The EU Taxonomy is a classification framework of environmentally sustainable economic activities, establishing criteria for activities to contribute to six climate and environmental objectives. A previous article by ISS analyzed reported Taxonomy data from companies subject to the Taxonomy disclosure obligations.

The EU Commission adopted major amendments to Taxonomy Delegated Acts on July 4, 2025, as part of the so-called Sustainability Omnibus Package, with the aim of reducing companies’ reporting burdens. The main amendments include a materiality threshold for disclosure exemption, new exclusions for the denominator of financial entities’ KPIs, and major simplification of Taxonomy reporting templates. While the simplification amendment is generally welcomed by market participants, there’s a general acknowledgement that the amendments will result in reduced granularity of available Taxonomy data.

This article provides a data provider’s perspective on these developments. Specific topics covered are the amendments’ implications for data availability and Taxonomy reporting and how data providers can help bridge the gap between data availability and reporting obligations. Access to reliable estimated data and data points to evaluate the quality of companies’ reported data are instruments that ISS’ clients can leverage to meet regulatory requirements.

Changes in Overall Reporting Approach and KPIs’ Computation

Impact of Introducing a Materiality Concept for EU Taxonomy Reporting

Under the adopted amendments to the EU Taxonomy reporting framework, companies are exempt from assessing the Taxonomy eligibility and alignment of economic activities that are deemed “non-material,” i.e., activities that generate cumulatively below 10% of the company’s KPIs’ denominators. For non-financial companies, the threshold applies to their total net turnover, capital expenditure (CapEx), or operational expenditure (OpEx). The new rules also clarify that reporting on OpEx KPI is optional if it is not material for a company’s business model. The recent amendments also require that an independent assessment be conducted for each KPI.

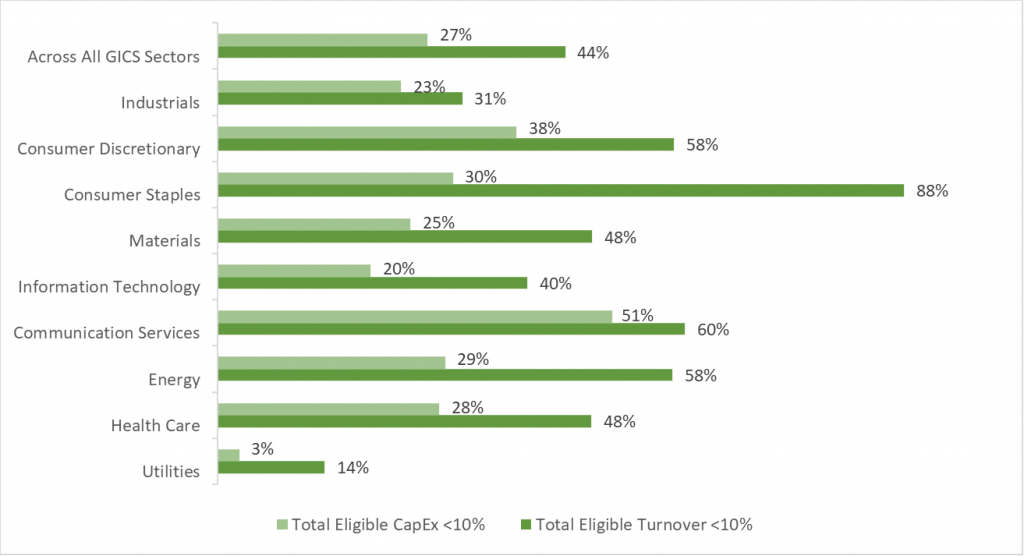

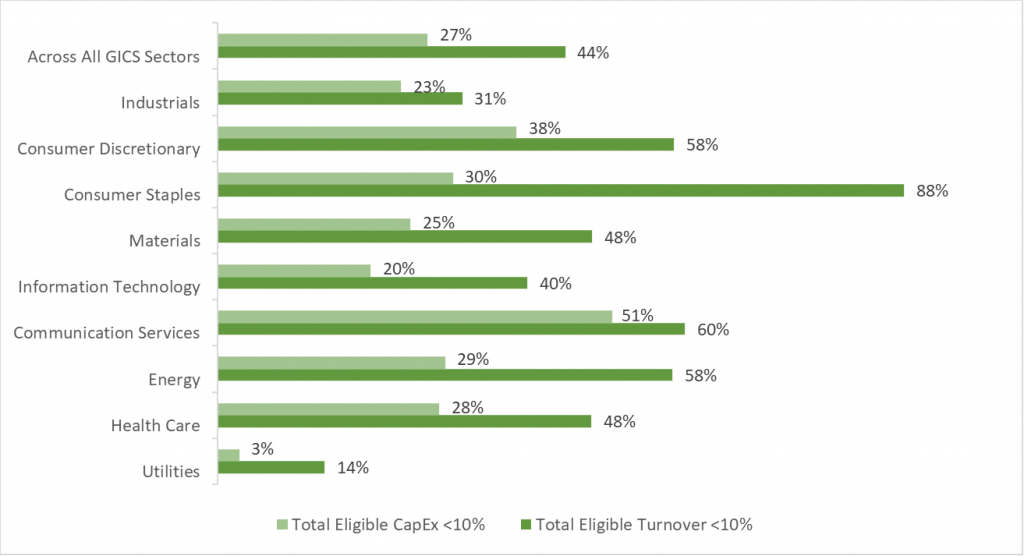

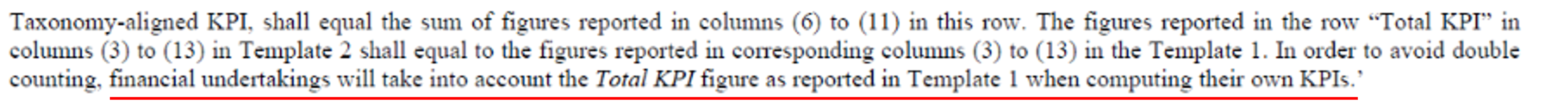

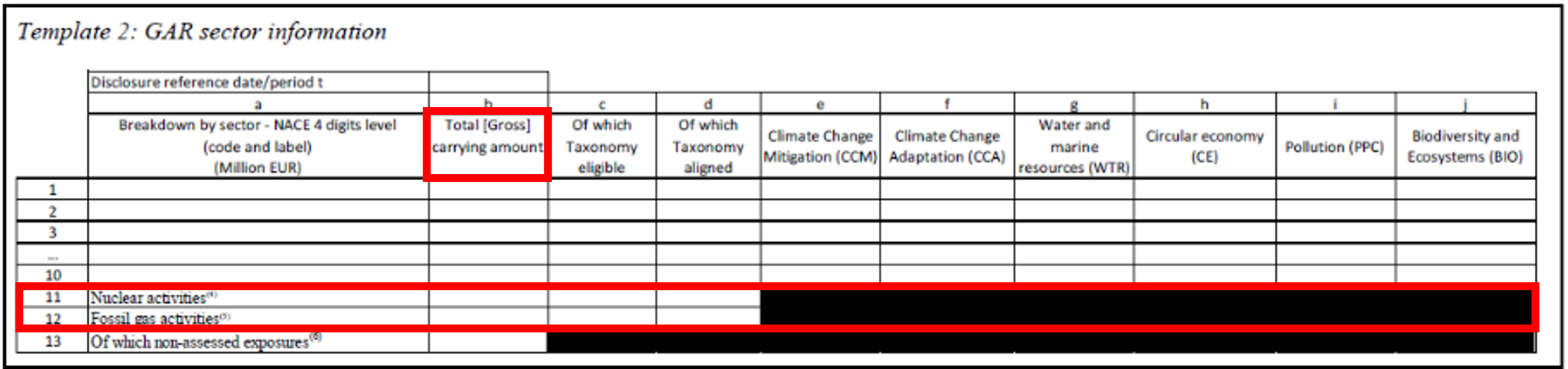

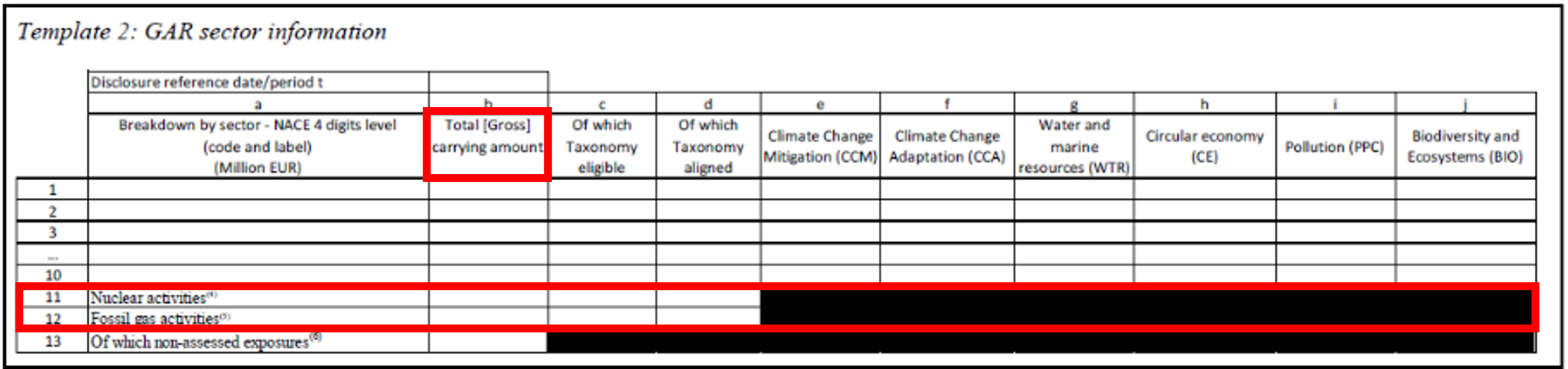

To showcase the estimated impact of this change on the availability of EU Taxonomy data for investors, Figure 1 below shows the share of non-financial companies within the ISS EU Taxonomy reporting universe that currently report less than 10% of total eligibility for turnover and CapEx on a cumulative basis.

Figure 1: Share of EU Taxonomy Reporting Non-financial Companies Reporting Less Than 10% of Eligibility for Turnover and CapEx, by GICS Sector

Notes: The analysis is based on FY 2023 data and covers 1500+ non-financial companies.

Source: ISS Sustainability Research

The overall share for turnover is 44% (approximately 700 companies) while the share for CapEx is nearly 30% (about 420 companies). Of all the sectors, Consumer Staples has the most significant share of companies with low Taxonomy eligibility, nearly 90%. With the new below-10% materiality threshold, a decrease in Taxonomy-reported data is expected for these companies.

The adopted amendments clarify that companies would still need to separately report, at an aggregated level, all their non-material (or non-assessed) economic activities and assets. However, concerns raised by several responders to the public consultation on these revised rules indicate that this change may result in less visibility on nascent efforts by companies in their path towards a sustainable transition, especially in the case of Taxonomy reporting by large undertakings.

In the case of financial companies, the less-than-10% cumulative materiality threshold applies to their financial assets, i.e., loans and investments financing specific economic activities whose use of proceeds is known. This threshold also extends to financial companies’ reporting on various KPIs (GAR stock and flow, financial guarantees, assets under management, fees and commissions, etc) that are not material to their business (i.e., which generate less than 10% of total net turnover).

Option Not to Disclose for Financial Institutions

The adopted amendment to the Delegated Act adds a new clause to Article 7 of the Taxonomy Disclosure Delegated Act, stating that financial undertakings are not subject to Taxonomy reporting until December 31, 2027, should they claim that they do not have exposures to Taxonomy-aligned activities.

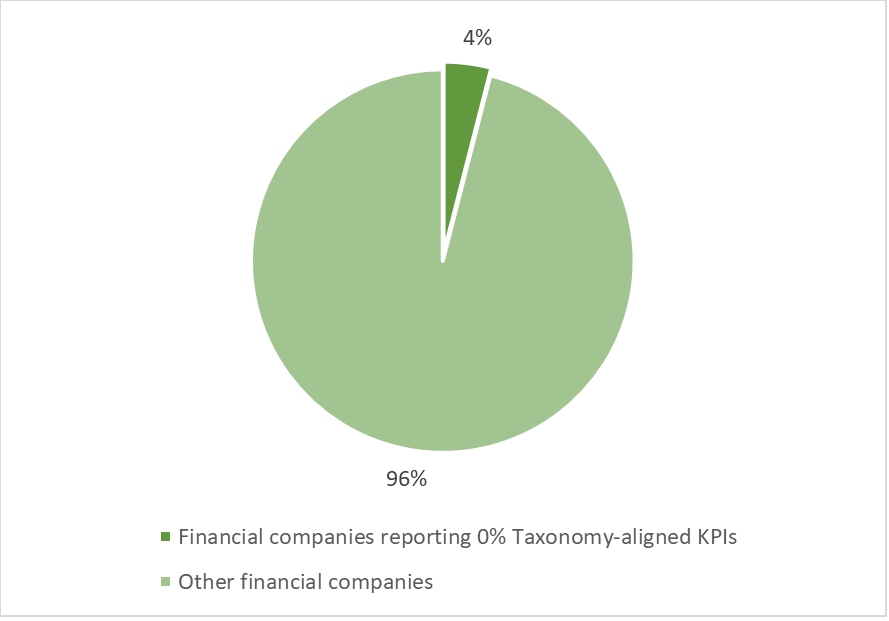

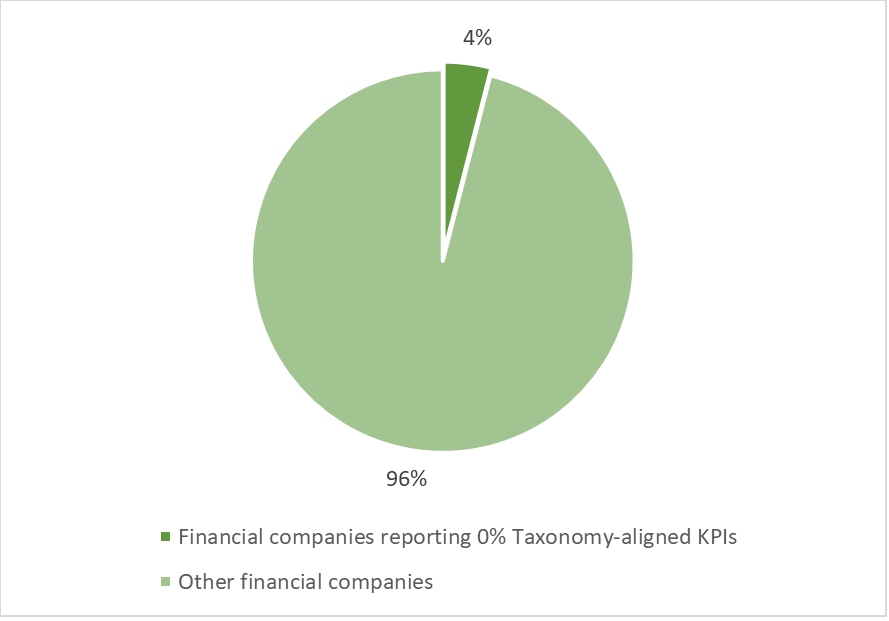

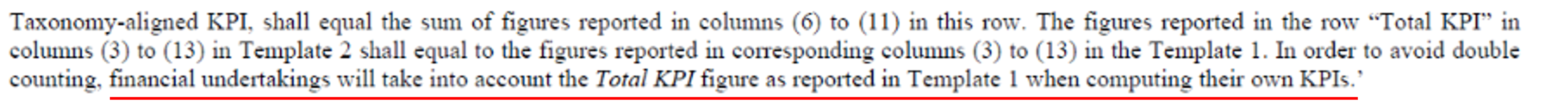

Within ISS’ EU Taxonomy reported data universe, approximately 4% of financial companies have reported 0% for their Taxonomy-aligned KPIs (Figure 2).

Figure 2: Share of Financial Undertakings Reporting 0% for Taxonomy-Aligned KPIs

Note: The analysis is based on FY 2023 reported data and covers 173 financial companies.

Source: ISS Sustainability Research.

These institutions thus might not report their Taxonomy disclosures within the next two years.

Change in Scope of KPIs of Financial Undertakings

Beyond the option of taking an exemption from EU taxonomy reporting for the next two years, financial undertakings have been provided additional relief in the form of reduced scope for their KPIs.

The adopted amendment to the Delegated Act excludes specific categories of assets, such as derivatives, cash and cash equivalents, on-demand interbank loans, goodwill, and commodities. This stems from the consensus that these assets cannot be assessed as such under the Taxonomy criteria. Further, the scope of these KPIs also excludes exposure to undertakings that are not subject to mandatory sustainability reporting under the Taxonomy.

Impacts of New Simplified Reporting Templates

One of the most noticeable amendments to the EU Taxonomy reporting templates is the significant reduction of required data points. Specifically, as stated in the adopted amendment to the Delegated Act, 64% of mandated data points were removed for non-financial disclosure and 89% were removed for credit institutions.

This disclosure relief will impact approximately 45% of ISS’ current EU Taxonomy dataset and more than 54% of the datapoints currently leveraged by ISS’ clients for their KPIs’ computation. As a result, several datapoints, mostly from non-financial companies, will have to be aggregated instead of being directly collected from companies’ reports. While such derivations are possible, discrepancies can arise if inconsistencies exist in reported datapoints used for the aggregation. Other datapoints that cannot be derived, mostly from financial companies, will have to be retired and no longer be available.

Removal of Do No Significant Harm and Minimum Social Safeguards Alignment in Non-financial Disclosures

A major simplification of reporting obligations is the omission of Do No Significant Harm (DNSH) and Minimum Social Safeguard (MSS) alignment disclosures for non-financial companies. In the previous template, explicit disclosure of these two areas was required for Taxonomy-aligned activities. Since compliance with DNSH and MSS criteria is a prerequisite for an activity to be Taxonomy aligned, this simplification should allow for more concise reporting.

Reduced Granularity of Activity-Level Data and Ambiguity on Partial Alignment in Non-Financial Reporting

While it might simplify reporting, the removal of DNSH datapoints also means less granularity of disclosed Taxonomy data at the activity level. At the same time, although the adopted amendment to the Delegated Act allows for partial alignment disclosure, stating that “undertakings subject to Articles 19a or 29a of the Accounting Directive could also be allowed to report on their activities which fulfil only certain requirements of Article 3 of the Taxonomy Regulation,” this provision is yet to be clearly reflected in the reporting templates.

This may lead to less visibility on companies’ sustainability transition, where companies are on a roadmap to improve their alignment share. As a result, decreased granularity may have an impact for financial institutions and other institutional investors that have considered transitioning and gradual improvement in Taxonomy alignment for their investment strategies.

Disclosure Relief from Taxonomy Eligibility and Alignment Breakdown

In the previous templates, both financial and non-financial companies were mandated to disclose not only the KPIs on overall Taxonomy alignment and eligibility, but aggregated shares of aligned enabling and transitional activities for each of the six Taxonomy objectives, as well as a breakdown of Taxonomy eligibility by each objective. This detailed disclosure is no longer present in the new reporting templates. As observed by ISS, in the previous templates, several companies failed to disclose this detailed breakdown. Thus, the removal of these fields in the updated templates is expected to resolve this gap in previous disclosure practices.

However, like the reduced granularity at activity level, this disclosure relief can pose certain challenges for financial undertakings if they leverage these data points in their investment decision-making process.

Clearer Reporting Format to Avoid Double Counting by Non-financials

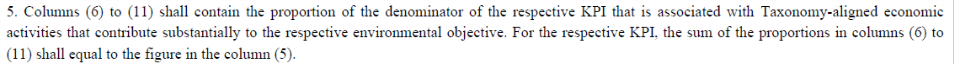

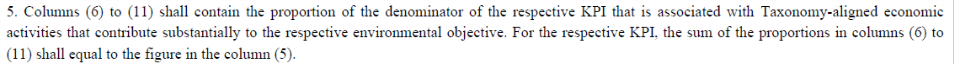

The new reporting template for non-financial undertakings mandates that, at the aggregated level for Total KPI in both Template I (Summary table) and Template II (Activity disclosure table), alignment should be counted only for the most relevant objective. (In contrast, Taxonomy alignment at the activity level can be counted for several objectives that the activities contribute to.) Compared to the previous template, where aggregated alignment could still be counted for more than one objective, this practice ensures a clearer approach for both avoiding double counting and reporting on total KPIs.

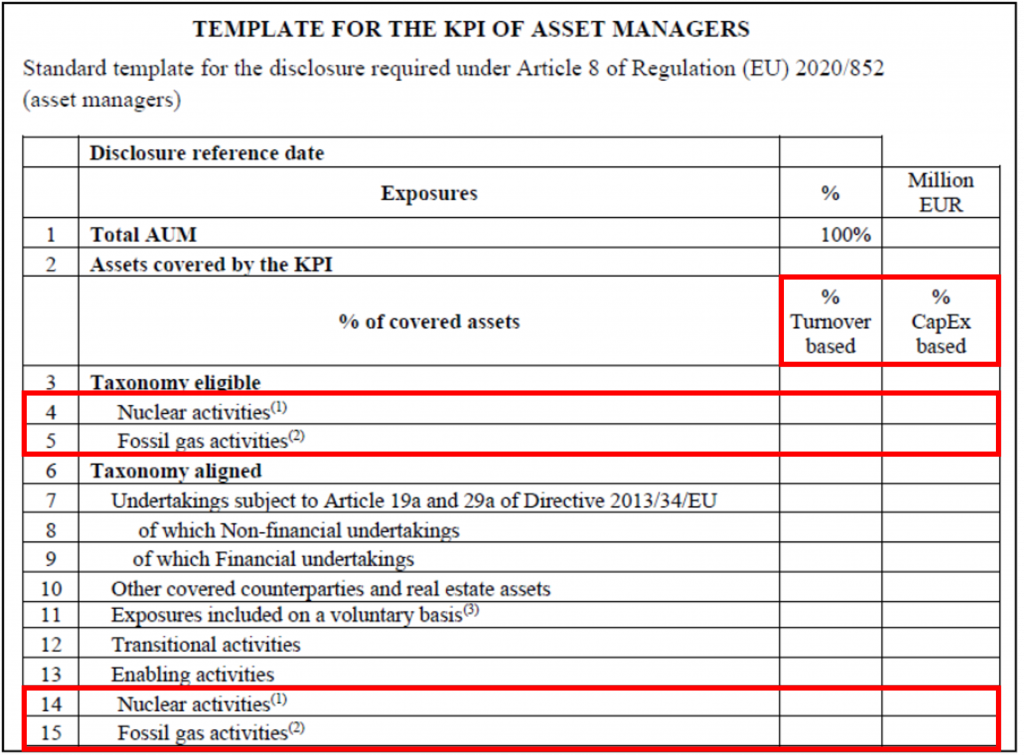

Further, for financial companies that will need the data of their non-financial counterparties to compute their own KPIs, the updated template (Figure 3) also contains clear instructions on which values shall be drawn from non-financial reports.

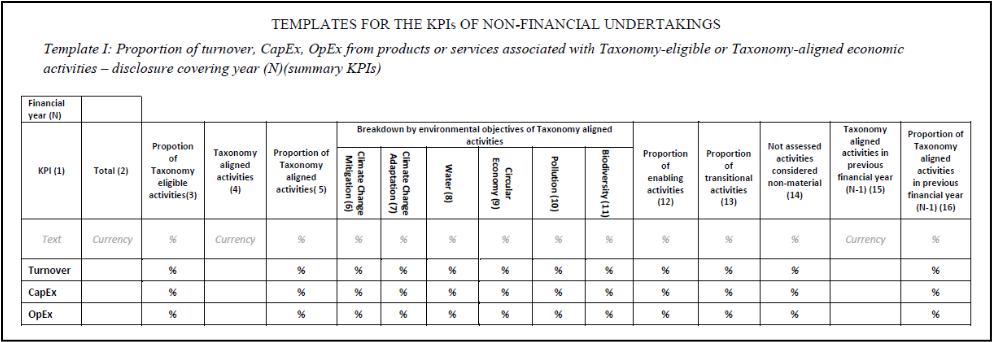

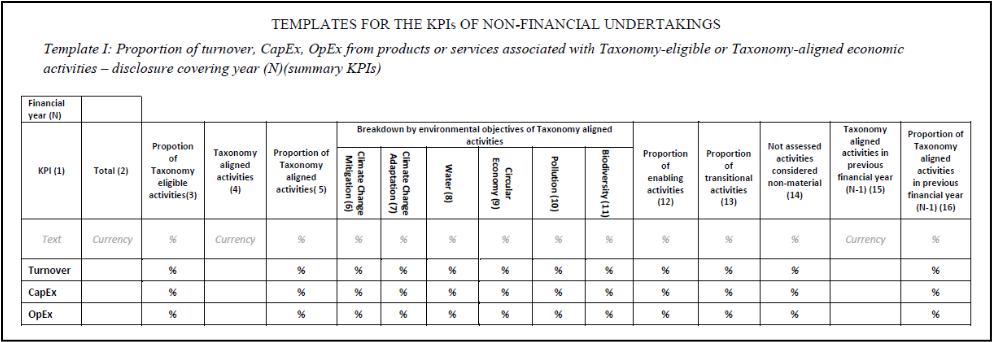

Figure 3: Template 1 of Non-financial Reporting Template and Relevant Footnotes

Note: Footnote 5 is from Template 1. It is for non-financial companies on how to compute KPIs and it also clarifies for financial companies how to understand non-financial reported value. Footnote 9 is from Template 2. It is for financial companies and states that these companies should refer to Template 1 for their KPI computation.

Source: Annexes to the Delegated Act

Integration of Nuclear & Gas (N&G) Disclosure into Financial Templates

Previously non-financial and financial companies were mandated to disclose their involvement in or financing of Nuclear and Gas (N&G) activities in a separate template laid out by Annex XII of the Disclosure Delegated Act. This dedicated N&G template has now been removed.

Companies now can disclose N&G activities within their own specific templates. For non-financial companies, the non-financial reporting template has always entailed the option to disclose N&G activities. On the financial side, N&G disclosure is now integrated into all financial templates, streamlining the reporting practice in this area and making it consistent with that for non-financial companies.

The removal of the dedicated N&G template is expected to resolve several irregularities observed so far for N&G disclosures, where significant contradictions exist between companies’ own reporting templates and N&G templates due to inconsistent scaling or different interpretations of reporting fields.

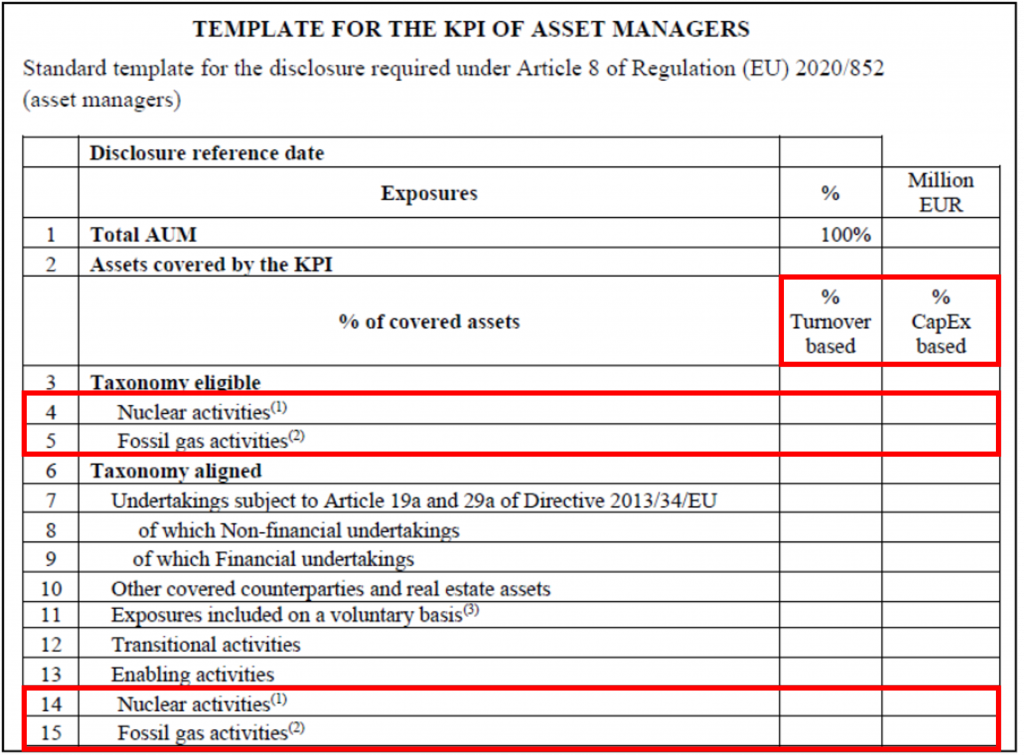

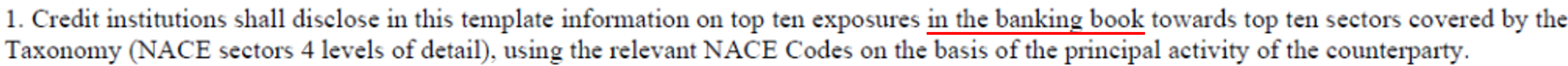

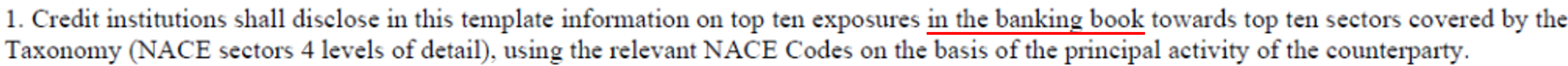

However, an inconsistency has been observed on the integration of N&G disclosure across different financial templates. For asset managers, investment firms, and insurance companies, exposures to N&G activities are to be disclosed in percentage values based on the Turnover and CapEx of counterparties. Credit institutions, however, are to disclose their N&G exposure in absolute banking book value within their GAR sector information table (Figure 4).

Figure 4: Nuclear & Gas Exposures Reporting in Asset Manager Template (top) and Credit Institution Template (bottom)

Source: Annexes to the Delegated Act

While credit institutions shall also duplicate the GAR sector information table for Turnover and CapEx-based disclosures, this inconsistency in disclosure unit for N&G data across financial templates might pose some difficulties for other financial institutions when computing their own N&G exposures related to their bank counterparties.

Computing Non-assessed Exposures for the First Time by Financials

As companies now have the option not to assess the Taxonomy eligibility and alignment of non-material activities or assets constituting less than 10% of their KPIs’ denominator, financial companies are mandated to disclose their non-assessed exposures due to their counterparties’ non-materiality evaluations. In addition, financial companies will also have to disclose their exposures to other financial counterparties that claim no association with Taxonomy-aligned activities and therefore do not disclose Taxonomy data. However, as these datapoints did not exist in the previous templates, financial companies may struggle to find the input to compute these disclosure fields when reporting for the first time in the new templates.

Existing Unresolved Challenge from the Financial Side

A reporting obligation that has yet to be covered by the new simplified reporting templates is a standard disclosure format for weighted average KPIs.

According to the third Commission Notice from November 2024, financial companies engaging in multiple financial businesses, besides filling out each specific template for their involved business segment, are also mandated to disclose a weighted average KPI that combines KPIs from their different financial activities based on their revenue proportions. The same approach also applies to insurance companies and investment firms, which need to consolidate their underwriting and investment KPIs (insurance), and on own accounts and not on own accounts KPIs (investment firms), based on the proportion of revenue from the respective business segment.

The new templates do not include fields for disclosure of these weighted average KPIs and, up until now, companies have tended to disclose these data points in the contextual information section within their Taxonomy report. Thus, this leaves room for reporting inconsistencies that may lead to data collection challenges for computing financial KPIs.

Conclusion

The adopted amendments to the EU Taxonomy reporting requirements and templates are expected to decrease the disclosure demands for reporting companies. In particular, the simplification of the reporting templates resolves several potentially unclear and inconsistent reporting approaches observed in the market, which may lead to better reported data quality in the next year and beyond.

Nevertheless, for the next reporting cycle, reporting companies have the flexibility to choose between reporting under the old and new templates and accompanying rules. Accordingly, the definitive impact of the changes recently introduced may be fully dimensioned only from 2027 on.

However, certain challenges remain. These include input being unavailable to compute certain values in the new reporting templates for the first time; the ongoing lack of a standard disclosure format for weighted average KPIs; and impacts from reduced granularity of reported data.

For financial institutions, efforts to address the first two challenges will benefit from further detailed guidance from the Commission, especially during the transition phase when companies report in the new templates for the first time. Addressing the impact of decreased granularity will depend on financial institutions’ specific approaches in applying data to implement their investment strategies.

From a data provider position, ISS Sustainability Solutions will closely follow the new simplified reporting templates as it updates its data collection and piping process. The update will ensure that the ISS data offering provides the granularity clients need to fulfil their reporting obligations. ISS will also be looking into developing dedicated datapoints that provide insight into the quality of data disclosed by reporting entities.

Explore ISS STOXX solutions mentioned in this report:

- Financial market participants across the world face increasing transparency and disclosure requirements regarding their investments and investment decision-making processes. Let the deep and long-standing expertise of the ISS ESG Regulatory Solutions team help you navigate the complexities of global ESG regulations.

By:

Phuong Anh Nguyen, Methodology Specialist – Regulatory Solutions and Fixed Income

Navaneet Desai, Product Manager – Regulatory Solutions

Bharat Juyal, Methodology Specialist – Regulatory Solutions and Fixed Income