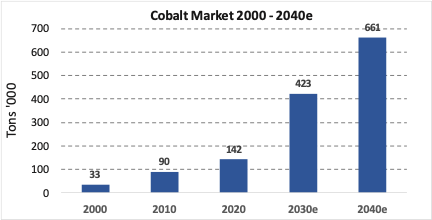

In the past, ISS ESG has discussed commodity investing using an environmental, social, and governance (ESG) framework. Today we look at a critical metal for electric vehicle (EV) and battery production: cobalt. The International Energy Agency (IEA)’s Sustainable Development Scenario foresees cobalt demand growth of 5x between 2020 and 2040.

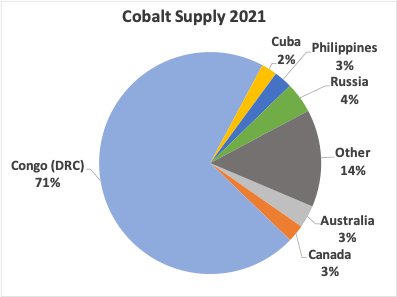

Pressure on the cobalt supply chain is already apparent, and this could intensify if not properly addressed. The largest current supplier of cobalt is the Democratic Republic of Congo (DRC), which provides about 70% of world supplies. Relying on a single natural material supply source with questionable ESG credentials (discussed below) poses risks, as the ongoing European energy crisis demonstrates. Diversifying the world cobalt supply is possible. One option is sourcing from countries such as Australia that perform better on ESG indicators such as strong institutions and respect for human rights. Reviewing present demand and supply, exploring relevant ESG concerns, and identifying some potential alternative supply chain approaches may be useful to investors seeking opportunities to encourage ESG-responsive cobalt production.

Cobalt Demand to Grow Dramatically

Cobalt’s central role in Net Zero presages outsized demand growth. As the energy sector shifts from consuming fossil fuels to requiring metals and minerals as primary inputs, the IEA in its World Energy Outlook predicted that the critical minerals’ market of $40 billion in 2020 will expand seven-fold by 2030, and 10-fold by 2050, to over $400 billion.

To meet demand, total cobalt production will need to grow 3x by 2030 and roughly 5x by 2040, as shown in Figure 1.

Figure 1: IEA Sustainable Development Scenario Forecasts 5x Cobalt Demand Growth by 2040

Note: e = IEA cobalt demand sustainable development scenario estimates

Source: United States Geological Survey (USGS), IEA, ISS ESG

New mines and new deposits will be required to satisfy our path to sustainability. Such outsized growth argues for close examination of supply capability and risks. From where will cobalt be sourced, and what are our options for new supply?

The Democratic Republic of Congo, Primary Cobalt Supplier

Five countries account for over 80% of global cobalt supply, with the Democratic Republic of Congo (DRC) being dominant at over 70% (Figure 2). Relying on a single provider of such magnitude presents a significant supply chain risk, as illustrated by Europe’s current experience in the natural gas market.

Figure 2: Cobalt Supply: Over 70% from Congo (DRC)

Source: USGS, ISS ESG

Setting aside the issue of supply concentration, mining practices and related issues in the DRC also present concerns for investors. There are alternate cobalt sources, however, even if not as abundant as those in the DRC. These will be considered later in this paper. First, a review of some concerns arising from cobalt mining today.

Human Rights and Cobalt: Artisanal Mining, Child Labor, Labor Standards

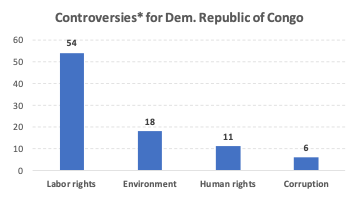

Cobalt mining practices present human rights concerns. A large portion of DRC cobalt production is through artisanal and informal small-scale mining, which operates without safety standards or worker protections. Child labor and accident rates are also concerns. ISS ESG’s Norm-Based Research shows that the DRC has considerable labor rights controversies (Figure 3).

Figure 3: ISS ESG Research Reveals Considerable DRC Labor Rights Controversies

Source: ISS ESG Norm-Based Research

* ISS ESG Norm-Based Research Assesses companies’ adherence to international norms on human rights, labor standards, environmental protection and anti-corruption set out in the UN Global Compact and OECD Guidelines.

Artisanal mining is an important part of DRC production. Such mining produces 15-30% of the country’s cobalt production, according to the World Economic Forum’s Making Mining Safe and Fair report. Artisanal cobalt mining thus accounts for roughly 15% of global production.

Artisanal production involves subsistence miners who are not officially employed by a mining company but work independently using rudimentary tools or in some instances their bare hands to dig out tunnels and collect ore. Reuters reports that 150,000 to 200,000 artisanal miners work in the DRC. These workers operate with no meaningful safety training, equipment, or protection.

Artisanal mine workers’ conditions represent a significant supply chain risk. According to Amnesty International, conflict between these informal miners and security forces working for authorized buying houses are commonplace. Artisanal producers are only permitted to sell their cobalt to Enterprise Générale du Cobalt, a state-owned company.

Accident rates and child labor appear problematic. While reliable accident data for artisanal mining is unavailable, information from the media and organizations such as Amnesty International and the German Federal Institute for Geosciences and Natural Resources (BGR) indicate that fatalities and long-term health problems are common. Exposure to cobalt dust can lead to a fatal condition known as “hard metal lung disease” according to the US Centers for Disease Control and Prevention (CDC). Moreover, child labor is prevalent, according to a study by BGR that found over 2,500 children were present at 29% of a sample of 58 sites.

Public and labor safety issues. A joint study published by the UK-based NGO Rights and Accountability in Development (RAID) links the high proportion of outsourced contractors in the cobalt mining industry to systemic abuses of public and labor safety standards within that industry. The study reports that in a sample of five major industrial mines in the DRC, which are estimated to have produced over 50% of global cobalt supply in 2020, around 57% of workers were supplied by subcontractors. In some mines, that proportion is significantly higher. Managers at subcontracting firms and others interviewed for the report explained that industrial mining companies prioritized contracted workers to reduce labor costs, limit their legal liabilities, and prevent workers from joining unions.

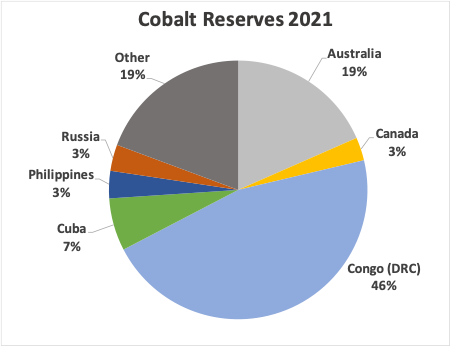

Australia: Meaningful Reserves with a B- ESG Country Rating

Industry can diversify its supply. Figure 4 illustrates current cobalt reserves. While the DRC has a large share of global cobalt reserves, other countries, most notably Australia, also have meaningful presence. Expanding the supply from Australia (a country with ambitious Net Zero goals) and other countries that perform better by ESG standards offers opportunities to reduce single-source and human rights risks.

Figure 4: Worldwide Cobalt Reserves

Source: USGS, ISS ESG

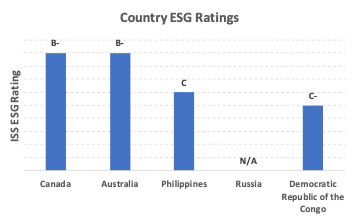

Figure 5 shows the ISS ESG Country Rating results for the top five cobalt reserve countries. Australia stands out as having both meaningful reserves and a relatively strong ESG rating. Canada exhibits an equivalent ESG rating. At a minimum, these represent two markets that could add diversity to the global production mix.

Figure 5: Major Cobalt Exporters’ Country ESG Ratings

Source: ISS ESG

Cobalt Miners Are Also Relatively Concentrated

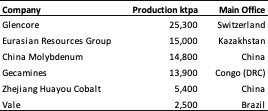

The top four mining companies account for over 40% of global production.Figure 6 shows major miners’ cobalt production rates. One diversified mining and trading company, Glencore, alone accounts for over 15% of total production volumes. Interestingly, most of these producers are located in emerging markets.

Figure 6: Major Cobalt Mining Companies (production in kilotons per annum [ktpa])

Note: Production rates are from the latest available reported year.

Source: Company reports, ISS ESG

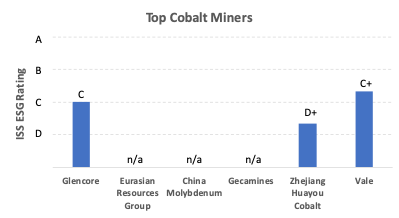

Some of the companies are private, and therefore without ESG grades (Figure 7). Vale, which has the lowest cobalt production of the group (being predominantly an iron ore producer), has the highest ESG rating, at C+.

Figure 7: ESG Corporate Ratings of Top Five Cobalt Mining Companies

Source: ISS ESG

Active Asset Ownership and Diversification

Stakeholder-focused investors have an important role to play. Single-source risk, artisanal mining, human rights concerns, and labor practices are problems in cobalt production, which is concentrated in the DRC. The size and severity of these issues may seem intractable without society-wide initiatives to resolve them, but there are actions investors can take.

Investors and active asset owners can demand greater transparency in the cobalt supply chain from the cobalt mine to the final manufacturer, such as EV producers. Capital can be channeled to those mining companies with the best sustainability records, or alternatively active owners can demand better practices from companies with poor ESG performance. Last but not least, investors seeking to generate real-world outcomes can explore opportunities to finance new projects in jurisdictions such as Australia with better worker and environmental protections. ISS ESG products such as the ESG Country Rating and ESG Corporate Rating and Norm-Based Research can assist investors as they pursue these opportunities.

Explore ISS ESG solutions mentioned in this report:

- Identify ESG risks and seize investment opportunities with the ISS ESG Corporate Rating.

- Assess companies’ adherence to international norms on human rights, labor standards, environmental protection and anti-corruption using ISS ESG Norm-Based Research.

- Access to global data on country-level ESG performance is a key element both in the management of fixed income portfolios and in understanding risks for equity investors with exposure to emerging markets. Extend your ESG intelligence using the ISS ESG Country Rating and ISS ESG Country Controversy Assessments.

By: Nicolaj Sebrell, CFA, Head of Energy, Materials, & Utilities, ISS ESG

Arthur Kearney, Associate, Metals & Mining, ISS ESG