Environmental, Social, and Governance (ESG) investing has evolved greatly as a concept over the past two decades. It now reaches nearly every aspect of the corporate and investment decision-making process, and rightfully so. This growth has presented so many amazing opportunities for investors and corporations to measure and improve practices across all aspects of the E, S, and G spectrum. It has also created a host of challenges for investment professionals who are trying to answer the question: “Does ESG matter?”

Globally ISS ESG continues to see and measure improvements in corporate ESG practice:

- more companies committing to carbon goals and more biodiversity awareness;

- more awareness of inclusive Corporate Social Responsibility policies, increased gender and ethnic diversity at board and management level; and

- better board composition, shareholder rights, and increases in stewardship practices such as engagement and voting.

ISS ESG has also watched and listened as sustainability reporting continues to evolve, with different approaches developing in different global regulatory situations. While these changes have driven the availability of clean, comparable, and consistent data, challenges remain in the capture, measurement, and analysis of that data.

As responsible investment becomes mainstream, questions are being raised about a number of the accepted wisdoms in the sector. It is healthy for there to be a closer examination of topics such as the links between ESG factors and returns, and the underlying reasons behind different ratings systems generating different results. As ISS ESG has noted recently, such enquiries are likely to lead to better outcomes for clients.

So back to that question, does ESG matter? The global ISS ESG team continues to answer that question with a resounding YES: ESG Matters, and here’s why.

ESG Matters…

The ESG (Environmental, Social, and Governance) spectrum has always had an implicit fourth pillar – Financial materiality. The last pillar in the ESGF acronym is the one that can help to connect ESG to the investment front office in perhaps the most critical way, by providing a strong motivation to link ESG to portfolio management processes.

ISS ESG evaluates the F pillar through the Economic Value Added (EVA) lens. EVA converts accounting profit to economic profit by reversing accounting distortions found within the as-reported financial statements, thereby measuring the dollar value profit after ALL costs, including the cost of giving shareholders a fair return on invested capital. EVA is a cleaned up, consistent, and comparable measure of profitability which allows investors to parse thousands of company disclosures globally with comparable accounting adjustments to drive informed investment decision making on a systematic basis. Think of EVA as financial quality: more EVA is always better, so firms that generate more EVA are most times assessed as higher quality. So why is EVA Quality important to ESG?

WTF (Why the F)?

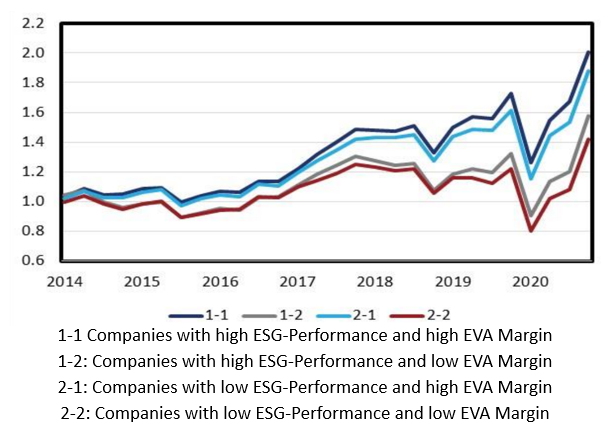

The use of ESG metrics in investment has been shown to provide sustainable value to investors. In the recent ISS ESG publication ESG Matters: Part II, we highlight that combining the ISS ESG Corporate Rating with EVA is even better. In a simple back test outlined in the paper, firms that exhibit both high-ESG and high-EVA Margin produce returns that are up over 100% over the last five years (i.e., doubling), when compared to firms that are low-ESG and low-EVA Margin which are up less than 40% over that same time period. This represents an annualized spread of ~12%.

Source: ISS ESG & EVA data

To pass the test of whether an investment strategy works, the results must not be driven by outliers. That means it should work in most sectors, countries, time periods, and in more stocks than not, and if it does not outperform, then it must make sense (for example risk-on versus risk-off markets favor different factors). Combining ESG with EVA passes all these tests.

Using EVA as the foundation of this assessment of Financial Quality brings additional comparability for ESGF analysis. It demonstrates empirically that investors care about EVA, and the results point to higher EVA Margin leading to higher valuation multiples. While this is not a groundbreaking relationship (with a respectful nod to Benjamin Graham and many investors before and after him), it does provide further support for the use of EVA as the measuring stick for Financial Quality. When compared to traditional Price-to-Book ratios, ISS ESG’s EVA-based data consistently outperforms global benchmarks.

How the F

ESG-minded investors sometimes feel as though they are faced with two somewhat binary decisions:

- Integrate ESG into their mandate and philosophy; or

- Continue to generate alpha.

The challenge with this framing is that their fiduciary responsibility lies between both options – but it does not have to. ESGF can be applied in a myriad of different ways, as illustrated in ISS EVA’s work and research.

There are many ways to be an effective ESG investor. ISS ESG’s entire global team works to support clients in building ESGF strategies that allow for persistent risk-adjusted outperformance versus global benchmarks. Our research supports the foundational view that integrating ESG into an investment decision process is not only sustainable for returns but sustainable for the world.

Please click on this link to access a recording of a webinar hosted by Gavin Thomson, Global Head of Integrated Portfolio Management at ISS ESG, on the 24th June.

Explore ISS ESG solutions mentioned in this report:

- Understand the F in ESGF using the ISS EVA solution.

- Identify ESG risks and seize investment opportunities with the ISS ESG Corporate Rating.

By: Anthony Campagna, Global Director Fundamental Research – Integrated Financials & Impact, ISS EVA. Gavin Thomson, Associate Director, ISS ESG