No business will survive—let alone thrive—unless it can adapt to what its customers need.

Asset managers know this truth all too well. Since the start of the century, managers have witnessed dramatic changes in how intermediaries interact with clients and how they are paid. Over the period, the advisor’s primary role shifted from fund selection to portfolio building to holistic financial planning. Now more financial life coach than investment advisor, successful advisors spend more time understanding clients’ financial goals and risk appetites and less time managing the nitty gritty of client portfolios.

Meanwhile, a majority of advisors moved to fee-based compensation models. With commissionable sales and embedded distribution fees increasingly a thing of the past, attracting advisor assets required a new way of thinking. Model portfolios have emerged as a response to advisors’ new job description. Using a ready-made template for asset allocation and investment selection enables advisors to outsource some—or all—portfolio management duties to another party, leaving advisors more time to spend with clients.

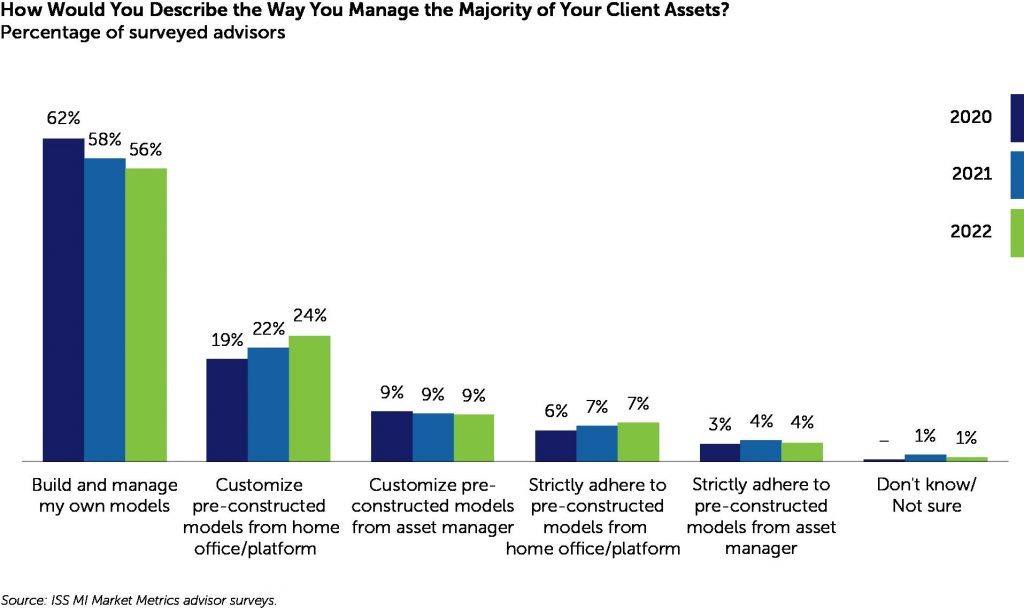

As we document in our recently published State of the Market: Intermediary Distribution report, advisors have enjoyed an explosion of choice in recent years. While models developed by the home office or third parties remain a minority preference among intermediaries, the number of advisors telling us they construct their own models has fallen considerably in recent years, as the chart below illustrates. Asked last summer to describe how they manage client portfolios by ISS MI’s Market Metrics team, 56% of surveyed advisors said they built their own, down considerably from 58% in 2021 and 62% in 2021. The bad news for managers with model portfolio aspirations: Increasing usage of home office and platform portfolios are driving the trend toward greater model adoption.

Flexibility is key to model users: Customized approaches were about three times as common as those that strictly followed pre-constructed models. Advisors were more likely to see model portfolios the way one might view a model home—as a workable base on which one can customize according to their needs and tastes. As one survey respondent put it, “Using a pre-constructed model provides a solid foundation from which I can swap in the best funds.”

Wirehouses leading model adoption, brokers embrace third parties, RIAs most likely to DIY

Advisors’ strong preference for customizability makes scale and execution capabilities crucial. Adjusting for every client’s unique risk appetite, goals, and financial situation becomes exponentially more complex the bigger an advisor’s book becomes. Without the operating capabilities to manage added complexity, a tool meant to free up time for more client interaction might bog advisors down in new administrative headaches.

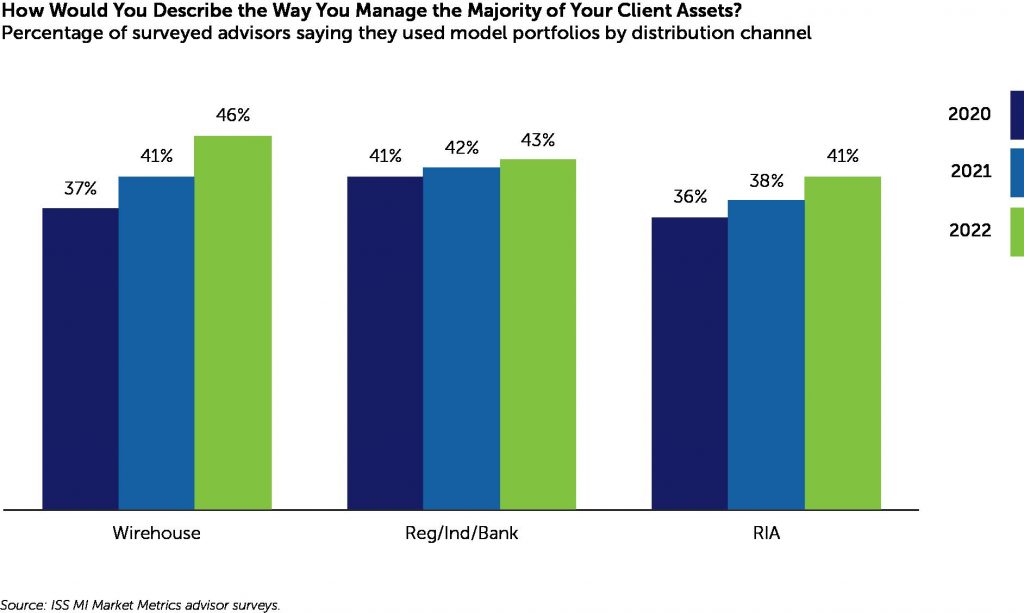

Scale and operational know-how probably help explain why model portfolios have made sharper inroads at wirehouses than any other distribution channel. Cost-effective execution is just part of the story; wirehouse advisors are under increasing pressure to track the home office’s asset allocation targets and use their recommended lists. Model portfolios are an efficient way to put the home office’s views into action. As the chart below illustrates, model adoption greatest among wirehouse advisors, with the percentage using models rising from 37% in 2020 to 46% by 2022.

Usage increased least within the broker dealer and bank channels, but model adoption within the segments was already relatively high in 2020. The segment enjoys comparable scale and execution advantages, enabling customization. But with less centralized decision making than wirehouses, the channels were twice as likely to prefer third-party platforms and turnkey solutions from platforms like Envestnet and AssetMark over home office models. By operating outside the traditional home office context, third-party provided portfolios are well aligned with advisors’ shift to more independent business models. Model providers will need to compete in walled gardens like Envestnet’s, including against the firm’s own successful models.

Among RIAs, model usage has grown most slowly. The channel remains least inclined to adopt model portfolios, with 59% of RIAs say they still build their own (in 2020, 64% did). The RIA consolidation wave may spur more model adoption, however. After selling, acquired RIAs often end up with improved access to a broader set of capabilities such as model marketplaces and automated portfolio management through TAMPs.

New opportunity, old problems?

Managers face similar challenges in the model space as they do elsewhere. It certainly offers no escape from competition from passives. Cheap, reliable, scalable, and easily substitutable, index funds are at least as well suited for model portfolios as they are in other total portfolio solutions products like target-date funds. Their perceived benefits–transparency, lower costs, better tax efficiency–are as powerful selling points in the model portfolio context as they are elsewhere. BlackRock and Vanguard are leading model providers for these reasons.

Still, exiting relationships with platform operators–not to mention advisors themselves–give certain managers an edge over upstart model portfolio providers. Capital Group’s deep relationships and brand power helps explain the firm’s success in the model portfolio arena. Asset managers can bring additional capabilities to bear. BlackRock’s ability to leverage its Aladdin risk-management system to help advisors monitor client portfolios is a case in point.

Model portfolios are just one tool asset managers can deploy to win to support advisors’ businesses. Managers that can employ them as a part of a multi-front effort, which might include advisor education or technology, will have an advantage in the race to meet intermediaries’ evolving needs.

______________

Simfund Enterprise subscribers can access the State of the Market—Intermediary Distribution Report on the Simfund Research portal. An earlier ISS Insights post based on this report discussing advisor sentiment toward mutual funds, ETFs, and SMAs can be read here. Another post highlighting the report’s analysis of advisors’ changing business models can be found here. For more information about this report, or any of ISS MI’s research offerings, please contact us.

By: Christopher Davis, Head of U.S. Fund Research, ISS Market Intelligence