What are Nature Dependencies?

Businesses across all industries both depend on and impact nature through their activities and supply chains in some way. For example, a beverage company that depends on groundwater may face risks if that natural resource becomes scarce (dependency). Simultaneously, if the company discharges untreated wastewater, this may pollute freshwater ecosystems and affect local communities (impact).

Table 1: Concepts Related to Nature Dependencies Assessment

| Term | Definition |

| Ecosystem | A natural unit of living things and their physical environment. Within an ecosystem, living and non-living elements function together. Ecosystems vary in scale. |

| Ecosystem Services | Services provided by ecosystems that are used in economic and other human activities. |

| Ecosystem Service Type | Provisioning services: e.g., ground water = potable water in the public water supply Regulating and maintaining services: e.g., pollination = successful yields of fruit and vegetable crops Cultural services: e.g., cultural = ecotourism |

| Nature-Related Risks | Potential threats (physical, transition, systemic) posed to a business arising from its and the wider society’s dependency and impacts on nature. |

Source: TNFD

This article will focus on dependencies, looking specifically at dependencies assessment data and the potential implications for investors.

The Role of Nature Dependencies in Risk Assessment

As introduced in the NCRI’s 2024 Deforestation Flagship and highlighted by TNFD, institutional investors are exposed to nature-related physical, transition, and systemic risks. These risks may arise from a company’s dependency on certain ecosystem services (e.g., ground water) and a company’s negative impacts on nature (such as resource exploitation).

A dependency assessment allows an investor to better understand which ecosystem services their portfolio depends on the most and which types of risks can arise due to material ecosystem service disruptions (Table 2).

Table 2: Examples of Nature Dependencies and Risks Associated with Ecosystem Service Decline

| Ecosystem Services Group | Ecosystem Service of Interest | Type of Risk | Risk Hazard/Event | Financial Risk |

| Maintenance & Regulation services | Pollination | Physical risk | Loss of pollinator services due to bee population decline | Crop yields decline, leading to raw material price increases |

| Provisioning services | Fibers & other materials | Transition risk | Regulation prohibiting trading or sale of deforestation-linked palm oil | Stranded assets |

| Cultural services | Recreational | Physical risk | Ocean acidification from climate change causing Great Barrier Reef to experience extreme bleaching event | Decline in tourism industry revenues, low fish catchment for seafood industry |

Source: U.K. Institute and Faculty of Actuaries, ISS STOXX, Australian Government

Three different types of data can be adopted to start a dependency assessment, as shown in Table 3:

Table 3: Type of Dependency Data Structure

| Dependency Data Structure | ||

| Data Available | Key Insights Derived from Data Source | Examples of Data Source |

| Modeled assessment | Understand the materiality of key ecosystem services issuers depend on (e.g., surface water) | Asset- or portfolio-level assessments (e.g., assessment that portfolio has high dependency on pollination) |

| Asset/geographical data | Understand whether issuer’s operations are in a location that is nature stressed (e.g., assets located in high-water-stress zones) | Water-stress areas, water-quality maps, & other spatial data |

| Public disclosures | Understand an issuer’s dependencies from a quantitative perspective based on reported data from companies | Sustainability reports (e.g., TNFD), performance indicators, and context-specific targets (e.g., SBTN) |

Source: ISS STOXX

Equipped with specific dependency-related data, an investor could:

- identify which ecosystem services are materially relevant to their portfolio;

- prioritize sectors and geographies for further in-depth analysis; and

- produce a short list of issuers and/or sectors that have both high dependency on select ecosystem services and that are located in ecologically stressed locations.

The section below will explore this three-step process by using ISS STOXX modelled data.

Case Study: The Dependencies Supporting STOXX Global 1800

The Natural Capital Research Institute (NCRI) used ISS STOXX’s Biodiversity Impact Assessment Tool (BIAT) to explore STOXX Global 1800 portfolio dependencies and which sub-industries are most at risk if the selected ecosystem services are in decline. It assumed an investment of €1 million in the portfolio.

ISS STOXX’s BIAT includes 22 granular ecosystem services factors that are classified into three groups: Regulation & Maintenance, Provisioning, and Cultural services (Table 2). Each factor is attached to the issuer level-materiality and revenue dependency of the companies within the portfolio.

Table 4: Biodiversity Impact Assessment Tool Factor Definitions

| Factor | Definition |

| Materiality | Assesses an issuer’s ability to continue operations if ecosystem service is negatively impacted Categorized by very low, low, medium, high, and very high (e.g., low materiality means no-to-very-limited disruption to operations, while very high means a potentially high degree of disruption) |

| Revenue dependency (%) | Assesses how much of a company’s revenue is dependent on select ecosystem services |

Source: ISS STOXX Biodiversity Impact Assessment Tool

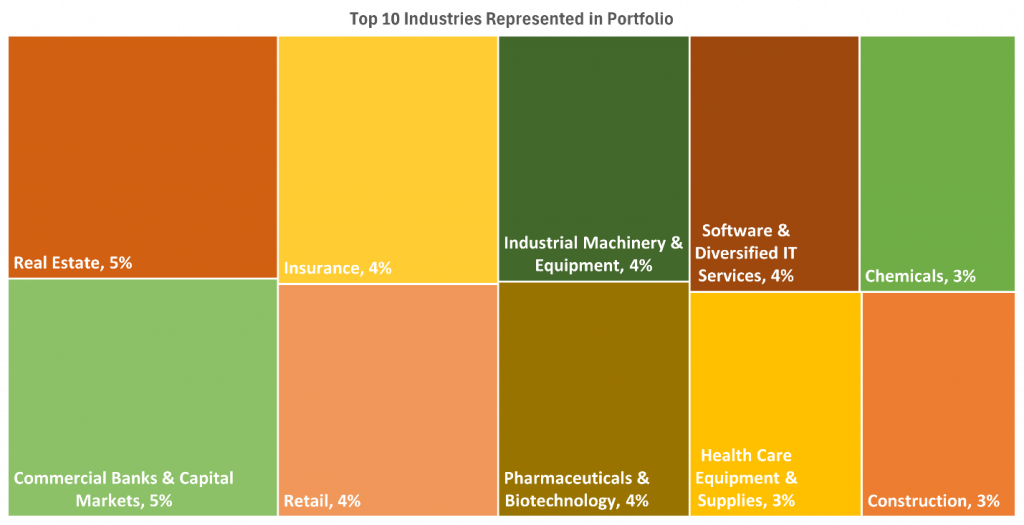

Figure 1 shows the breakdown of the GICS Sub-industries within the STOXX Global 1800 index.

Figure 1: Top 10 GICS Sub-Industries Represented within STOXX Global 1800 Index (%)

Source: STOXX Global 1800 portfolio breakdown- ISS STOXX BIAT

The dependency analysis undergone at the portfolio level shows that 72% of the portfolio’s revenues are dependent on the Regulation & Maintenance ecosystem services group while 22% of the portfolio revenues are dependent on provisioning services (Table 5).

Table 5: Grouped Ecosystem Services by Dependency Revenue (%)

| Ecosystem Services Group | Materiality Classification | Dependency Percentage |

| Regulation & Maintenance | Low | 72% |

| Provisioning | Medium | 22% |

| Cultural | Low | 6% |

Source: BIAT

At first glance, the portfolio’s dependency on the Provisioning ecosystem services group may seem less important, as its revenue is only 22% dependent on this group. However, when considering the medium materiality classification, this changes.

Provisioning services (e.g., fibers, wood, and plants), have a much higher materiality classification. This means that if Provisioning services diminish and/or disappear due to nature loss, the portfolio would face a much larger probability of risks, as operations would lose the ability to protect themselves from the abrupt changes in ecosystem service availability.

Portfolio-Level Revenues from Select Ecosystem Services

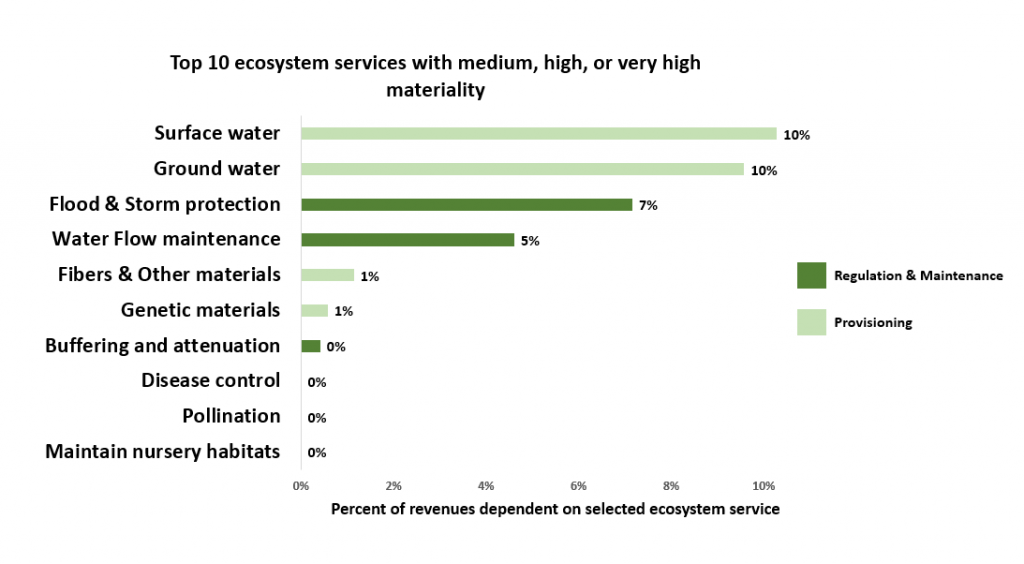

BIAT ensures a more granular analysis of each ecosystem service group and which specific ecosystem services are influencing the dependency-based revenue shown above.

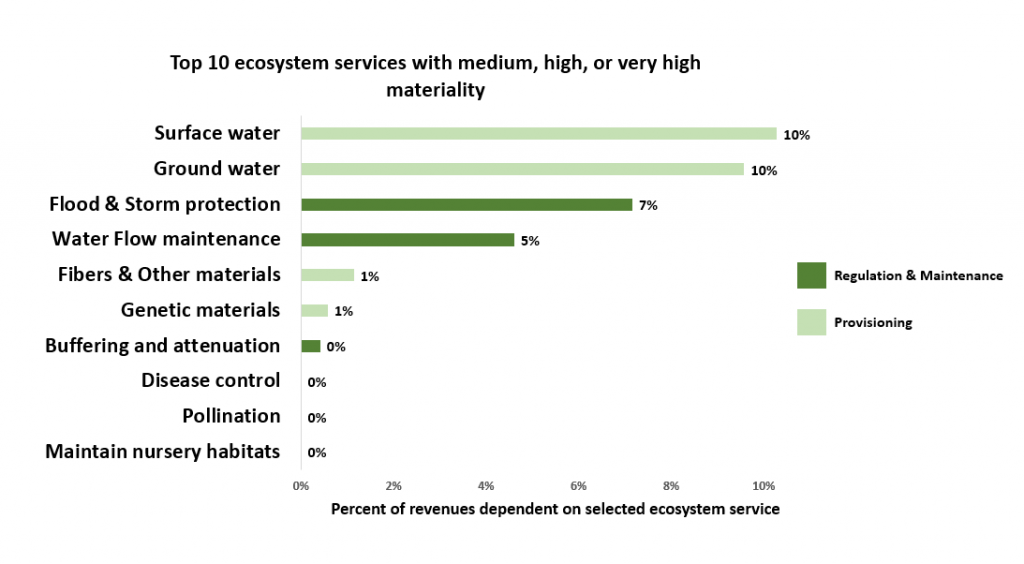

When looking at overall ecosystem service materiality for the portfolio, surface and ground water have the greatest revenue dependency (Figure 2).

Figure 2: STOXX Global 1800 Revenues Associated with Ecosystem Services

Notes: Very low to low materiality data has been removed, and the focus is solely on medium to very high materiality. More granular data is available when using ISS STOXX BIAT.

Source: BIAT

Moreover, approximately 30% of the STOXX Global 1800 revenues are materially dependent on water-based ecosystem services (surface water, ground water, flood and storm protection, and water flow maintenance). As a significant portion of the revenue generated by the companies in the portfolio relies on the availability of water resources, this material dependency implies that businesses may be vulnerable to any change in water availability, quality, and regulatory change related to water use.

Surface Water Dependency Deep Dive

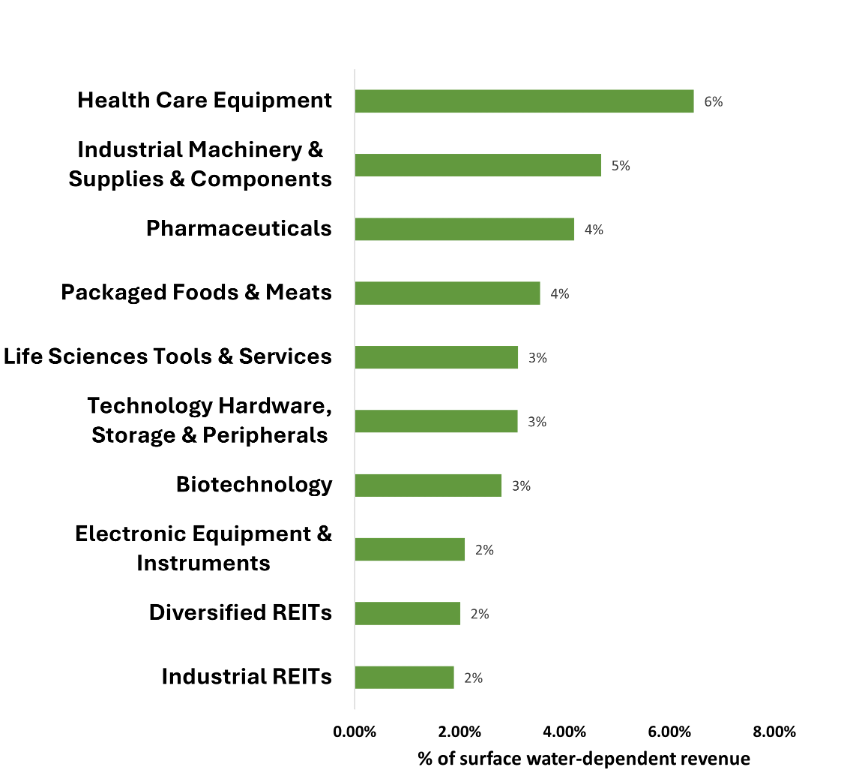

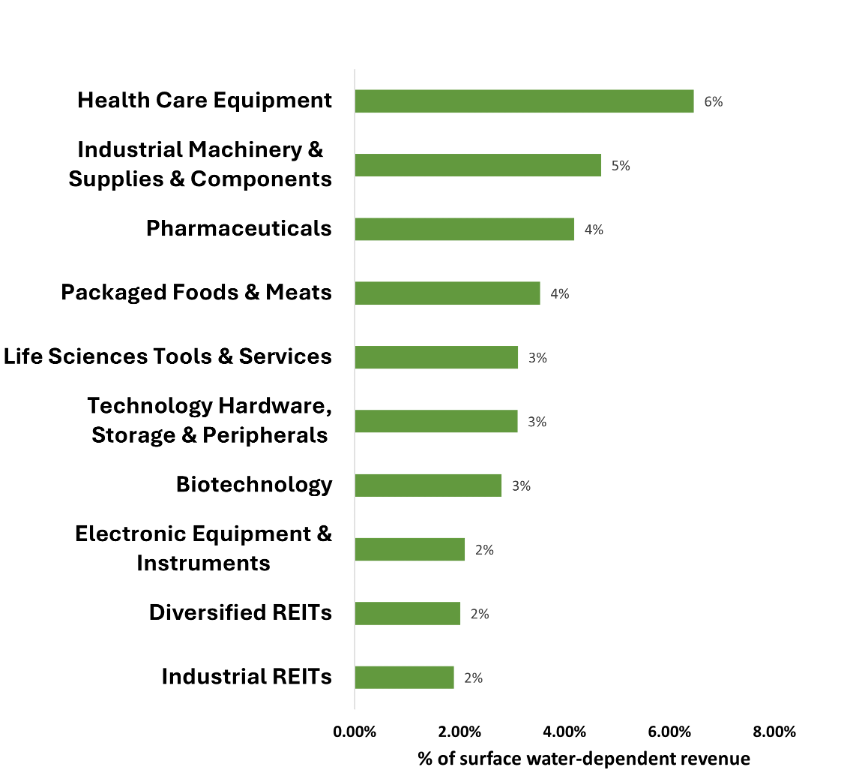

Surface water is water located on top of land, such as rivers, lakes, wetlands, and oceans. Disruption in surface water provisions could lead to agricultural production shortages, policies enacting water rationing or price increases, declines in trade, and increased manufacturing costs. Almost 10% of the STOXX Global 1800 portfolio issuers revenues are significantly dependent on surface water. This analysis can be expanded by adding a sub-industry lens (Figure 3).

Figure 3: Top 10 GICS Sub-Industries Driving STOXX Global 1800 Portfolio-Level Surface Water Ecosystem Revenue Dependency

Source: BIAT

A significant percentage of surface water revenue dependencies (distinguished by GICS sub-industry classification) originate from Health Care Equipment, Industrial Machinery, and Pharmaceuticals.

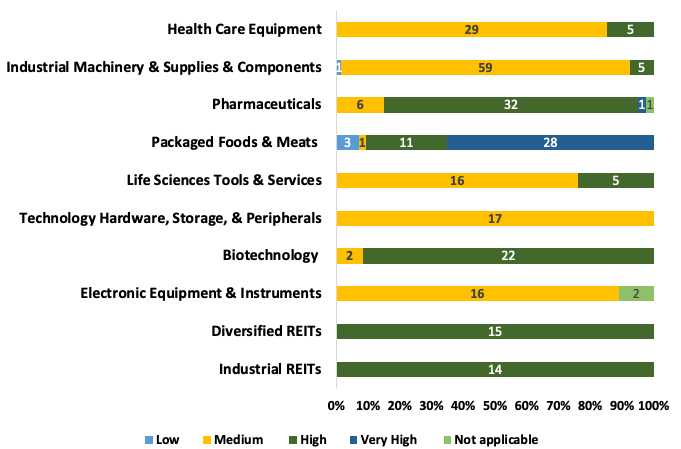

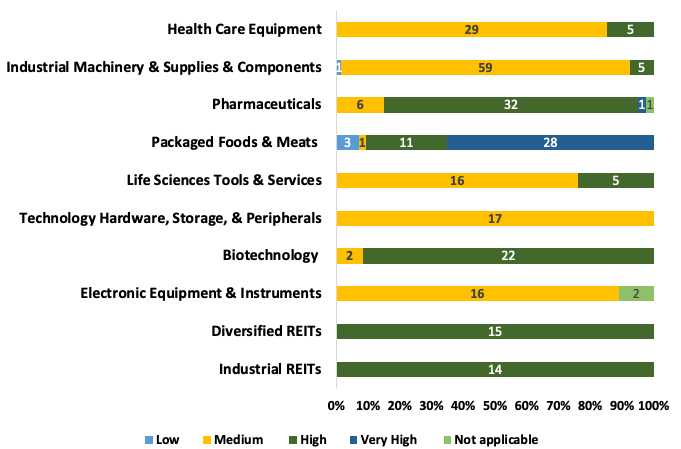

Pharmaceuticals, Packaged Foods & Meats, and Diversified & Industrial REITs are the industries with a high to very high materiality of surface water (Figure 4). With these materiality levels considered, these industries combined account for a higher surface water-related revenue than Health Care Equipment alone.

Figure 4: Industry-Related Materiality of Surface Water in STOXX Global 1800, by GICS Sub-Industry

Source: BIAT

For example, water plays a critical role in the pharmaceuticals supply chain. The production of sterile drugs (e.g., vaccines) requires large amounts of water throughout the entire manufacturing process. Moreover, the implications of having high materiality of surface water for these industries could translate into major physical, transition, and systemic risks (in the long term). For example, if the quantity and quality of surface water is slightly disrupted, these could result in large operational and product delays for companies and potentially translate into financial losses.

Why It Matters to Investors

As explored in this article, it is possible to assess portfolios dependencies via tools such as ISS STOXX BIAT and be informed about potential short-, medium-, and long-term risks.

The information generated from dependency assessments allows investors to understand their portfolio companies’ exposure to potential operational risks. As nature-related risks arise from companies’ dependencies, the materiality and extent of these dependencies can negatively affect a companies’ financial performance.

One way investors can use this data is to engage with high-risk companies to understand how they are adapting to nature loss in their operations. The data could also aid investors in future issuer selection processes and the prediction of financial volatility based on scenarios where certain material ecosystem services are disrupted.

Explore ISS STOXX solutions mentioned in this report:

- ISS STOXX’s Biodiversity Impact Assessment Tool helps investors assess the impact of companies’ business and supply chain activities on biodiversity.

By:

Caitlin Harris, FLAG Lead, Natural Capital Research Institute, ISS STOXX

Clarissa Persico, Freshwater & Oceans Lead, Natural Capital Research Institute, ISS STOXX