The sky is not falling, but take nothing for granted

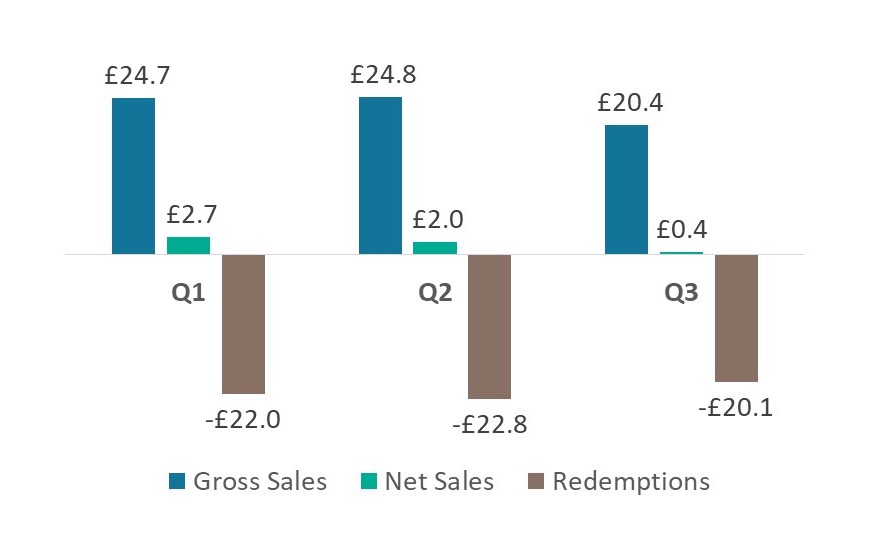

Q3 financial adviser platform gross sales were far from pretty. Gross sales were down nearly 20% from Q2, with 43 of 57 IA Sectors registering a decline. The quarter however had a silver lining. Redemptions also remained muted, meaning that net sales stayed above water. The sky may be cloudy but it is not yet falling.

Figure 1: Financial adviser platform gross sales, gross redemptions and net flows year-to-date (in billions)

Source: Financial Clarity, ISS Market Intelligence.

As much as gross sales took a hit in the third quarter, the fact redemptions have not spiked speaks to the ability of advisers to keep investors invested. No small task in a market defined by uncertainty and volatility, both political and economic. Opposed to a story of doom and gloom, our latest Financial Clarity sales figures point much more towards a wait and see story, one where investors may be sitting on the sideline with cash, wondering whether to invest or even increase their cash holdings.

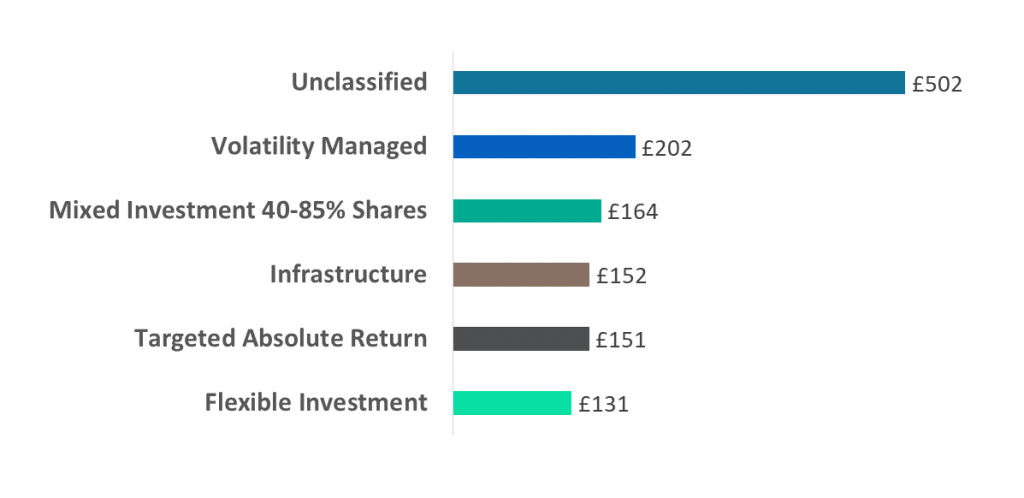

With broad based declines in gross sales and only minimal total flows, only six sectors posted net sales of over £100 million. Of these six, four were asset allocation sectors and a fifth, the unclassified sector, is a sector dominated by funds used in model portfolio service (MPS) programs.

Figure 2: Q3 fund sectors with greater than £100 million in net flows (in millions)

Source: Financial Clarity, ISS Market Intelligence.

The unclassified

In addition to funds used within MPS programs, the unclassified sector also contains a number of wealth manager, financial adviser and network developed funds as well as non-UK domiciled funds not assigned to a fund sector. Over 125 discretionary fund manager, wealth manager, financial adviser and network developed funds have been identified in our database.

To learn more about our thoughts on MPS, listen to our recent podcast.

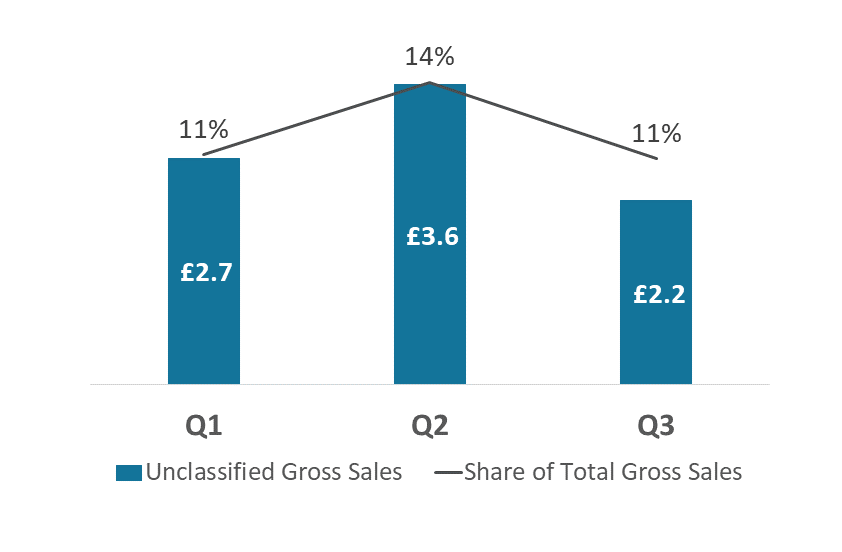

Figure 3: Financial adviser platform sales and net sales of funds in the unclassified sector (in millions)

Source: Financial Clarity, ISS Market Intelligence

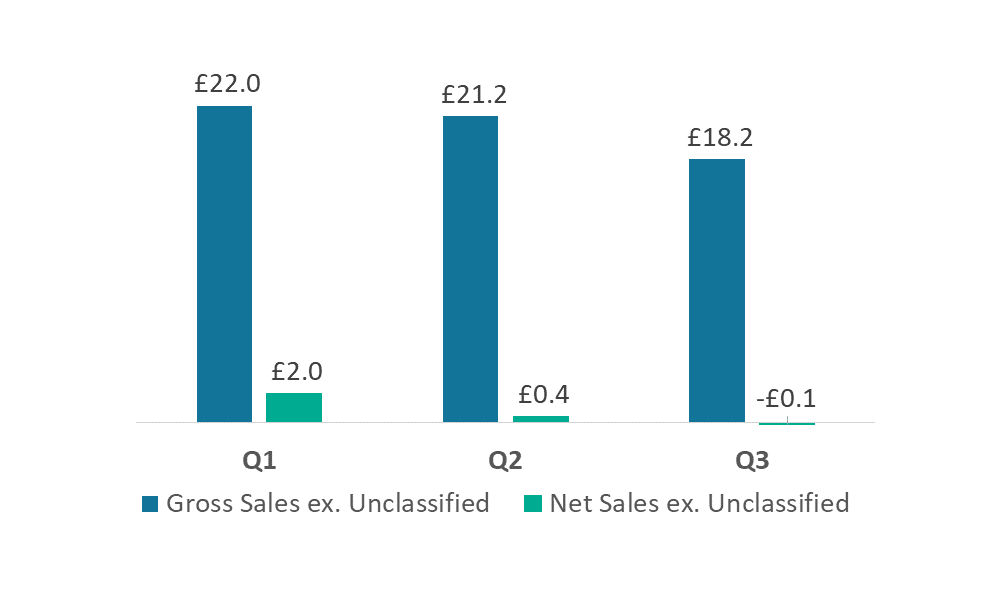

From a sales and flows perspective, the unclassified sector remained important throughout 2022. In terms of gross sales, the sector has accounted for 12% of total year-to-date financial adviser platform gross sales, with a high of 14% in Q2. More importantly than the size of the diverse category is that without the unclassified sector’s positive net flows in Q2 and Q3, there would have been almost zero net flows amongst the rest of the IA sectors.

Figure 4: Financial adviser platform sales and net sales excluding unclassified funds (in millions)

Source: Financial Clarity, ISS Market Intelligence.

The trend towards building custom funds for model programs was also in the news of late. Fidelity International launched two multi-asset funds for Howard Wright advisers.¹ Expect customization of funds in regard to the support of model programs, MPS or other, to remain a hot topic as DFMs and wealth management firms look to differentiate themselves in an increasingly crowded space.

Green shoots remain for Passive ESG strategies

Passive environmental, social and governance (ESG) strategies² were one of the few bright spots in Q3, seeing net flows increase even as most categories saw declines. Passive ESG strategies brought in £222m in net flows in Q3 compared to £36m in Q2. The IA sectors benefiting the most from this were UK All Companies and Japan. Active ESG strategies meanwhile slipped into outflows. Active ESG strategies started to stumble from a net sales perspective in Q2, after posting strong Q1 net sales numbers. This should act as a reminder that ESG adoption among retail investors will not be straight forward. ESG strategies will ultimately face investor scrutiny on their performance and as a result may show a cyclicality depending on the sector weightings of their holdings. With the Financial Conduct Authority (FCA) further framing its Sustainable Disclosure Requirements on 25 October, there is an open question as to how ESG fund flows and product development will move in advance of final regulations being set. Will the pending finalisation of the rules hold back fund managers and distributors from launching and promoting new ESG funds or will recent guidance encourage increased activity as there is more certainty about tomorrow’s regulatory regime?

Tomorrow’s fund sale

On everyone’s mind is where tomorrow’s fund sale will take place. A question that is clouded both by a recessionary economic outlook and the changes taking place within the financial adviser channel. This author surmised in July (read ‘Floor is Lava’) that UK retail sales would trend towards asset allocation products, as clients navigate uncertainty through the application of portfolio diversification. A position this author still holds. As shown, these sectors held up relatively well in Q3 and are solutions oriented to a stay-the-course frame of mind. Of course, traditional asset allocation solutions will have to compete with MPS offerings for flows, making it all the more important that we understand the impact that MPS offerings are having on fund flows.

Talk to us today to learn more about how we can help your business

Notes:

1. For more information please read: https://citywire.com/new-model-adviser/news/fidelity-launches-bespoke-funds-for-wolverhampton-ifa/a2400161

2. Calculated based on the funds flagged as ethical in Financial Clarity

Commentary by ISS Market Intelligence

By: Benjamin Reed-Hurwitz, Vice President, EMEA Research Leader, ISS Market Intelligence