Board diversity is a key element of good corporate governance. It can play an important role in supporting innovative activity and organizational change, fostering an environment where different approaches to decision-making and problem-solving can generate outcomes more reflective of the attitudes of the broader society.

Various studies have highlighted board diversity’s benefits for corporate performance. Investors are increasingly encouraging companies to improve their boards’ gender, ethnic, cultural, age, professional, and educational diversity. An increasing number of regulators globally are also calling on listed companies to enhance corporate governance practices by ensuring board diversity, especially gender diversity. Gender diversity in the boardroom not only enables diversified insights into a company’s operations, it has also been found to help firms better manage risks and build corporate reputation.

Hong Kong is no exception to this global push. In December 2021, the Hong Kong Exchange revised its Corporate Governance Code and Listing Rules. The revision, which came into effect on 1 January 2022, requires all new IPO applicants who file an A1 submission after 1 July 2022 to appoint at least one director of a different gender than the other board members. All existing listed companies will be required to appoint one director of a different gender no later than 31 December 2024.

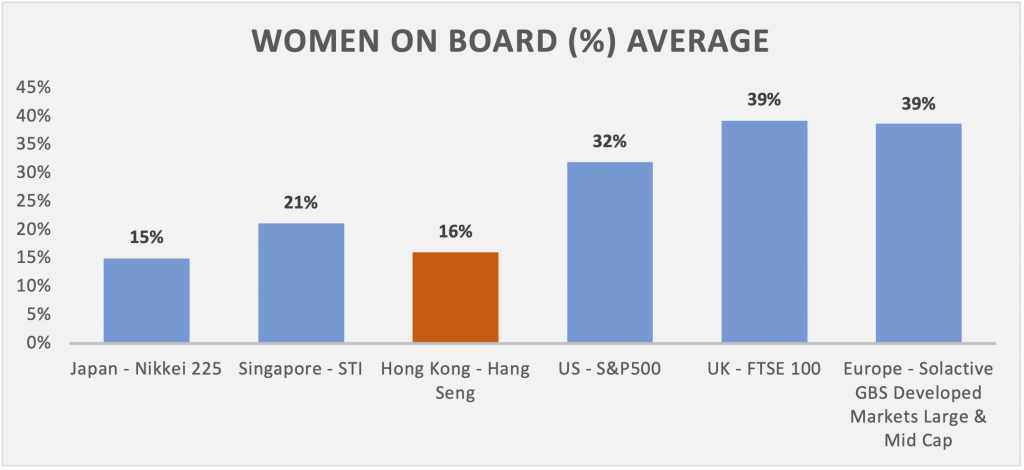

This regulatory push will help Hong Kong to overcome some of the traditional obstacles to board diversity that see the country still lagging other global financial hubs in terms of representation of women on corporate boards. Data from ISS ESG’s Governance QualityScore indicates that, among companies listed on the Hong Kong Exchange, only 16% of board members, on average, are women (Figure 1). This places Hong Kong companies behind those in the other major global hubs of Singapore, the US, the UK, and Europe.

Figure 1: Representation of Women on Corporate Boards, by Market

Source: ISS ESG Governance QualityScore

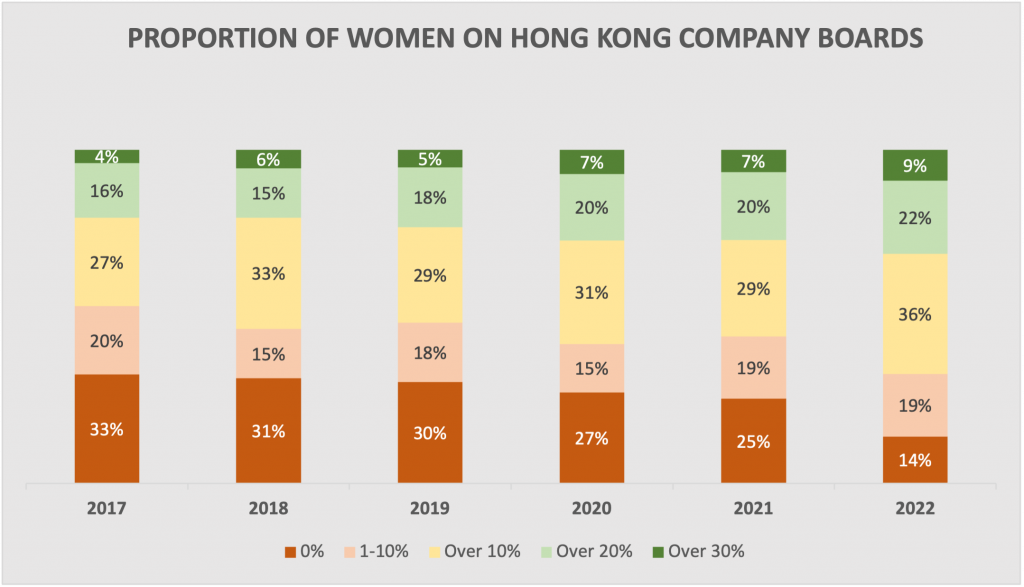

When looking at the boards of Hang Seng Index-listed companies between 2017 and 2022 (Figure 2), an incremental improvement in the representation of women in the board can be observed. The reduction in the number of companies with 0% women’s board participation is most evident. Equally apparent is the increasing number of companies with 20% or more women on the board, the number increasing from 23 in 2017 to 43 in 2022.

Figure 2: Percentage of Women Directors of Hong Kong Companies

Source: ISS ESG

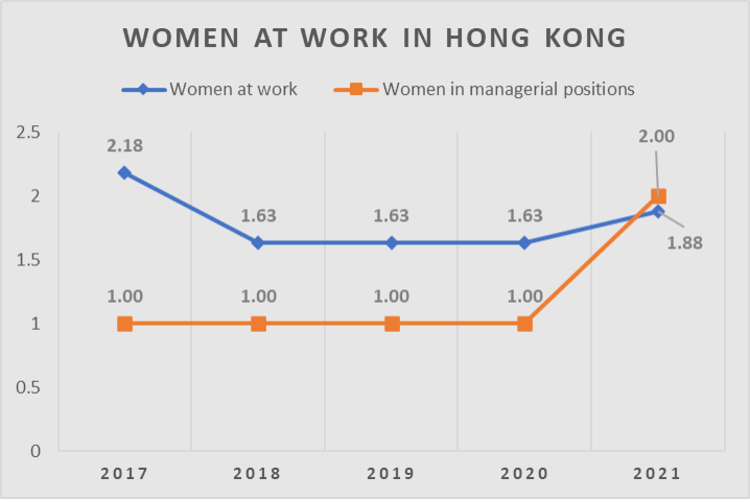

The overall health of Women at Work indicators in Hong Kong can help in understanding whether there has been a systemic hindrance to women’s board participation. The Women at Work topic in the ISS ESG Country Rating, which looks at factors such as women in managerial positions and the female employment ratio and income ratio, shows an average score of 1.79 (corresponding to a medium rating score) out of a possible 4 for the 2018-2021 period. The new regulations in Hong Kong have resulted in this score improving considerably, however, to the point where it is now comparable with major markets such as the US and Europe. This suggests increases in female representation are likely in future years.

The female employment ratio reached an upper-medium level and has remained stable in recent years. The share of senior or middle management positions held by women remained, on average, 33.1%. The trend for women to constitute a lower proportion of company management than men has traditionally been associated with external factors such as caring responsibilities falling more on women, which can prompt women to leave the workforce either permanently or temporarily. This can, in turn, limit the pool of women candidates for senior executive or board positions.

Figure 3: Women’s Participation in the Workforce and Management in Hong Kong

Source: ISS ESG Country Rating (Scores range from 1=Low to 4=High)

Another factor that may contribute to the relatively low number of women on Hong Kong company boards is corporate culture. The Financial Times cites corporate-governance experts who argue that many Hong Kong companies are owned and run by family patriarchs who are more likely to choose a man to fill out their boards. This cultural inclination could further limit opportunities for women to be represented.

The revised Corporate Governance Code and Listing Rules may help increase the number of women on company boards. To promote a continuous increase in the meaningful representation of women within corporations, however, investors may wish to monitor the broader Women at Work indicators. ISS ESG products such as the ESG Country Rating, the Governance QualityScore, and Director Data are resources investors can draw on in this effort.

Explore ISS ESG solutions mentioned in this report:

- Use ISS ESG Governance Data to drive investment, engagement, and voting decisions.

- Access to global data on country-level ESG performance is a key element both in the management of fixed income portfolios and in understanding risks for equity investors with exposure to emerging markets. Extend your ESG intelligence using the ISS ESG Country Rating and ISS ESG Country Controversy Assessments.

By: Yommi Cheung, Vice President, Account Executive Asia Pacific, ISS Hong Kong

Suk Yun Chun, Head of ESG Client Success APAC, ISS ESG