Below is an excerpt from ISS ESG’s recently released paper “The Taxes Paradigm Shift – From Burden to Impact”. The full paper is available for download from the Institutional Shareholder Services (ISS) online library.

KEY TAKEAWAYS

- Funding the Covid-19 recovery has led to a revived global debate about tax policy and rates, with 130 countries agreeing on a global minimum tax rate.

- Corporate tax avoidance is a major ESG issue, but disclosure on responsible tax practices is noticeable by its absence.

- Responsible investors are increasingly taking into account the implications of fair taxation for social issues such as global inequality, particularly given an increased focus on outcomes-based investing and stakeholder capitalism.

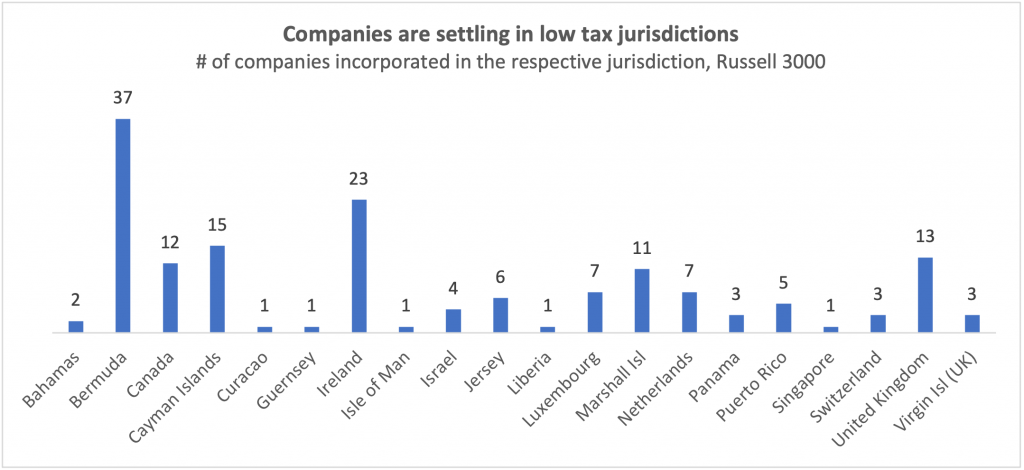

Source: ISS ESG, 2021

Explore ISS ESG solutions mentioned in this report:

- Extend your ESG policies to your fixed income portfolio with ISS ESG Country Rating.

- Assess companies’ adherence to international norms on human rights, labor standards, environmental protection and anti-corruption using ISS ESG Norm-Based Research.

- Identify ESG risks and seize investment opportunities with the ISS ESG Corporate Rating.

- Understand the F in ESGF using the ISS EVA solution.

- Understand the impacts of your investments and how they support the UN Sustainable Development Goals with the ISS ESG SDG Solutions Assessment and SDG Impact Rating.

- Develop engagement strategies, define achievable engagement objectives and manage your engagement process with the ISS ESG Engagement Service.

- Make active ownership a key plank of your responsible investment implementation with ISS Proxy Voting Services.

By Hendrik Leue, ISS ESG, Head of Bespoke Research & Advisory Solutions.