Preamble

ISS ESG’s Quarterly Engagement Update series highlights key trends that emerge through activities conducted on behalf of participating investors under ISS ESG’s Collaborative Engagement Services. These services allow investors to participate in cost-effective joint outreach and dialogue with companies on material sustainability-related themes.

The services also support global investor compliance and reporting requirements with regard to voluntary and statutory stewardship frameworks, including the Principles for Responsible Investment (PRI), the EU Sustainable Finance Disclosure Regulation (SFDR), the EU Shareholder Rights Directive II (SRD II), and stewardship codes across the globe.

The Collaborative Engagement Services leverage ISS ESG’s expertise, research, and data to identify key performance indicators for corporate ESG improvement and momentum that are aligned with recognised standards such as the United Nations Sustainable Development Goals (SDGs).

By engaging collaboratively, institutional investors can increase their focus on Environment, Social, and Governance (ESG) issues and effectively communicate their concerns to investee company management. ISS ESG facilitates engagement on behalf of the participating clients to promote change through active ownership and dialogue. Engagement focus areas include enhanced disclosure, a push for improved sustainability performance, and mitigation of ESG risks.

ISS ESG’s Collaborative Engagement Services consist of two elements:

- The ISS ESG Norm-Based Engagement Solution (formerly known as ‘Pooled Engagement’) is based on outreach to a select universe of upwards of 100 public companies annually. Companies are identified based on their involvement in alleged violations of human rights and labour rights and breaches of environment- and corruption-related recognised international standards, including the OECD Guidelines for Multinational Enterprises, the UN Global Compact, and the UN Guiding Principles on Business and Human Rights.

- The ISS ESG Thematic Engagement Solution – launched in 2022 – prioritises outreach to a select universe of 30-50 public companies per theme over a two-year or three-year engagement cycle. It focuses on companies identified as underperforming in the areas of Net Zero, Gender Equality, Water, and Biodiversity.

Collaborative Engagement Activity

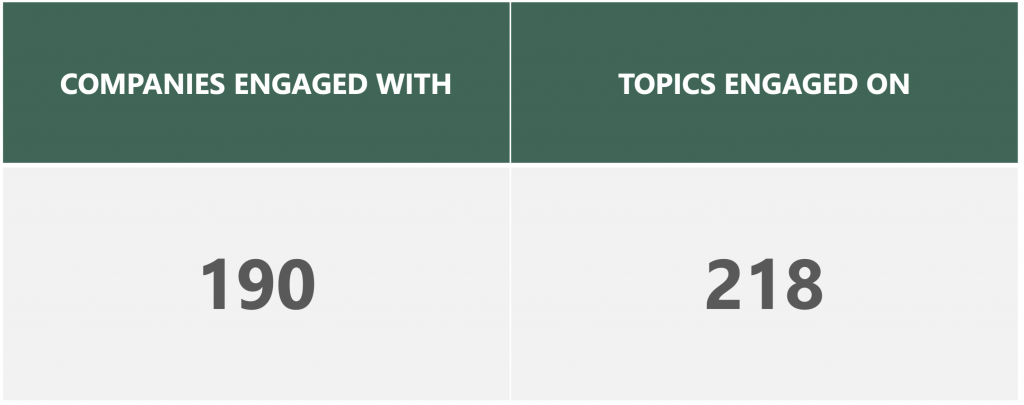

In Q3 2024, ISS ESG facilitated engagement on behalf of signatory investors with a total of 190 companies across 218 topics. ISS ESG conducted engagements with 50 companies under Norm-Based Engagement, the Thematic Engagement solution facilitated engagement with 147 companies, and 7 companies were engaged with both solutions. Q3 2024 marks the end of the first engagement cycle of ISS ESG’s Water, Biodiversity and Gender Equality Thematic Engagement services, which are renewed in Q4 with new objectives and an updated list of target companies.

Table 1: Collaborative Engagement Activity, Q3 2024

Source: ISS ESG

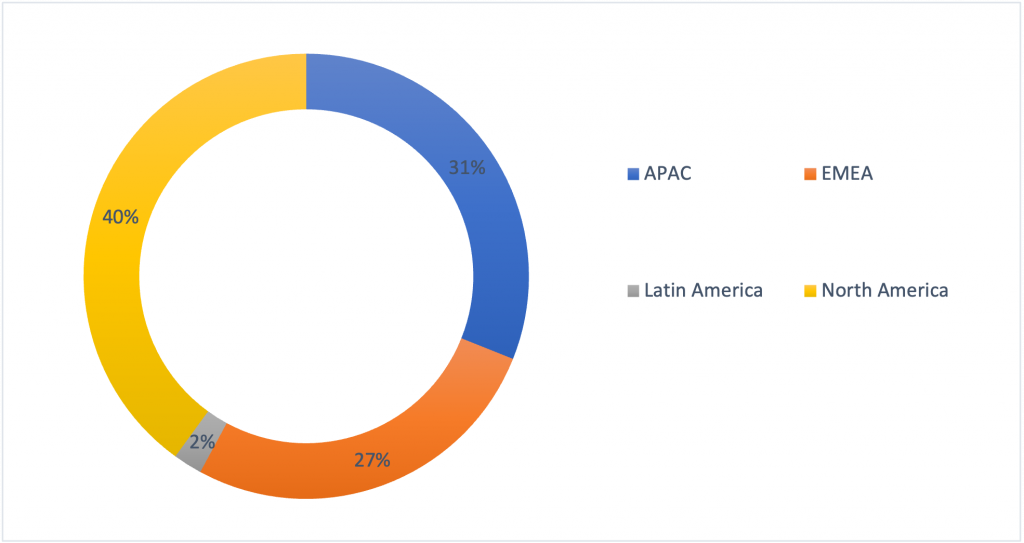

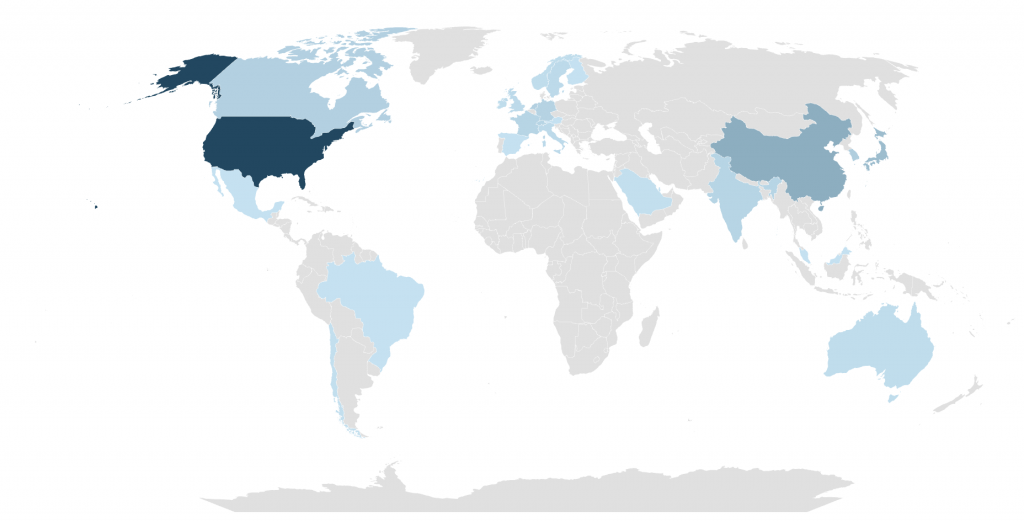

The companies engaged with are spread out globally, with domiciles in Asia-Pacific (APAC) (31%); Europe, the Middle East, and Africa (EMEA) (27%); and Latin America (2%) and North America (40%).

Figure 1: Regional Distribution

Source: ISS ESG

Note: Darker shades of blue reflect higher numbers of engaged companies.

Source: ISS ESG

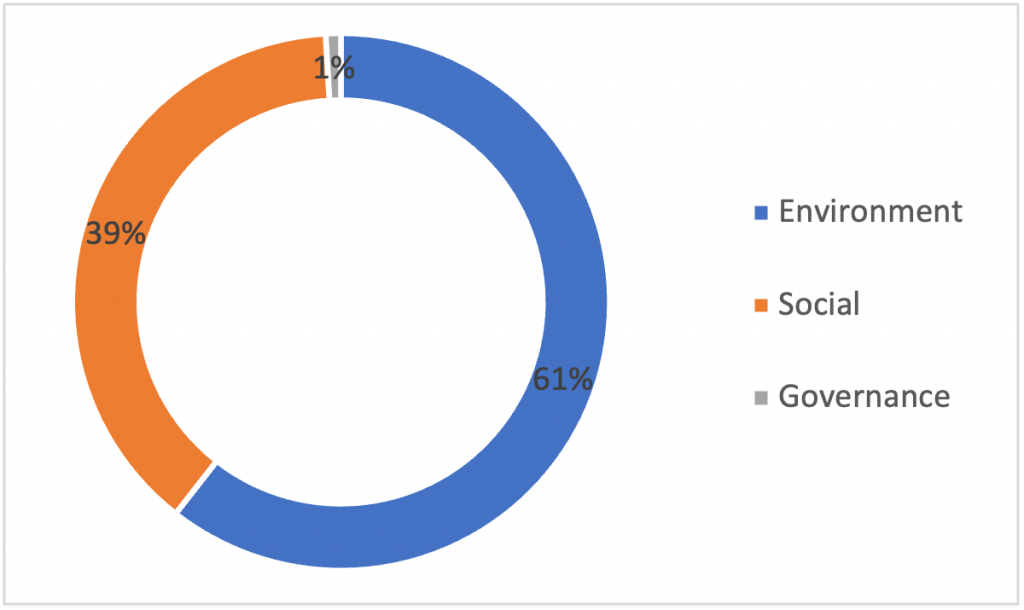

Across the 218 topics that ISS ESG facilitated engagement on during Q3 2024, Environment topics (61%) held the majority of the engagement for the quarter, followed by Social topics (39%), while 1% of the topics concerned the Governance pillar.

Figure 2: ESG Breakdown

Source: ISS ESG

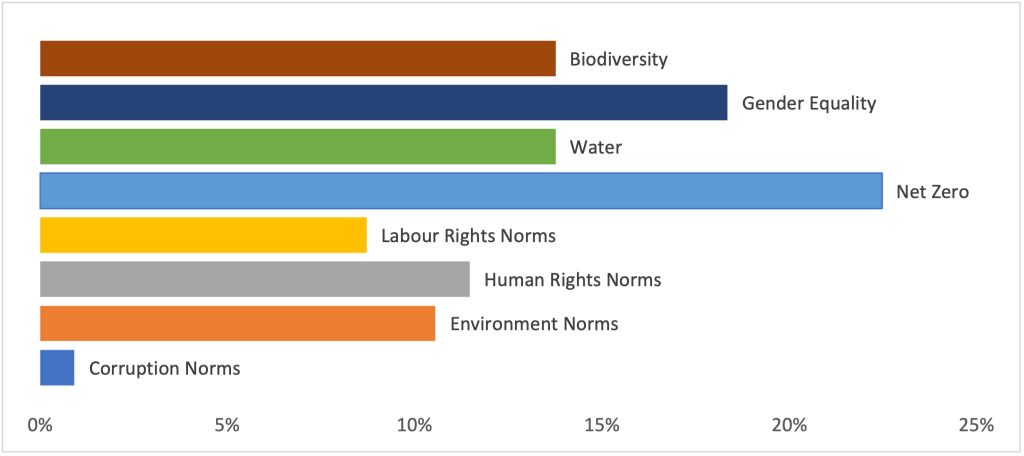

A closer examination of the ESG breakdown reveals that, within the Environment topics addressed by ISS ESG during Q3 2024, Net Zero emerged as the most prominent focus. Following the launch of the new Net Zero Thematic Engagement cycle, which expanded to include 50 companies, 62% have already responded through written responses or engagement meetings. Within the area of Environment Norms, the most common sub-topics included controversies related to biodiversity and environmental impact.

Among Social topics, most of the engagements related to Gender Equality, closely followed by Human Rights Norms and then Labour Rights Norms under Norm-Based Engagement. Within Labour Rights Norms, the most common topics were workplace health and safety, industrial accident, forced labour, human rights due diligence, modern slavery, and discriminations. Within the area of Human Rights Norms, the most common sub-topics were controversies related to indigenous rights, living standards, and stakeholder consultation.

Figure 3: ESG Topics Breakdown

Source: ISS ESG

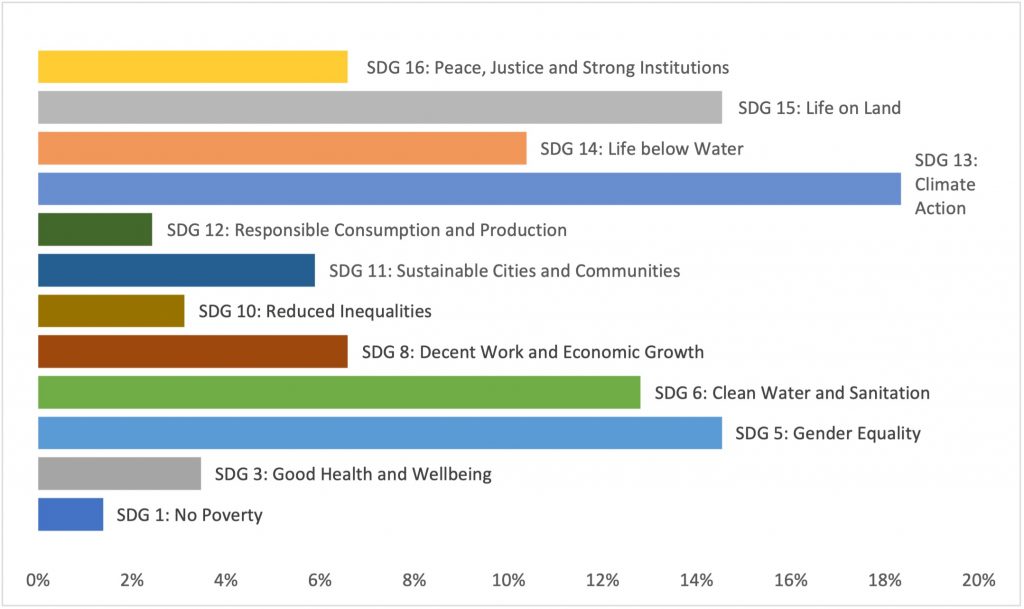

The topics that ISS ESG facilitated collaborative engagement on in Q3 2024 covered 12 of the UN Sustainable Development Goals (SDGs). The most common SDGs included SDG 13 – Climate Action, SDG 15 – Life on Land, SDG 5 – Gender Equality, and SDG 6 – Clean Water and Sanitation.

Figure 4: SDG Breakdown

Source: ISS ESG

Future Action

For more than a decade, various soft and hard law initiatives have combined with investor demand as active ownership approaches generally, and engagement specifically, have grown worldwide. These trends have encouraged more common frameworks for investment stewardship for investors seeking changes in the companies they invest in.

ISS ESG’s Collaborative Engagement Services, including Norm-Based Engagement and the Thematic Engagement Solution, are available to support investors in this important area of their stewardship practice. In Q2 2024, ISS ESG launched the second cycle of the Net Zero Thematic Engagement service, with an extension of the target list to 50 companies, and the second cycles of the Biodiversity, Water and Gender Equality Thematic Engagement services have been initiated in Q4 2024.

ISS ESG has also published a range of Thought Leadership material covering ESG engagement, including Stewardship Excellence: Engagement in 2021 and Sustainability Engagement in the Asia Pacific: A Look Back Over the Past Decade. ISS ESG Engagement Managers have also shared insights on corporate engagement in several webinars and articles on themes such as Net Zero, Water, Biodiversity, Gender Diversity, and Modern Slavery, including an April 2024 webinar dedicated to Key Trends in ESG Engagement and the article “Terms of Engagement: Investor Challenges on the Road to Net Zero,” published in November 2023.

Explore ISS ESG solutions mentioned in this report:

- Develop engagement strategies, define achievable engagement objectives and manage your engagement process with ISS ESG’s Norm-Based Engagement Solution and Thematic Engagement Solution.

By:

Shweta Shah, Sustainability Engagement Coordinator, ISS ESG

Sujay Pan, Sustainability Engagement Coordinator, ISS ESG

Loïc Dessaint, Head of Sustainability Engagement, ISS ESG