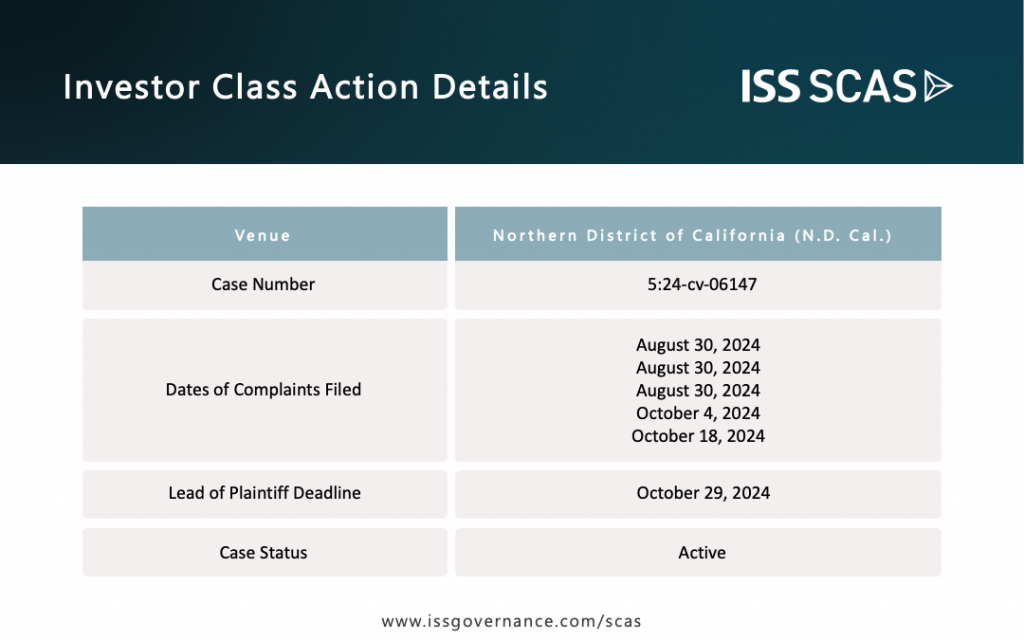

Between August 30, 2024 and October 18, 2024, a series of five initial complaints were filed in the United States District Court for the Northern District of California by different plaintiffs (“Plaintiffs”) and counsel, alleging securities fraud claims against Super Micro Computer, Inc. (“Super Micro” or the “Company”) and certain of the Company’s executives (together with Super Micro the “Defendants”), with February 2, 2021 and September 25, 2024, inclusive as the longest asserted class period among these complaints.[1] The complaints make substantially similar allegations, mainly that Defendants misrepresented that the Company’s: financials complied with Generally Accepted Accounting Principles (“GAAP”), internal controls were effective, gross margins were sustainable, and exports complied with trade control regulations. Similarly, the complaints assert that investors were harmed, with billions of dollars in market capitalization losses, when the truth was revealed over a number of disclosures (though the complaints vary somewhat in the number of alleged disclosures). The lead plaintiff deadline was October 29, 2024, and ten parties—with losses totaling approximately $100 million cumulatively—each moved for lead. Mere hours after the close of the lead plaintiff deadline, the Company announced that its auditor had resigned because it had been, “unwilling to be associated with the financial statements prepared by management.”

Super Micro manufactures servers and storage solutions and sells its hardware to technology companies, including, but not limited to, those working with artificial intelligence (“AI”). Super Micro was one of the hottest stocks of early 2024. After falling to around $71 in January 2023, the Company’s share price closed at the end of 2023 at approximately $284—quadrupling its 2023 low—and again more than quadrupled to over $1,188 by March 13, 2024 (the 2024 increase alone representing a change in market capitalization of over $50 billion), during the period in which AI related businesses saw rapidly increasing valuations.[2] Moreover, Super Micro’s valuation had increased enough that it was added to the S&P 500 in March.

The latest-filed complaint alleged that, on August 6, 2024, the Company announced its 4Q and full year 2024 financial results and conducted an investor earnings call, where the Company disclosed a significantly lower gross margin, which an August 7, 2024 Wall Street Journal article described as “an all-time low” for the Company. This complaint asserts that Super Micro’s stock price declined on August 7, 2024 from $616.94 to $492.70 per share, or over 20% on this news.

The complaints all cite a report published on August 27, 2024 by short seller Hindenburg Research (“Hindenburg”), titled, “Super Micro: Fresh Evidence of Accounting Manipulation, Sibling Self-Dealing and Sanctions Evasion at this AI High Flyer.” As cited in the complaints, in this report Hindenburg asserted, among other things, that: 1) the Company engaged in a fraudulent revenue recognition scheme by misallocating revenue to hardware sales instead of services to inflate margins, recording revenue when equipment could not be delivered or installed, and booking revenues for faulty or incomplete products; 2) a number of customers had received faulty equipment from Super Micro; 3) due to increased pricing pressures from large competitors and lower cost manufacturers, Super Micro’s gross margins had started to collapse; and 4) Super Micro violated export controls by shipping products to Russia. The complaints claim that Super Micro’s August 26, 2024 stock market decline from $562.51 to $547.64, or approximately 3%, was in response to the publication of the report.

On August 28, 2024, Super Micro disclosed that it would “not timely file its Annual Report on Form 10-K for the fiscal year ended June 30, 2024” because additional “time is needed” for its “management to complete its assessment of the design and operating effectiveness of its internal controls over financial reporting[.]” The complaints allege that this announcement caused Super Micro’s share price to drop more than 19% from $547.64 to $443.49 on August 28, 2024.

The two latest filed complaints assert that the Wall Street Journal reported, on September 26, 2024, that the U.S. Department of Justice was investigating Super Micro. These complaints assert that as a result, the Company’s share price declined more than 12% that same day, from $458.15 per share to $402.40. This was barely a third of the March 13, 2024 closing price. Taking the four alleged corrective disclosures from the last complaint filed, Super Micro’s stock price dropped nearly $300, or more than $15 billion.

On October 30, 2024, the day after the lead plaintiff deadline in the case, Super Micro issued a Form 8-K, which stated that on “October 24, 2024, Ernst & Young LLP (‘EY’) sent the members of the Audit Committee a letter of resignation as the Company’s registered public accounting firm[.]” The Company stated that, in the letter, EY wrote, “we are resigning due to information that has recently come to our attention which has led us to no longer be able to rely on management’s and the Audit Committee’s representations and to be unwilling to be associated with the financial statements prepared by management, and after concluding we can no longer provide the Audit Services in accordance with applicable law or professional obligations.” Super Micro’s stock price closed on October 30, 2024 at over $330, down from over $491 or approximately 33% down. An amended complaint in this case will likely allege this drop as a corrective disclosure, which would drive up the total market losses and therefore potentially damages.

The complaints allege a variety of Defendants statements as false and misleading, such as various quarterly financial results and certifications about financial controls. The complaints also assert that investors were harmed when the truth was revealed.

The lead plaintiff filing deadline for this case was October 29, 2024. There was significant interest in taking leadership of the case, with ten separate motions for lead plaintiff—six of which involved institutional investors—and fourteen different law firms seeking appointment as counsel. The total claimed losses across these various movants amounted to approximately $100 million. This level of interest from institutions and many accomplished plaintiffs’ firms suggests widespread belief among the plaintiffs’ bar that the claims against Defendants are meritorious and may result in a significant settlement.

Additionally, an earlier securities fraud class action against Super Micro and certain of its executives settled in 2023 for $18.25 million. The complaint in that action alleged that the Company engaged in an improper revenue recognition scheme and that investors were harmed when the truth was revealed.[3] The complaint further alleged that the Company had announced in August 2017 that it would be unable to file its fiscal year 2017 10-K, was unable to make its required filings with the SEC for the next 20 months, and was delisted from the NASDAQ. The complaint asserted, “on May 17, 2019, the Company issued a Restatement for a five-year period [] admitting that Super Micro and its officers and managers were aware of, engaged in, and concealed sales and accounting misconduct[.]”

The court will have to decide who should serve as lead plaintiff in the pending cases, and thereafter that lead plaintiff will start drafting an amended complaint to be filed perhaps 30-60 days after appointment. In the interim, the facts seem to be developing in this case.

[1] The five complaints are all related actions with their own dockets. The plaintiff who filed one of the complaints subsequently voluntarily dismissed the action. The remaining four actions will almost certainly be consolidated once a lead plaintiff is appointed.

[2] Super Micro effectuated a 10:1 share split on October 1, 2024. This insight uses or adjusts to pre-split prices to match the complaints.

[3] See, Hessefort v. Super Micro Computer, Inc., No. 4:18-cv-00838-JST (N.D. Cal.), at ECF No. 110.

“No portion of this insight constitutes legal advice, and no attorney-client relationship is intended or is established.”

Donald F. Grunewald, Director of Litigation Analysis, ISS SCAS