As global demand for water increases, the social impacts of water scarcity will become more profound. For example, water scarcity has been linked to climate-induced migration, and it is estimated that 216 million people could be internally displaced by 2050. After migrating, people often face challenges finding work in their new location, because they do not have the required documentation or know the local language. Research shows that climate migration also exacerbates factors that increase the risk of modern slavery.

Modern slavery is a concern for which legislation is increasingly holding companies to account. Moreover, it is a major contributor to greenhouse gas emissions, suggesting that climate change and modern slavery may be mutually reinforcing.

Companies that are well-prepared for such risks and have appropriate policies to mitigate them are more likely to be well-positioned from an Economic Value Added (EVA) perspective. Taking climate migration as an example, this Insights post explores the significance for investors of the social impact of water scarcity.

Risk by Industry and Location

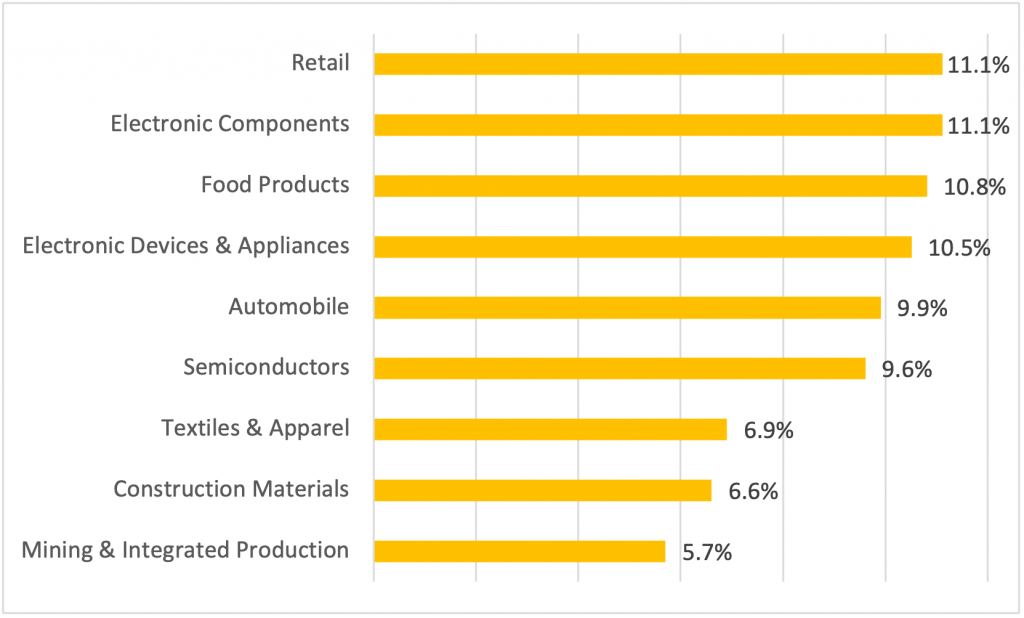

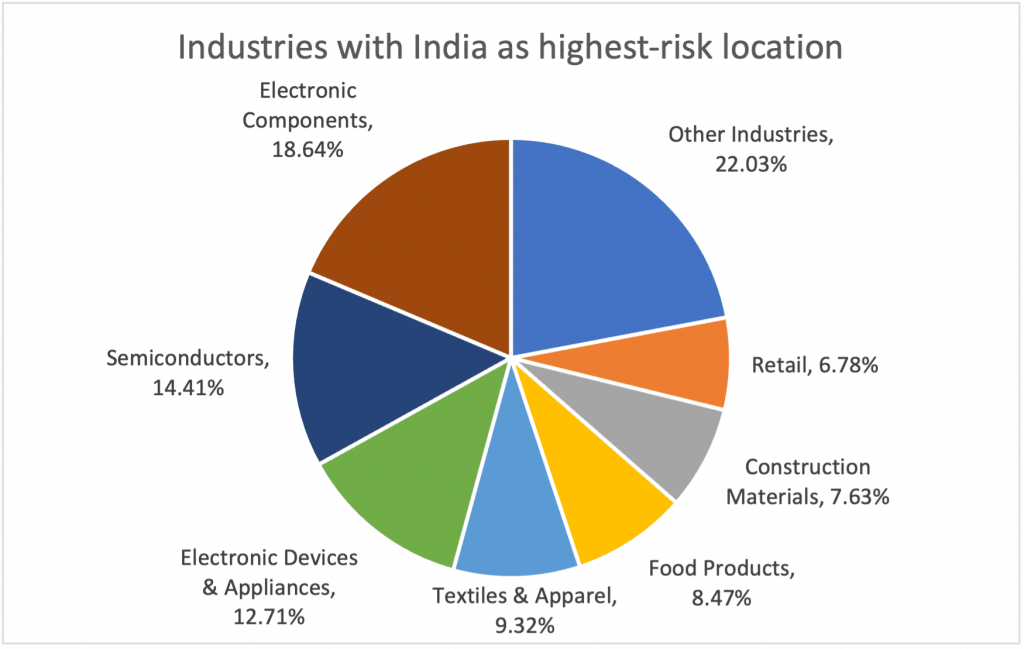

When used in tandem, ISS ESG’s Water Risk Index and Modern Slavery Scorecard can identify industries that face the greatest water scarcity and modern slavery-related risks in their supply chains. Figure 1 shows that Retail, Electronic Components, and Food Products are among these industries.

Figure 1: Breakdown of Industries at High Risk for Water Scarcity and Modern Slavery in the Supply Chain (>$10 Billion Market Cap)

Source: ISS ESG

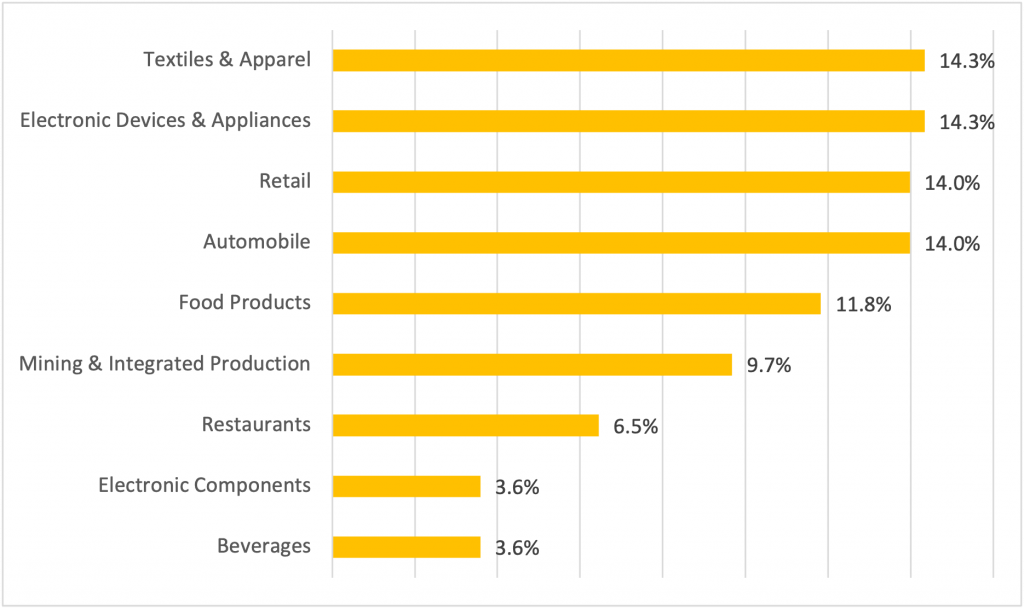

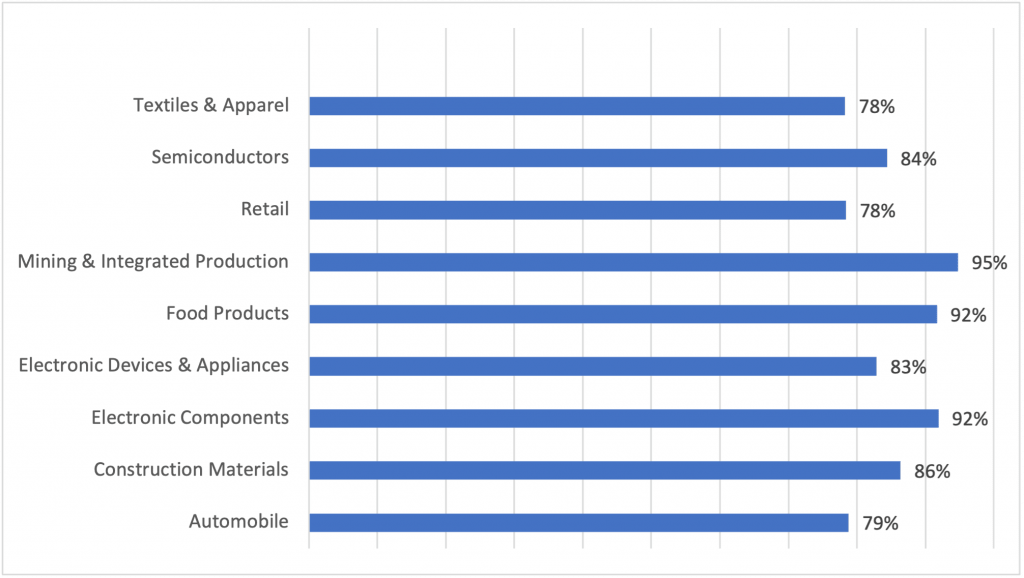

Meanwhile, Figure 2 shows industries that are deemed at high risk and have experienced labor controversies, based on ISS ESG’s Modern Slavery Norm-Based Research data.

Figure 2: Breakdown of Industries at High Risk for Water Scarcity and Modern Slavery in the Supply Chain That Already Experience Labor Controversies (>$10 Billion Market Cap)

Source: ISS ESG

There is significant overlap between the industries that are at risk for climate migration-related labor rights violations and those that have already experienced labor controversies. Textiles & Apparel, however, has experienced an outsized proportion of labor controversies relative to its risk.

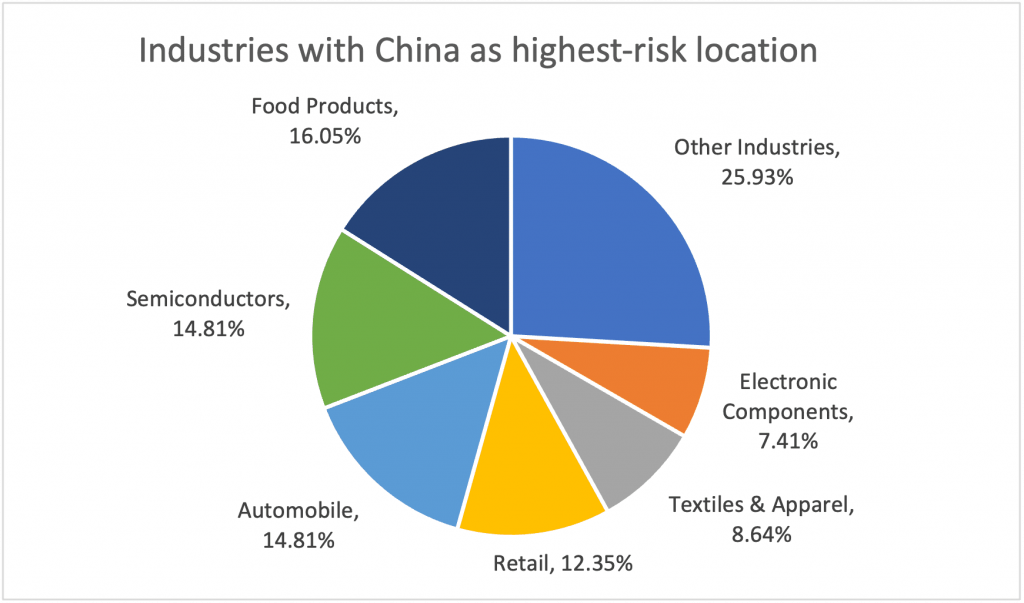

For more than 50% of large cap companies in the ISS ESG Corporate Rating universe, India and China were the locations with the highest risk for water scarcity and modern slavery in the supply chain. The largest proportion of companies for which China was the highest-risk operating location were in the Food Products, Semiconductors, and Automobiles industries. The largest proportion of companies for which India was the highest-risk operating location were in the Electronic Components, Semiconductors, and Electronic Devices & Appliances industries (Figure 3).

Figure 3: Breakdown of Industries Where China and India Are the Highest-Risk Locations for Water Scarcity and Modern Slavery in the Supply Chain (>$10 Billion Market Cap)

Source: ISS ESG

Company Responses to Climate Migration Risks

Policies on Non-regular Employment

A proactive step corporations can take to mitigate the potential negative implications of precarious labor resulting from climate migration is to develop and strengthen their position on non-regular employment. Non-regular employment can include temporary/part-time workers and contractors who are employed by an external agency, which can increase the risk of labor violations in a company’s own operations.

An indicator in ISS ESG’s Corporate Rating assesses whether a company uses non-regular employment and whether the company implements measures to lessen non-regular employment’s negative effects. As Figure 4 indicates, most companies in at-risk industries have very weak positions on non-regular employment, and most companies across all industries have a D- grade for their position on non-regular employment in ISS ESG’s Corporate Rating.

Figure 4: Breakdown of Industries That Have Received a D- for Their Position on Non-Regular Employment (>$10 Billion Market Cap)

Source: ISS ESG

This finding is troubling because it raises the question of whether companies have fully invested in the policies and measures that would minimize the risk of labor violations in their operations.

Modern Slavery Disclosures

Country-level legislation is becoming increasingly stringent in its approach to corporate supply chains, which include direct and indirect suppliers. For example, the UK’s Modern Slavery Act (2015) requires businesses that operate in the UK with an over £36 million turnover to provide an annual statement identifying the measures they are taking to ensure their supply chain is free from modern slavery. Similarly, the German Act on Corporate Due Diligence Obligations in Supply Chains, implemented in 2023, applies to companies operating in Germany with at least 3,000 employees. The Act requires proactive and ongoing human rights due diligence, which covers modern slavery and other human rights abuses throughout the supply chain. Other countries in Europe, including the Netherlands and Austria, among others, are considering similar legislation.

ISS ESG carefully monitors the quality of corporate modern slavery disclosures, and organizes them into four categories, from leader to laggard:

- Leader: Comprehensive disclosure policies and procedures

- Outperformer: Some disclosure policies and procedures, with evidence of good practice

- Medium-Performer: Some disclosure, but without demonstrating good practice

- Laggard: Poor performance

To take a proactive approach to the risks they face from climate-induced migration, companies can ensure they have comprehensive policies and practices in place.

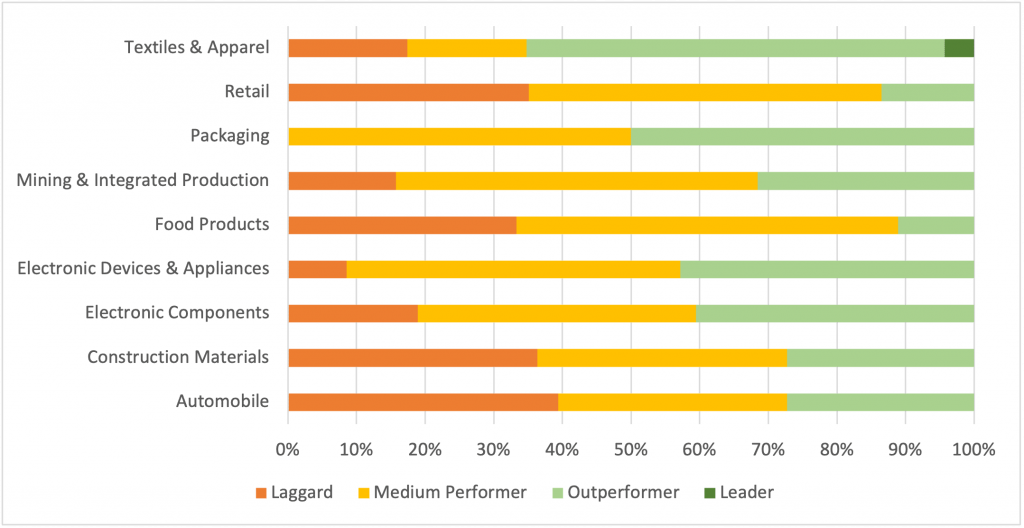

Currently, Textiles & Apparel is the only industry with companies that are Leaders in terms of their disclosure (Figure 5). It is also the only industry in which the majority of companies are Outperformers on disclosure. For all other industries reviewed, the majority of companies are Medium-Performers. The industry with the largest percentage of Medium-Performers is Food Products (56% of companies in the industry), and the industry with the largest percentage of Laggards is Automobile (39% of companies in the industry).

Figure 5: Industry Breakdown of Modern Slavery Disclosure Quality, for Industries at High Risk for Water Scarcity and Modern Slavery in the Supply Chain (>$10 Billion Market Cap)

Source: ISS ESG

Other high-risk industries have yet to improve modern slavery policies and practices to guard against the risks that climate-related migration might pose.

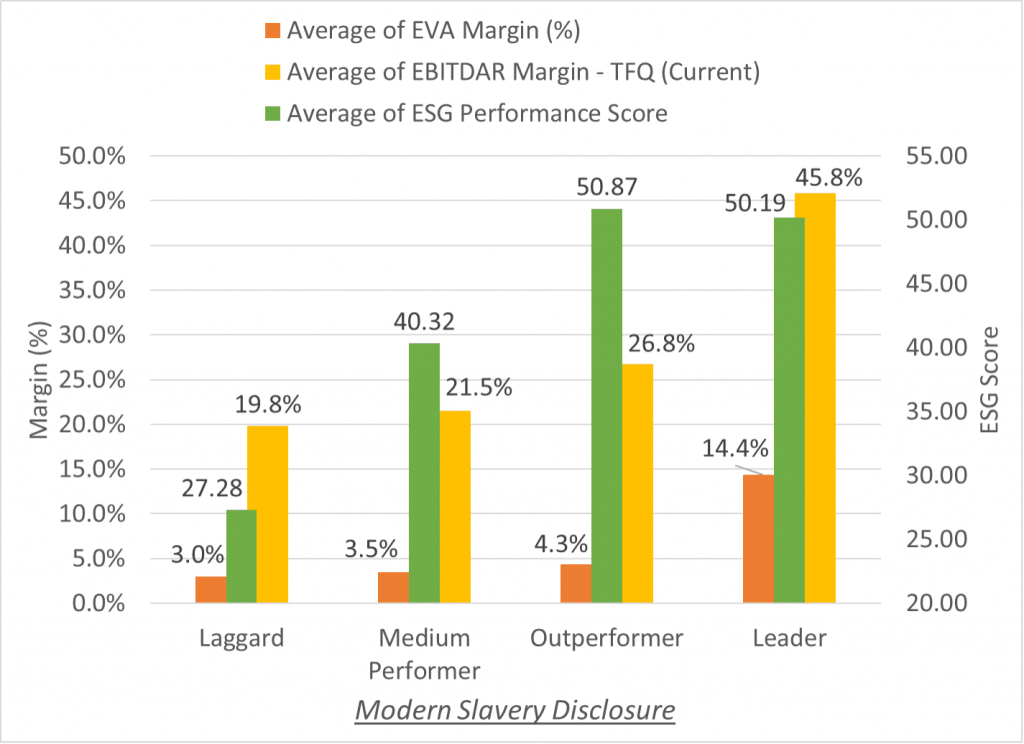

Performance on Three Key Metrics

Using ISS ESG’s Economic Value Added (EVA) data, it is possible to determine how companies at high risk for water scarcity and modern slavery perform financially compared to companies that are less well-prepared. Figure 6 compares companies with four levels of disclosure — Laggards, Leaders, Medium-Performers, and Outperformers — based on three key metrics:

- Average of EVA Margin (%): The profit margin that results after all operating expenses, taxes, and capital charges have been paid.

- Average of EBITDAR Margin (%): EBITDAR Margin is a measure of operating profitability. It is considered a more accurate and comparable indicator of cash operating profit compared to EBITDA.

- Average of ESG Performance Score: The ISS ESG Performance Score allows for cross-sector comparisons using a standardized best-in-class threshold, measuring company performance on a scale of 0 to 100, with 50 representing the Prime threshold applicable to the industry. The ESG Performance Score is the numerical representation of alphabetic ratings (D- to A+) on a scale of 0 to 100.

Figure 6: Industry Breakdown of Modern Slavery Disclosure, for Industries at High Risk for Water Scarcity and Modern Slavery in the Supply Chain, by Key Metrics (>$10 Billion Market Cap)

Source: ISS EVA

As per Figure 6, Leaders and Outperformers fare consistently better on these metrics than companies with poorer disclosure quality. Compared to Medium-Performers and Laggards, Leaders and Outperformers have higher EVA Margins, indicating superior economic value creation. They also have higher EBITDAR Margins – TFQ (Current), suggesting strong operational performance. Finally, they have significantly higher ESG Performance Scores, indicating a strong commitment to Environmental, Social, and Governance practices.

In short, a greater commitment to addressing modern slavery in the supply chain and better processes tend to be accompanied by improved financial performance.

Investors and Climate Migration Risks

At the nexus of environmental and social concerns, climate migration can result from water scarcity and can exacerbate the risk of modern slavery in supply chains. Investors may wish to prioritize investments in companies that take a proactive approach to mitigating climate migration-related risks through, for example, high-quality modern slavery disclosures and robust positions on non-regular employment. Investors can engage with companies on their disclosure practices, labor standards, and other areas related to climate-induced migration. ISS ESG can support investors as they pursue these goals, through services such as the ISS ESG Corporate Rating, ISS EVA, the Modern Slavery Scorecard, and Norm-Based Research.

Explore ISS ESG solutions mentioned in this report:

- Identify ESG risks and seize investment opportunities with the ISS ESG Corporate Rating.

- Understand the F in ESGF using the ISS EVA solution.

- Identify, evaluate and act on modern slavery risks and their impact on investments with the Modern Slavery Scorecard.

- Assess companies’ adherence to international norms on human rights, labor standards, environmental protection and anti-corruption using ISS ESG Norm-Based Research.

Authored by:

Sophia Iosue, Corporate Ratings Associate

Harshal Sonawane, Corporate Ratings Analyst