Below is an excerpt from ISS ESG’s recently released paper “The Promises and Pitfalls of the SFDR”. The full paper is available for download from the Institutional Shareholder Services (ISS) online library.

KEY TAKEAWAYS

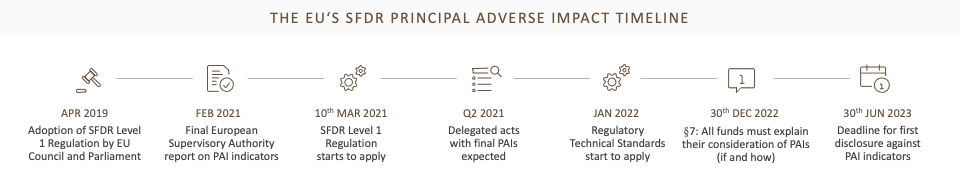

- The European Union’s Sustainable Finance Disclosure Regulation (SFDR) promises to enhance transparency and standardization in the finance industry’s response to sustainability challenges.

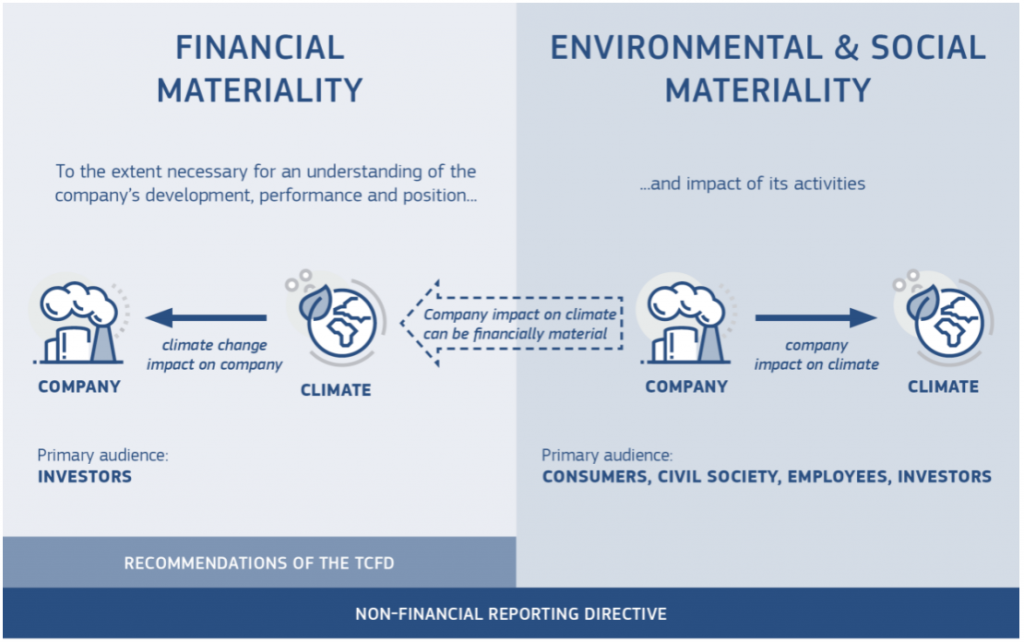

- The SFDR’s engrained concept of double materiality and the metrics defined for measuring Principal Adverse Impacts resonate very well with ISS ESG’s research and methodologies.

- Data availability is a key challenge in the context of reporting on Principal Adverse Impact indicators, but it is not insurmountable and should not be used as an excuse for inaction – established strategies such as modelling and estimation can be applied to bridge the gaps.

The double materiality perspective of the Non-Financial Reporting Directive in the context of reporting climate-related information.;

Source: https://ec.europa.eu/finance/docs/policy/190618-climate-related-information-reporting-guidelines_en.pdf

Explore ISS ESG solutions mentioned in this report

- Measure the performance of your investments against the regulator-defined Principal Adverse Impact (PAI) indicators and metrics using the ISS ESG SFDR Principal Adverse Impact Solution.

The full paper is available for download from the Institutional Shareholder Services (ISS) online library. You can access the full paper here.

By Dominika Dobielewska, Associate, ESG Methodology, ISS ESG. Ronja Wöstheinrich, Senior Associate, ESG Methodology, ISS ESG