In the third of ISS ESG’s series on Climate Stress Testing, the Climate team examines some of the key practical steps that financial institutions should consider when conducting a Stress Test.

The concept of climate stress testing is increasingly gaining attention among regulators and financial institutions. The Dutch central bank announced as early as 2017 that they would introduce stress tests to ensure financial stability in the face of increasing climate risks. More recently, French authorities have conducted a pilot test on banks and insurance companies to measure resilience to climate change, and the Bank of England is currently in the process of performing a climate stress test of a similar kind. The European Central Bank has released their climate risk stress testing results for the European Union, finding that financial stability risks from climate change tend to be concentrated in certain sectors, geographies, and firms, and that they are strongly path-dependent.

The assessment of climate-related risk on a broader scale goes back to 2017 when the Task Force on Climate-related Financial Disclosures (TCFD), established by the Financial Stability Board (FSB), released its first set of recommendations. The resulting framework had, and still has, a dual purpose:

- To support informed investment, credit, and insurance underwriting decisions; and

- To enable investors and regulators to better understand climate-related risks associated with financial institutions.

In addition to climate-related governance structures and strategies, the recommendations explicitly refer to climate-related metrics to be reported on and scenario analyses to be conducted by financial companies. Building on this framework, financial companies have since started collecting an increasing amount of climate-related data on their portfolios. Climate stress testing builds on this foundation.

WHY ARE REGULATORS INTERESTED IN STRESS TESTING?

Before diving further into climate stress testing, it is crucial to understand the intent and the reasoning behind conventional stress tests. As the 2007-2008 global financial crisis (GFC) demonstrated, financial institutions can find themselves the subject of contagion and large-scale systemic risk. In the aftermath of the GFC, stress testing was used to preemptively estimate a bank’s solvency and overall health in periods of hypothetical external shocks and market distress. This process serves not only as an internal risk management tool for financial institutions but also allows supervisory authorities to impose higher minimum capital requirements as a buffer to shocks if they find insufficient resilience in the financial system.

Key focus areas for stress testing extend from liquidity risk to credit risk, market risk, and others. Shocks in interest rates, equity and debt market prices, commodity prices, and similar are commonly used as scenario factors for stress testing analysis. The Bank for International Settlements summarizes stress testing principles as follows:

“All material and relevant risk should be considered, and all applied stresses need to be sufficiently severe to obtain meaningful insights about a bank’s resilience.”

This means that scenarios should address a financial institution’s core vulnerabilities and try to identify risk concentrations. The underlying data needs to be timely, accurate, and complete, as well as available at a sufficiently granular level.

This approach works reasonably well for conventional stress tests due to the availability of historic data and the ability to calibrate factors from past economic shocks. When thinking about climate stress tests, however, regulators need to rely on predicted data. Past climate shocks are likely not indicative of future ones and, most importantly, relevant data is not widely available. In addition, as the analysis must extend much further into the future than a mere two to five years, the uncertainty and risk regarding both the physical impacts of climate change and the resulting societal and policy responses is compounded.

HOW CAN A CLIMATE STRESS TEST BE APPROACHED?

There are credible ways and models to account for critical risk drivers as part of a climate stress test. The first step is to take account of the current carbon footprint of each portfolio company and to establish a model on how carbon emissions will be driven by the underlying fundamentals of the respective company. ISS ESG holds one of the most comprehensive historical climate datasets available in the market, and this is leveraged by clients in combination with proprietary sub-sector specific models to assess companies’ individual emission trajectory trends. This approach is discussed in more detail in the first part of this series; an example is provided in the second part. Based on these models, a baseline scenario for the portfolio is established. ISS ESG’s Climate Solutions team works closely with ISS’ Integrated Financials and Impacts team to project out company financials and the accompanying GHG emissions to 2050.

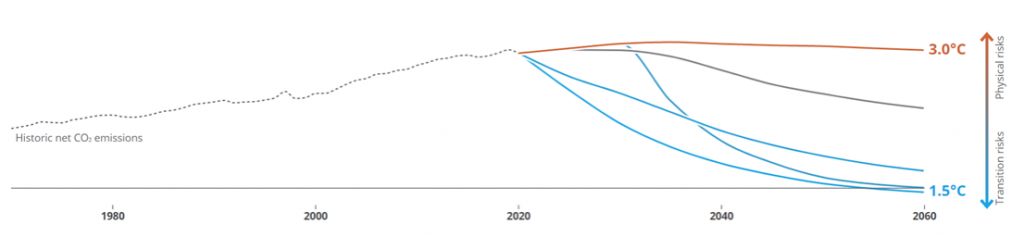

The second step is to look at transition risk. Here, different scenarios such as the ones from the Network for Greening the Financial System (NGFS) can be utilized, as shown in Figure 1. For transition risk specifically, the NGFS looks at a range of carbon price trajectories differentiated by country and/ or region. These carbon prices are integrated into the financial forecasts, for example as increased costs of goods sold, together with different growth trajectories for green and brown revenues to determine the transition Value-at-Risk under the different transition scenarios.

Figure 1: Risks Associated with Different Climate Change Scenarios

Source: NGFS

The third step is the estimation of physical risk. Leveraging the same climate model outputs used by the Intergovernmental Panel on Climate Change (IPCC) for scenarios of moderate and severe climate change, impact models for the most important hazards are deployed, including:

- tropical cyclones;

- coastal floods;

- river floods;

- wildfires;

- droughts; and

- heat waves.

Depending on asset-level exposure, these hazards can then be used to adjust the forecasts. For example, droughts and heat stress impact GDP and depress revenue, while damages due to tropical cyclones and floods pose operational risk through increased repair costs and business interruptions.

The portfolio climate Value-at-Risk can then be calculated as a combination of different scenarios of transition and physical risks. Banks and financial institutions can utilize these estimates in their risk models to get a better understanding of default rates and loss given default.

As the risks of climate change become more apparent, financial institutions are facing pressure from both regulators and their own clients to demonstrate a proactive approach to the issue. ISS ESG provides advisory services and robust tools to enable investors and lenders to measure their exposure to climate-related risks across both equity and debt portfolios as well as loan books.

Explore ISS ESG solutions mentioned in this report:

- Use ISS ESG Climate Solutions to help you gain a better understanding of your exposure to climate-related risks and use the insights to safeguard your investment portfolios.

- Financial market participants across the world face increasing transparency and disclosure requirements regarding their investments and investment decision-making processes. Let the deep and long-standing expertise of the ISS ESG Regulatory Solutions team help you navigate the complexities of global ESG regulations.

By Steffen Bixby, Head of U.S. Climate Analysis, ISS ESG Climate Solutions. Yuka Manabe, Senior Associate, ISS ESG Bespoke Research & Advisory. Solutions Simona Cristofanelli, Associate, ISS ESG Climate Solutions.