The European Securities and Markets Authority’s (ESMA’s) guidelines on fund names using ESG or sustainability-related terms have had a significant impact on European markets since being published in May 2024. These guidelines were introduced to protect investors against greenwashing by providing fund managers with criteria for fair, clear, and non-misleading fund names.

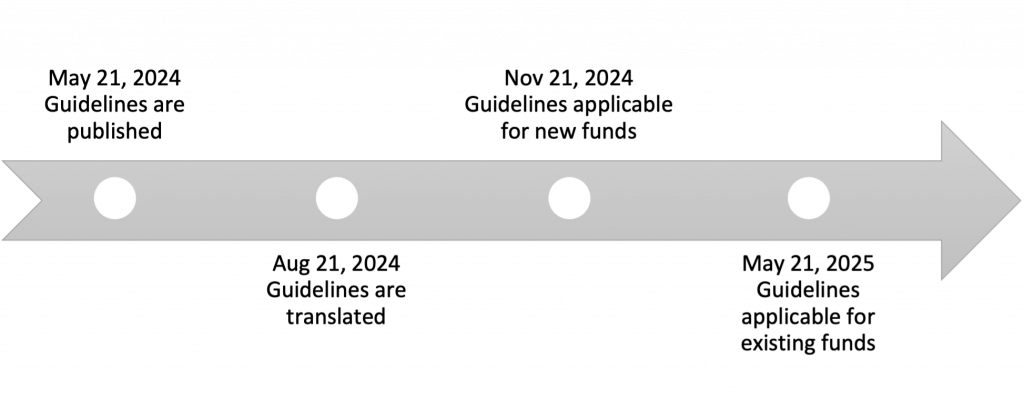

Since the guidelines’ publication, financial market participants seeking to align their existing funds with these guidelines have needed either to adjust the index’s composition or drop sustainability-related terms from the fund names by the final deadline of May 21, 2025 (Figure 1).

Figure 1: Regulatory Timelines of ESMA Fund Naming Guidelines

Source: ISS ESG

ESMA in their impact analysis identified 6,490 funds with ESG-related terms in their names (9.6% of the total) which could potentially be affected under the scope of the guidelines. Though ESMA has provided a transition period for existing funds to comply, some market providers have chosen to rename their funds rather than amend their methodology to align with the ESMA guidelines.

A previous article on this topic provided an overview of the guidelines and analyzed their potential impact across 28,000+ funds. The article highlighted the significance of the applicable exclusion criteria set out under Article 12.1 of the Commission Delegated Regulation (CDR) EU 2020/1818 for funds that contained ESG or Sustainability-related terms in their name. ESG/sustainability terms in fund names are categorized into six distinct groups, where each terminology group has slight differences in compliance requirements.

This article explains how the ISS ESG ESMA Fund Name Guidelines Solution can be leveraged to assess funds and to ensure alignment with the ESMA guidelines by identifying issuers for exclusion. The ESMA Fund Name Guidelines product offering provides in-depth issuer-level data by leveraging ISS ESG’s research and data as well as a proprietary methodology developed by the Regulatory Solutions team.

The article also highlights the flexibility of the solution in ensuring compliance with other national or international labels and standards. The solution can also be used to customize portfolio construction and apply screening criteria using widely held indices.

ESMA Fund Name Guidelines’ Exclusion Criteria

Under the Guidelines, funds with ESG/sustainability-related names must meet exclusion criteria that bar investment in certain companies. These might include, for example, companies involved in controversial weapons or that derive certain percentages of their revenue from fossil fuels. This article will explore different approaches that can be leveraged to ensure alignment with the exclusion criteria component of the Guidelines.

Interpreting Exclusion Criteria

Although ESMA has published some clarifications on how fund managers should align with their guidelines, there is still room for interpretation. For instance, for Article 12.1 (c) on violations of international norms, some might interpret “violations” as only those that are verified, while others might consider reports from credible sources such as recognized non-governmental organizations as well. Moreover, the regulation does not address whether severity thresholds should be considered in defining the scope of a “violation.”

The ESMA Fund Name Guidelines Solution provides a baseline interpretation of the exclusion criteria in line with the regulatory requirements. The product also provides additional data, which allows for a more stringent approach to cater to different clients’ investment strategies. A summary is outlined in Table 1.

Table 1: ISS ESG’s Baseline and Alternative Interpretations of Exclusion Criteria under Article 12.1

| Regulation | Definition from Regulation | Fund Name | Baseline Interpretation | Alternative Interpretation (in addition to activities flagged under the baseline interpretation) |

| Article 12.1 (a) | Controversial Weapons | Sustainability, Environmental, Impact, Transition, Social, or Governance-related terms | Activities related to anti-personnel mines, biological weapons, chemical weapons, cluster munitions | Activities related to weapons prohibited by one or more EU member states such as nuclear weapons, depleted uranium, white phosphorus, and incendiary weapons |

| Article 12.1 (b) | Cultivation and production of Tobacco | Sustainability, Environmental, Impact, Transition, Social, or Governance-related terms | Revenues derived from involvement in production of tobacco | |

| Article 12.1 (c) | Violations of UN Global Compact principles / Organisation for Economic Co-operation and Development Guidelines for Multinational Enterprises | Sustainability, Environmental, Impact, Transition, Social, or Governance-related terms | Verified, very severe failures to respect established norms without remedial measures taken | Verified and unverified (yet credible), severe and very severe violations of established norms, even if there are ongoing remedial measures |

| Article 12.1 (d) | Deriving revenues of 1% or more from involvement in coal-related activities | Sustainability, Environmental, or Impact-related terms | Revenues from mining (including thermal and metallurgical coal), processing, and trade of coal | Revenues derived from services related to coal |

| Article 12.1 (e) | Deriving revenues of 10% or more from involvement in oil-related activities | Sustainability, Environmental, or Impact-related terms | Revenues from extraction, refinement, and distribution of oil | Revenues derived from services related to oil |

| Article 12.1 (f) | Deriving revenues of 50% or more from involvement in gas-related activities | Sustainability, Environmental, or Impact-related terms | Revenues from extraction, processing, and distribution of gas | Revenues derived from services related to gas |

| Article 12.1 (g) | Deriving revenues of 50% or more from Electricity Generation, with a GHG intensity of more than 100 g CO2 e/kWh | Sustainability, Environmental, or Impact-related terms | Revenues from electricity generation, which includes generation of electric power from fossil fuels, as well as the generation of electric power using biomass with a GHG intensity of more than 100 g CO2 e/kWh |

Source: ISS ESG

Varied Impact of Interpretations on Indices

To delve further into the impact of the ESMA Guidelines, this analysis uses some widely held indices to demonstrate the extent to which the exclusion criteria would affect holdings. Although these indices are not required to ensure the Paris-Aligned Benchmark (PAB) or Climate Transition Benchmark (CTB) alignment specified under Article 12.1, evaluating them against these criteria can assist funds tracking these indices to raise their inclusion thresholds while minimizing the risk of greenwashing when tracking indices not employing an ESG tilt.

Flagging Constituents Using the Baseline Approach

Of the 600 companies covered by the STOXX Europe 600 index, 26 companies are flagged under the PAB exclusion criteria (Article 12.1 (a) – (g)) using ISS ESG’s baseline interpretation. Out of these cases, 80% are due to fossil fuel-related criteria, of which oil-related activities are the most prominent.

For the Solactive Global index, 268 companies, out of a pool of 3,305 companies, are flagged under the PAB exclusion criteria. Similar to the STOXX Europe 600 index, 77% of these exclusions are caused by involvement in fossil fuel-related activities. Ninety-four companies exceed the threshold for involvement in oil-related activities, while 81 companies exceed the coal exclusionary threshold and 31 exceed the gas threshold.

A similar observation is made for STOXX USA 500, where most exclusion events are due to revenue derived from coal, oil, and gas-related activities beyond the threshold, according to the baseline interpretation of the criteria.

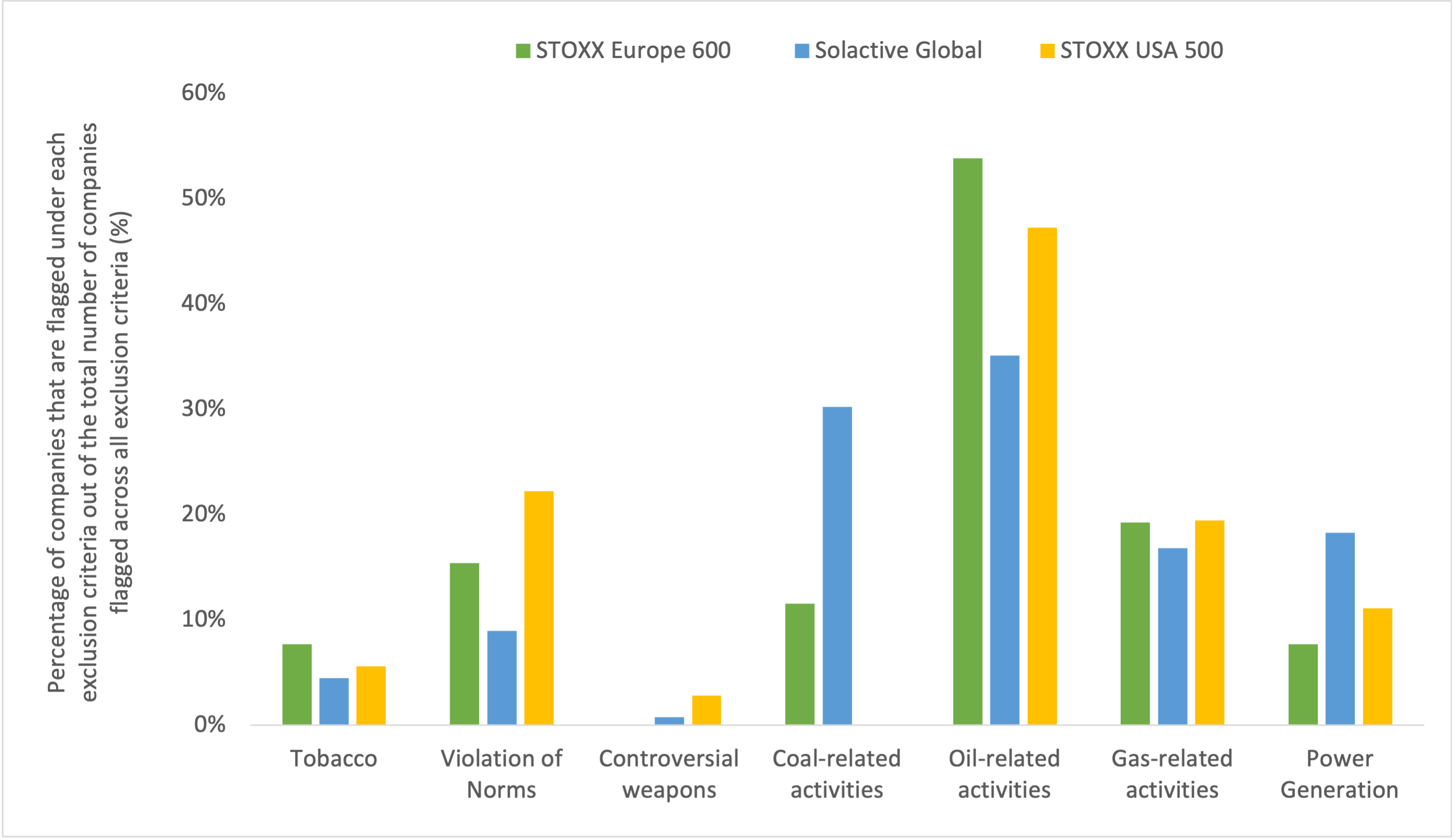

Figure 2 below displays the percentage impact of each exclusion criteria as a share of all the companies in each index flagged for exclusion according to PAB.

Figure 2: Analysis of Conventional Indices with Regard to PAB Exclusion Criteria

Note: The same company within an index is sometimes counted under multiple exclusion categories.

Source: ISS ESG

Among the fossil fuel exclusions, the largest numbers of companies exceed the revenue threshold due to oil-related activities. This can be attributed to the 10% threshold criteria for the oil activities, compared to a more lenient 50% threshold criteria for gas activities. While the exclusionary threshold for coal-based activities is stricter, at 1% of revenues, the STOXX USA 500 index has full compliance with this threshold.

For STOXX Europe 600, coal, oil, and gas activities account for 12%, 54%, and 19%, respectively, of all constituents not aligned to the exclusion threshold. As noted, STOXX USA 500 observes no constituents surpassing the coal threshold while in 47% and 19% of cases constituents are flagged for involvement in oil- and gas-related activities above the exclusionary threshold, respectively.

Flagging Constituents Using a Stricter, Alternative Interpretation

The ESMA Fund Names Guidelines solution offers additional datapoints that can be leveraged, alongside the primary datapoints, to identify companies for exclusion beyond the minimum regulatory requirements. For instance, the revenue derived from services related to coal, oil, and gas is also included in these criteria.

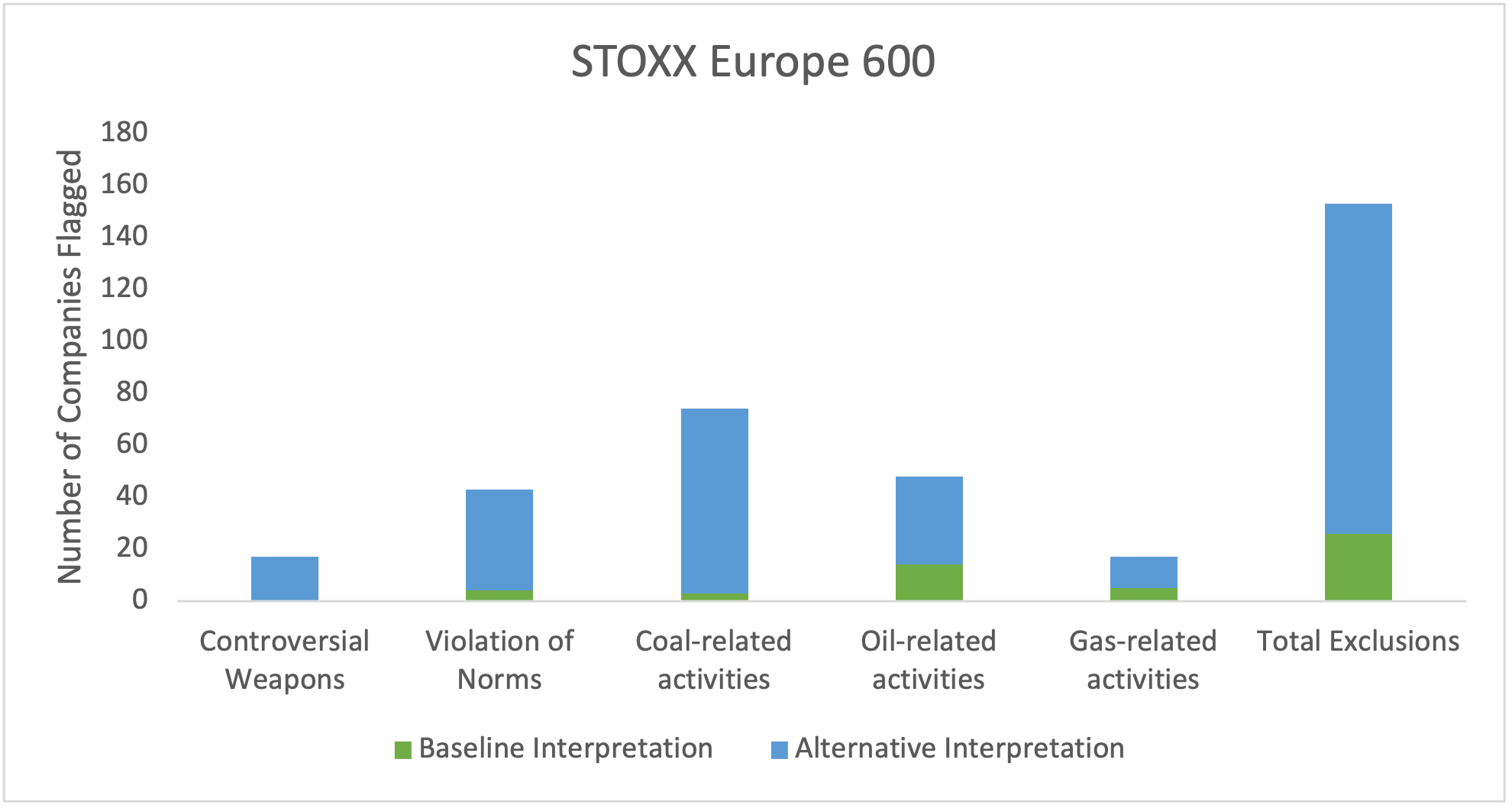

Application of this stricter interpretation presents significant variations in the results that can be seen in Figure 3 for STOXX Europe 600 and in Figure 4 for Solactive Global.

Figure 3: Exclusions from Applying Baseline vs Stricter Alternative Interpretation of Exclusion Criteria to STOXX Europe 600 Index

Note: The same company is sometimes counted under multiple exclusion categories.

Source: ISS ESG

For STOXX Europe 600, the number of fossil fuel exclusions increases from 21 issuers to 87—out of 600 issuers—excluded (3.5% excluded under the baseline interpretation compared to 14.5% excluded under the alternative interpretation). From the perspective of market capitalization, approximately 6% (USD982 billion) of the STOXX Europe 600 is affected according to the baseline interpretation and around 28% (amounting to USD4.5 billion) when using the stricter interpretation.

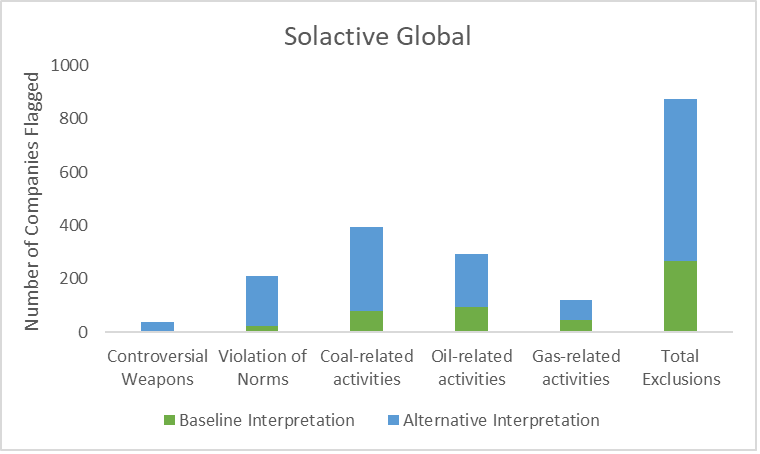

Figure 4: Exclusions from Applying Baseline vs Stricter Alternative Interpretation of Exclusion Criteria to Solactive Global Index

Note: The same company is sometimes counted under multiple exclusion categories.

Source: ISS ESG

For the Solactive Global index, the fossil fuel-related exclusions with a strict alternative interpretation are as high as 425 companies (12.9%) out of 3,305, compared to only 207 (6.3%) under the baseline interpretation. Under the alternative interpretation, most non-alignment is still attributed to combined fossil-fuel-related activities, but companies that exceed the coal-related-activities revenue exclusion threshold are now the main driver of exclusion.

The ESMA Fund Name Guidelines Solution leverages ISS ESG’s Norm-Based Research (NBR) to apply ESMA’s Violation of Norms criteria (Article 12.1(c)), which include international norms and frameworks such as the United Nations Global Compact Principles and the OECD Guidelines for Multinational Enterprises.

In the baseline interpretation, the issuers with a verified, very severe, failure to adhere to international norms related to fossil fuels (Score 10 under the NBR Overall Score) are excluded. Under this interpretation, around 0.5% of companies are flagged in the STOXX Europe 600 and Solactive Global. However, when a stricter interpretation is applied to include issuers that also have credible allegations of failure to respect norms and issuers that have a verified failure to adhere to international norms but have remedial actions in place, the percentage of issuers now flagged rises to 6.4% in the STOXX Europe 600 and to 5.7% in Solactive Global.

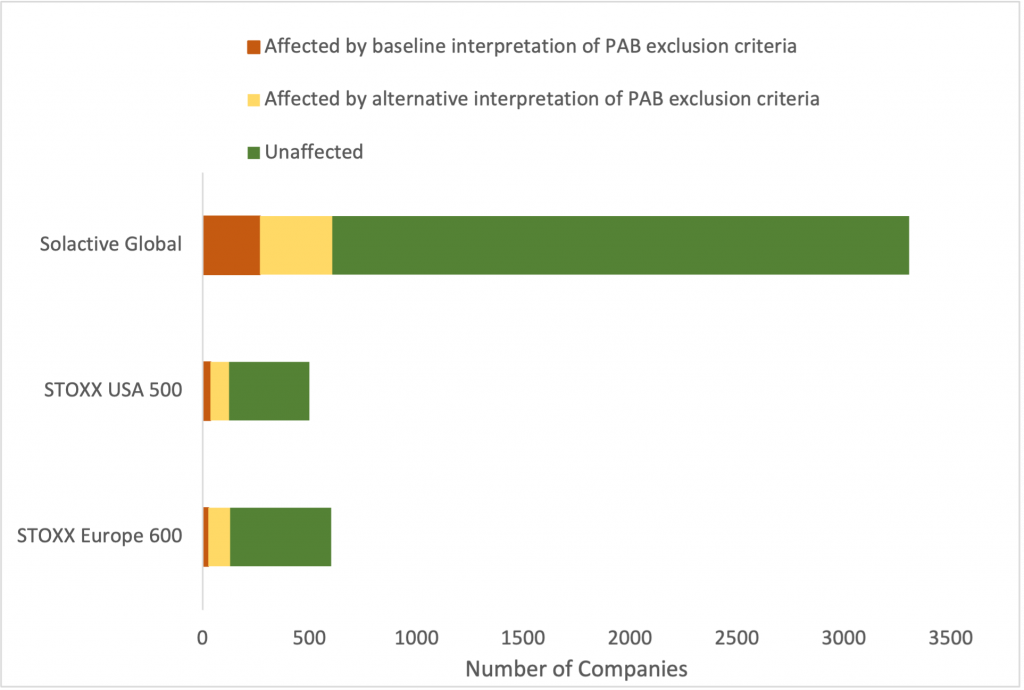

Overall, when applying baseline interpretations across not only fossil-fuel related exclusions but all exclusion criteria, non-ESG-tilt indices such as STOXX Europe 600 and Solactive Global Index have 4.3% and 8.1% of their constituents, respectively, which are not aligned with the PAB exclusion criteria. However, the number jumps to 21.6% and 18.3%, respectively, with the stricter interpretation. This difference might be relevant for index-tracking funds, as a stricter interpretation would help them both to have broader perspectives on their holdings and to meet their mandates over time.

Figure 5 below summarizes the overall effect on these indices using the ISS ESG’s ESMA Fund Name Guidelines solution. Across the three indices analyzed, less than 10% of companies are flagged when using a baseline interpretation of the exclusion criteria. However, under the stricter alternative interpretation, almost a fifth of companies are flagged for exclusion.

Figure 5: Effect of Different Interpretations of Exclusion Criteria on Indices

Source: ISS ESG

Other Use Cases of the ESMA Fund Name Guidelines Solution

The ISS ESG ESMA Fund Name Guidelines Solution is designed flexibly, allowing users to easily customize and tailor this solution to their risk appetite, personal values, or investment mandate.

Compliance with Other Labels and Standards

A hypothetical investor would like to invest in the STOXX Europe 600 index but with a stricter definition of controversial weapons that aligns with the Socially Responsible Investing (SRI) label in France. Under the French SRI definition, controversial weapons include nuclear weapons, in addition to the four types of weapons identified by ESMA as relevant for the ESMA Fund Name Guidelines exclusions: anti-personnel mines, biological weapons, chemical weapons, and cluster munitions.

The ESMA Fund Name Guidelines Solution includes as the primary datapoint (datapoint name InvolvInContrWeapons) the four controversial types of weapons defined by ESMA for exclusion. The dataset also provides a datapoint with a wider definition that includes nuclear weapons as well as depleted uranium (datapoint name InvContrWepBMR). The solution allows users to easily toggle between the datapoints used as the primary exclusion criteria to suit their investment preferences.

In this case, by switching to the stricter definition in line with the French SRI label, 15 additional issuers within the STOXX Europe 600 index would be flagged under the controversial weapons involvement screen.

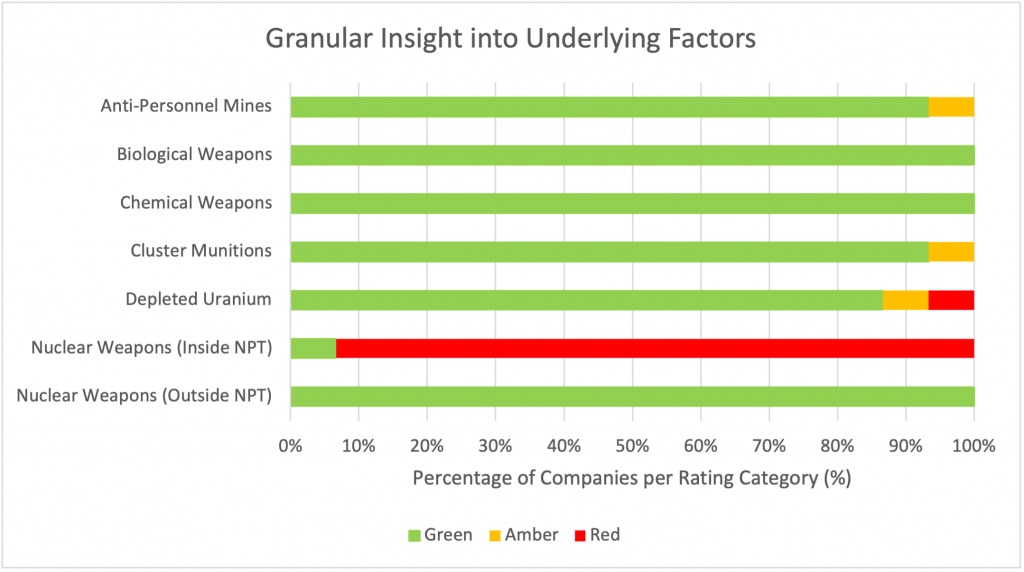

Granularity to Aid Flexibility in Applying Exclusions

Users can also easily understand in more granular detail which controversial weapon involvement has caused the exclusion and can make any adjustments to the exclusion as desired. For instance, in the case illustrated in Figure 6, 1 issuer out of the 15 has a red flag (per ISS ESG’s Norm-Based Research solution) for involvement in a depleted uranium program and can thus be included within the investment portfolio if desired.

Figure 6: Granular Insight into Underlying Datapoint Flags

Note: The traffic light assessments of Red, Amber, and Green reflect the degree of verification and the level of involvement of a company in the various controversial weapons.

Source: ISS ESG

Custom Portfolio Construction

Investors can also utilize this data to analyze unnamed funds or indices to screen out and/or replace issuers that do not meet certain exclusion thresholds. Suppose that an investor would like to mirror the STOXX Europe 600 index but to exclude companies that exceed the oil and gas Paris-Aligned Benchmark exclusion criteria, as defined by the EU Climate Benchmark Regulation, from their investment portfolio. Investors can easily assess which issuers exceed the exclusion threshold, as well as identify issuers with a similar market capitalization or industry to replace these excluded issuers within their investment portfolio.

Conclusion

The ISS ESG ESMA Fund Name Guidelines Solution caters to market demand for a solution that collates information on companies’ involvement in activities that are not in alignment with the exclusionary thresholds required for regulatory compliance. This solution enables a wider application, allowing for customization in screening criteria to meet client investment objectives or specific national and international regulations. The ESMA Fund Name Guidelines Solution ultimately can go beyond fund labelling and expand into creating portfolios that are conscious of the environmental or social impact of investments.

Explore ISS STOXX solutions mentioned in this report:

- Quickly and effectively evaluate & benchmark the ESG performance of equity and bond funds globally using the ISS ESG Fund Rating service.

- Assess companies’ adherence to international norms on human rights, labor standards, environmental protection and anti-corruption using ISS ESG Norm-Based Research.

By:

Min Low, ESG Product Manager – Regulatory Solutions

Rupali Goyal, ESG Methodology Specialist – Regulatory Solutions and Fixed Income

Ria Modh, ESG Methodology Specialist – Regulatory Solutions and Fixed Income