Credit Cycles Follow a Regular Pattern

The U.S. credit cycle seems to be turning down, but has the market recognized this? Which variables are related to credit risk? Does positioning a portfolio to high credit quality lead to alpha, and if so, when? Below are some of the key takeaways from ISS Economic Value Added (EVA)’s recently released paper on the credit cycle. To access the full paper, please download it directly from the ISS EVA online library.

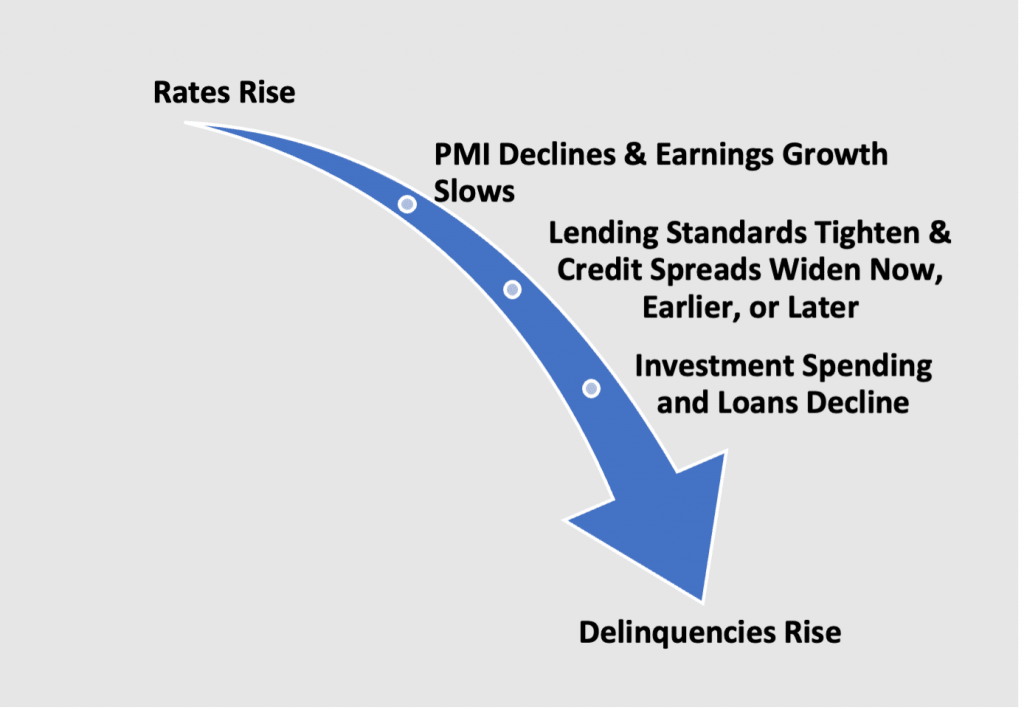

The U.S. credit cycle appears to be entering the latter stages preceding a typical rise in delinquencies (Figure 1): interest rates are up, manufacturing Purchasing Managers Indices and earnings growth are down, lending standards are tightening, and loan growth rate is fading, but credit spreads remain reasonably tight, and nonresidential private investment is strong. Is it only a matter of time before investments decline and delinquencies rise?

Figure 1: Credit Cycle

Source: ISS EVA

Recent economic data has been more resilient, as consumers have been switching spending habits from goods to services, but how long this can last is uncertain. Real wage growth is negative, excess savings from stimulus is fading, and credit card debt is rapidly rising.

In an environment where delinquencies may start rising, it may be relevant to consider firms with high credit quality and/or associated with high credit ratings. However, being selective and applying discretion may remain a determining factor to generate alpha, as the importance of high credit quality tends to vary according to sectors (Where?) and periods (When?), throughout economic and market cycles.

Credit is Due “Where” …

High credit quality is generally associated with a recurring set of variables. The Credit Quality Model presented in the full paper helps to identify the best single variables on a standalone basis, and to rank them according to their corresponding alpha (highest to lowest): stock volatility (lower is better), size based on sales (higher is better), return on capital (higher is better), free cash flow (higher is better), and share buybacks (higher is better).

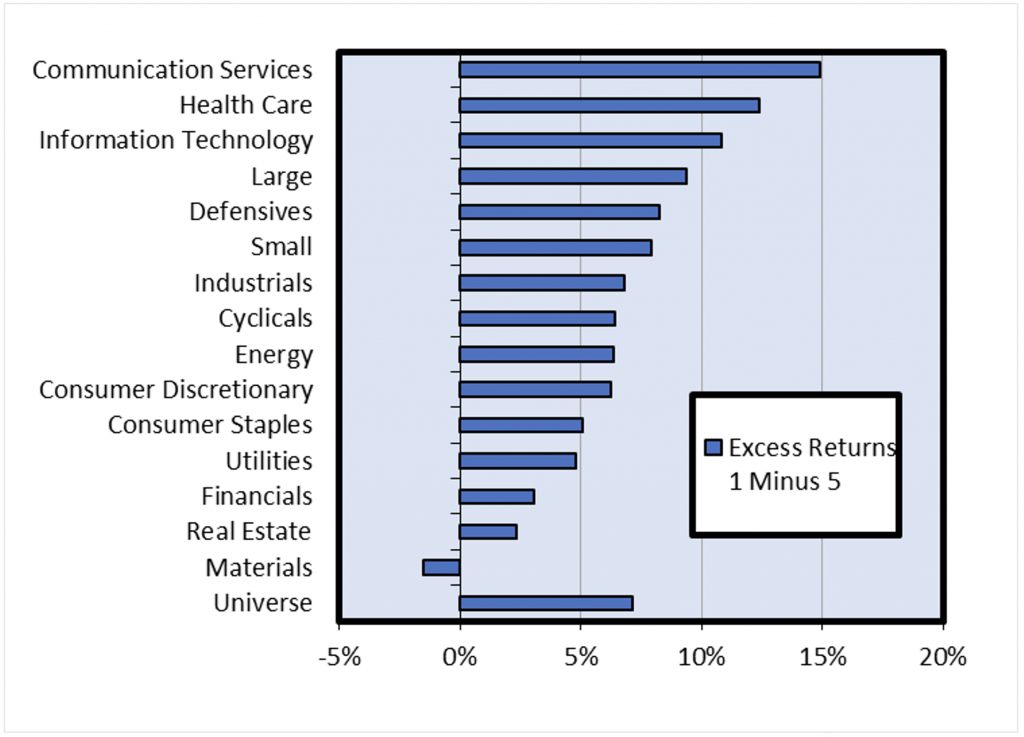

Perhaps surprisingly, high credit quality generally outperforms low credit quality by the greatest margin in growth sectors such as Health Care and Information Technology (Figure 2). Both Health Care and Information Technology have better credit ratios, on average, than the overall S&P 500, despite their business models being perceived as less stable, due to their embedded fast-growing nature.

Figure 2: Alpha Is Highest in Growth Sectors

Note:1s are firms in the top quintile on the Credit Quality Model and 5s are bottom quintile companies based on quarterly GICS sector-neutral sorts. Excess returns are 12-month forward returns post the sorts for the period 12/31/1999 through 3/31/2023.

Source: ISS EVA (Investor Express), FactSet. Back-tests are run with FactSet Alpha Testing.

Credit is Due “When” …

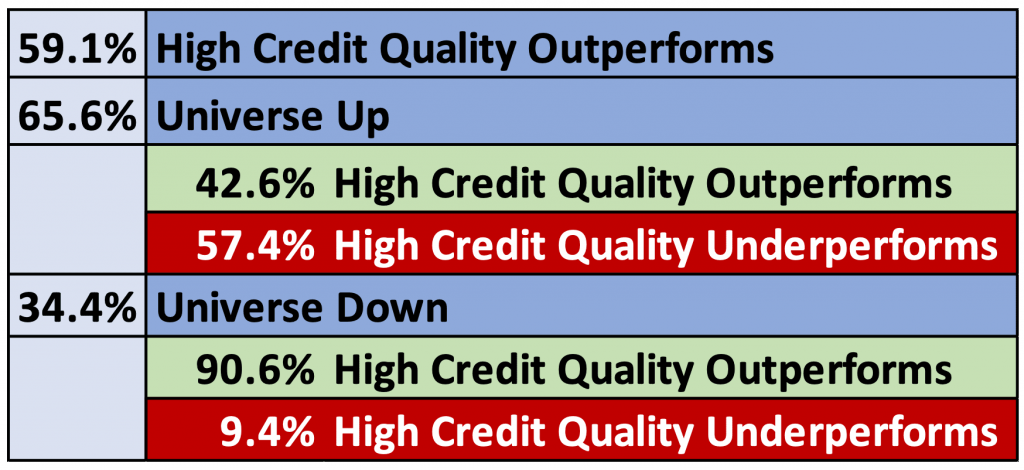

High credit quality tends to consistently outperform over the long-term, and especially during times of turmoil. As presented in the full paper, recent history (12/31/1999 to 03/31/2023) suggests that high credit quality has outperformed the U.S. universe (>$250m market cap) in 59% of the quarters; this average rises to 91% in down markets (Figure 3).

Figure 3: High Credit Quality Outperforms during Market Corrections

Note: Color-coded percentages are the probability of GICS sector-neutral top-quintile (high credit quality) stocks outperforming or underperforming an equal-weighted universe of U.S. stocks greater than or equal to $250 million in market cap from 12/31/1999 through 3/31/2023.

Source: ISS EVA (Investor Express), FactSet.

If the U.S. credit cycle continues its current course, set off by tightening monetary policy, investors may wish to pay close attention to the credit quality of their portfolios.

Pursuing High-Performing Companies

As they navigate the credit cycle and seek to identify companies with high credit quality, investors can draw on ISS EVA. ISS EVA offers assessments of companies’ underlying economic profits as well as of the relationships between companies’ profitability and their performance on Environmental, Social, and Governance (ESG) issues. Investors can find additional support in evaluating companies’ ESG performance from the ISS ESG Corporate Rating.

Explore ISS ESG solutions mentioned in this report:

- Understand the F in ESGF using the ISS EVA solution.

- Identify ESG risks and seize investment opportunities with the ISS ESG Corporate Rating.

Authored by:

G. Kevin Spellman, PhD, CFA, Senior Advisor, ISS EVA