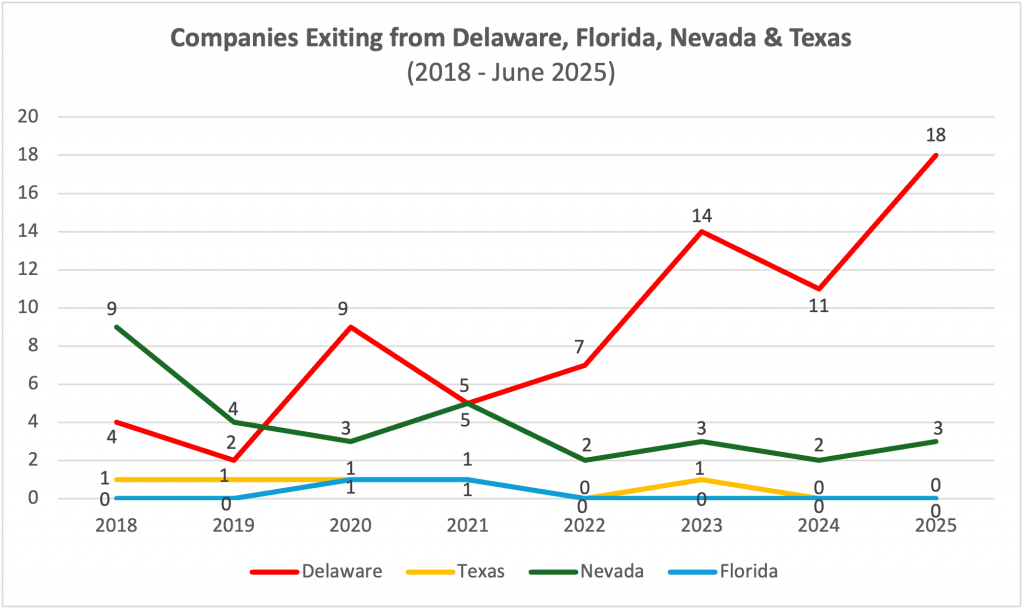

Is the top spot as the nation’s premier state of incorporation on the verge of a shake-up? Several prominent companies, most of which have controlling shareholders, have either sought or threatened to reincorporate out of Delaware in the wake of recent Chancery Court rulings that imposed higher hurdles on controlled companies. Through June of this year, eighteen companies have proposed to reincorporate out of Delaware, versus ten moving into Delaware from other states.

Source: ISS Governance Research & Voting

Twelve of those 18 Delaware companies are moving to Nevada, two to Florida, two to the Cayman Islands and one each to Texas and Indiana. Some of the better-known companies leaving Delaware include Simon Property Group, Trump Media & Technology, and the four companies controlled by the Dolan family, including AMC Networks and Madison Square Garden Sports.

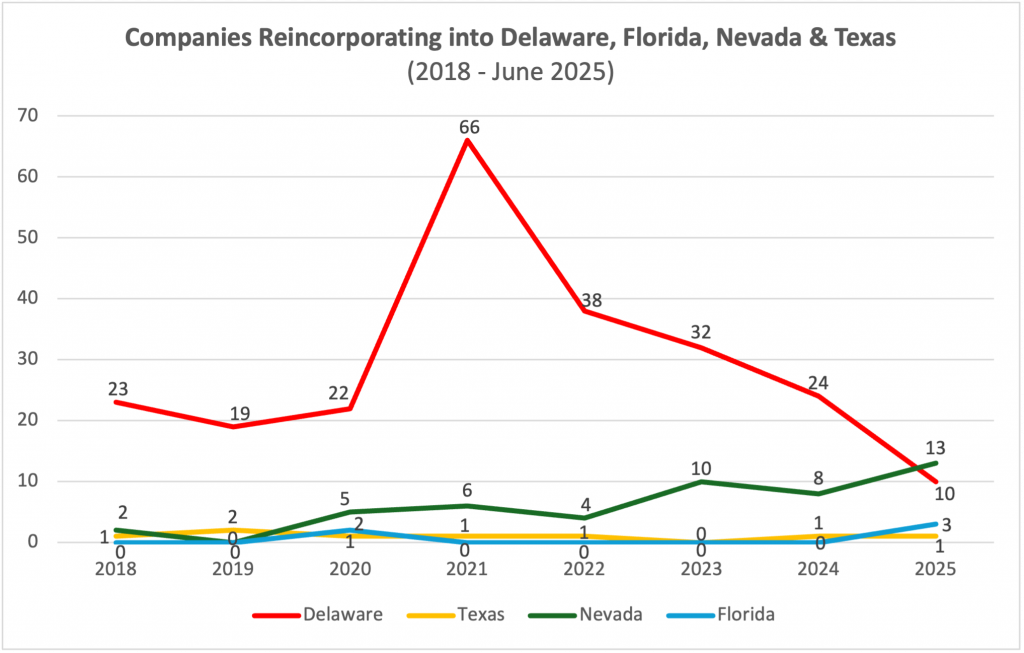

In the past five years since a peak in 2021, the number of companies moving to Delaware has also declined (see graph below). The sharp uptick in reincorporations to Delaware in 2021 was prompted largely by the SPAC merger boom, as a number of SPACs incorporated in the Cayman Islands moved to Delaware in connection with their business combinations.

Source: ISS Governance Research & Voting

In response to the threat of further losses, Delaware announced earlier this year a series of proposed reforms to the Delaware General Corporation Law that would effectively overturn some of the recent Chancery court rulings and give greater latitude to companies and controlling shareholders, in an explicit attempt to head-off the “DExit” that would threaten to reduce a major source of revenue for the state.

Enter Nevada as the preferred destination for reincorporations. Many of the recent relocations from Delaware to Nevada cited the ability to eliminate their annual Delaware franchise tax, which they argued will result in substantial savings over the long term. On the other hand, some companies like Tempus AI also believe reincorporation from Delaware to Nevada will allow them to operate with “flexibility” and provide them with a predictable, statute-focused legal environment during what they consider a time of rapid business change. This represents something of a reversal in corporate attitudes, as companies have for years viewed Delaware’s Chancery Court, with its expert judges and extensive body of precedent, as an asset rather than a liability compared to other states’ statute-focused environments.

Reincorporations also have corporate governance impacts. With a Nevada reincorporation for instance, shareholders become subject to a more restrictive freeze-out provision, face a higher bar for removal of directors with or without cause, and lose the right to vote on changes in authorized share capital. Furthermore, companies are able to exculpate officers and directors against violation of the fiduciary duty of loyalty, which most other states do not permit and is considered by many to be contrary to shareholders’ interests.

While Nevada is currently the leading alternative to Delaware, the question of which state will ultimately win out as the preferred alternative corporate incorporation destination remains far from settled. Here enters Texas. As companies weigh their options, Texas is vying to become the preferred choice. To bolster its attractiveness, it has opened a statewide Texas Business Court with judicial divisions (modeled after Delaware’s Court of Chancery) and is working on the creation of the Texas Stock Exchange (TXSE). Texas has also enacted a new law, Senate Bill 29, which took effect on May 14, 2025, and which among other things allows Texas companies traded on a national securities exchange to specify in their governing documents that derivative lawsuits may only be filed by the holders of a specified percentage of a company’s shares, not to exceed 3 percent. Furthermore, Texas Senate Bill 1057, which was signed into law with effective date of September 1, 2025, would allow companies to require that a shareholder submitting a proposal (other than for the election of directors) own either 3 percent of shares or shares with a market value of $1 million, and solicit the holders of at least 67 percent of voting power. But despite these overtures, Texas’ appeal as an incorporation destination has also been limited by the availability of jury trials in its business court. As a result, “Version 2.0” of the Texas Business Court–excluding jury trials–is anticipated by expert observers within the next one or two years. Still, the rushed nature of this year’s lawmaking in Texas, including its use of unclear language, may have contributed to increased legal uncertainty as well.

Number of Companies Incorporated by State (ISS Coverage Universe)*

| States | Companies (#) | Companies (%) |

| Delaware | 2686 | 62.5% |

| Maryland | 304 | 7.1% |

| Nevada | 229 | 5.3% |

| Pennsylvania | 101 | 2.4% |

| California | 77 | 1.8% |

| New York | 75 | 1.7% |

| Ohio | 69 | 1.6% |

| Virginia | 62 | 1.4% |

| Florida | 55 | 1.3% |

| Indiana | 45 | 1.0% |

| Texas | 48 | 1.1% |

| Total: | 4297 | 100% |

Source: ISS Governance Research & Voting

*The table includes operating companies and REITs. Mutual funds and BDCs are excluded.

As the reincorporation competition between states pushes forward, it is important not to lose sight that Delaware, with over 62% market share, is still by far the largest state for incorporations.

Appendix: Reincorporation Proposals by Meeting Date

| Company Name | Country | Meeting | Reincorp FROM | Reincorp TO |

| Eightco Holdings Inc. | USA | 1/16/2025 | Delaware | Nevada |

| Ellington Credit Company | USA | 1/17/2025 | Maryland | Delaware |

| K Wave Media, Ltd. (formerly Global Star Acquisition Inc.) | USA | 2/3/2025 | Delaware | Cayman Islands |

| Aspire Biopharma Holdings, Inc.(formerly PowerUp Acquisition Corp) | USA | 2/4/2025 | Cayman Islands | Delaware |

| USA Rare Earth, Inc. (formerly Inflection Point Acquisition Corp._ | USA | 3/10/2025 | Cayman Islands | Delaware |

| Daktronics, Inc. | USA | 4/16/2025 | South Dakota | Delaware |

| Jade Biosciences, Inc. | USA | 4/16/2025 | Delaware | Nevada |

| SouthState Corporation | USA | 4/23/2025 | South Carolina | Florida |

| Universal Logistics Holdings, Inc. | USA | 4/23/2025 | Michigan | Nevada |

| BeOne Medicines Ltd. (formerly BeiGene Ltd.) | USA | 4/28/2025 | Cayman Islands | Switzerland |

| Trump Media & Technology Group Corp. | USA | 4/30/2025 | Delaware | Florida |

| Simon Property Group, Inc. | USA | 5/14/2025 | Delaware | Indiana |

| Tempus AI, Inc. | USA | 5/20/2025 | Delaware | Nevada |

| XOMA Royalty Corporation | USA | 5/28/2025 | Delaware | Nevada |

| Roblox Corporation | USA | 5/29/2025 | Delaware | Nevada |

| ProKidney Corp. | USA | 5/29/2025 | Cayman Islands | Delaware |

| Iveda Solutions, Inc. (adjourned to Aug. 29, 2025) | USA | 6/2/2025 | Nevada | Delaware |

| Zion Oil & Gas, Inc. | USA | 6/4/2025 | Delaware | Texas |

| Sphere Entertainment Co. | USA | 6/4/2025 | Delaware | Nevada |

| Crescent Biopharma, Inc. (formerly GlycoMimetics, Inc.) | USA | 6/5/2025 | Delaware | Cayman Islands |

| AMC Networks Inc. | USA | 6/5/2025 | Delaware | Nevada |

| Madison Square Garden Entertainment Corp. | USA | 6/9/2025 | Delaware | Nevada |

| Madison Square Garden Sports Corp. | USA | 6/10/2025 | Delaware | Nevada |

| Forward Air Corporation | USA | 6/11/2025 | Tennessee | Delaware |

| Fidelity National Financial, Inc. | USA | 6/11/2025 | Delaware | Nevada |

| Upexi, Inc. | USA | 6/16/2025 | Nevada | Delaware |

| Penguin Solutions, Inc. | USA | 6/16/2025 | Cayman Islands | Delaware |

| TuHURA Biosciences, Inc. | USA | 6/23/2025 | Nevada | Delaware |

| Revelation Biosciences, Inc. | USA | 6/23/2025 | Delaware | Nevada |

| Royalty Management Holding Corporation | USA | 6/24/2025 | Delaware | Florida |

| Affirm Holdings, Inc. | USA | 6/25/2025 | Delaware | Nevada |

*The table also includes companies with country of coverage of USA incorporated or reincorporating outside the US

By: ISS Governance