The potential impact of expansive tariffs sent shockwaves throughout financial markets in early April. Recent ISS Market Intelligence research has covered how this was reflected in the mutual fund and ETF market. The severe and sudden nature of the April 2nd announcement prompted anxiety from a wide variety of investors, which subsequently placed pressure on the intermediary advisors on whom many investors rely to manage their accounts. ISS MI fielded a survey of 134 financial advisors in April to understand how they were responding to the market upheaval and what they are most looking for from their home offices and asset manager partners.

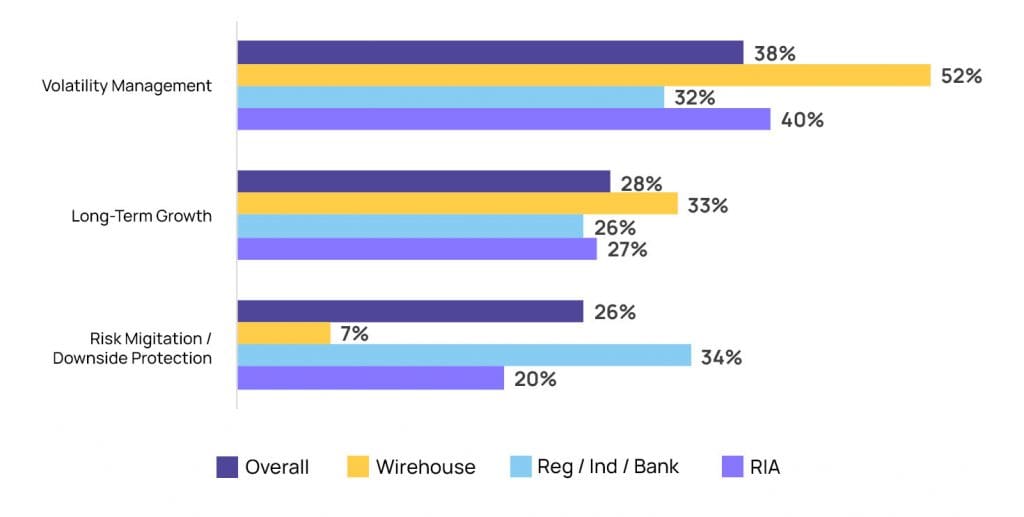

Responding to volatility was understandably at the forefront of many advisors’ minds. When asked what outcome they were most concerned with solving, 38% said “volatility management,” compared to 28% for long-term growth and 26% for downside protection, as seen in Figure 1. Wirehouse advisors were significantly more focused on volatility management at 52%. Regional and independent broker-dealer advisors conversely weighed downside protection more strongly.

1. Most important outcome for advisors, April 2025

Volatility Management Stands as Top Issue for Advisors

By: Alan Hess, Vice President, ISS Market Intelligence