Earlier this month FINRA announced that it has fined Barclays Capital $2 million for failing to comply with its Best Execution obligations in connection with its customers’ electronic equity orders. This follows another $2 million fine a few months ago for Best Execution violations levied against Deutsche Bank.

In both cases, the firms routed orders directly to their own trading venues and did not provide sufficient review that their customer trades met the standards laid out in rule 5310. FINRA Rule 5310 on Best Execution requires firms to seek the most favorable terms reasonably available for their customers’ orders. To meet this standard, firms must conduct “regular and rigorous” reviews evaluating the order execution quality their customers receive under the firm’s current routing arrangements. Additionally, firms are required to examine the execution quality their customer orders could receive through alternative routing arrangements. Rule 5310 lists several factors that firms should consider when conducting these reviews, including price improvement, percentage of the order that is filled, speed of execution, and information leakage.

What is the risk for the buy-side?

Although Rule 5310 outlines the broker’s responsibility for best execution, it is also best practice and makes sound business sense for the buy-side to proactively monitor the quality of their executing brokers. Although it is the asset owner who incurs the immediate financial cost when a broker does not provide Best Execution, there are other hidden costs and risks for the investment manager as well—including potential reputational damage to fund managers.

When Best Execution failures like these appear in the news, asset owners often want to know if their funds were traded with non-compliant brokers or venues. Given the asset owner generally does not have a relationship with the broker, the natural inclination is to hold the investment manager responsible for their Best Execution. This suggests that investment managers should proactively monitor their brokers and use reasonable diligence to effectively speak on the execution quality of the brokers they trade with.

What can you do to monitor your brokers?

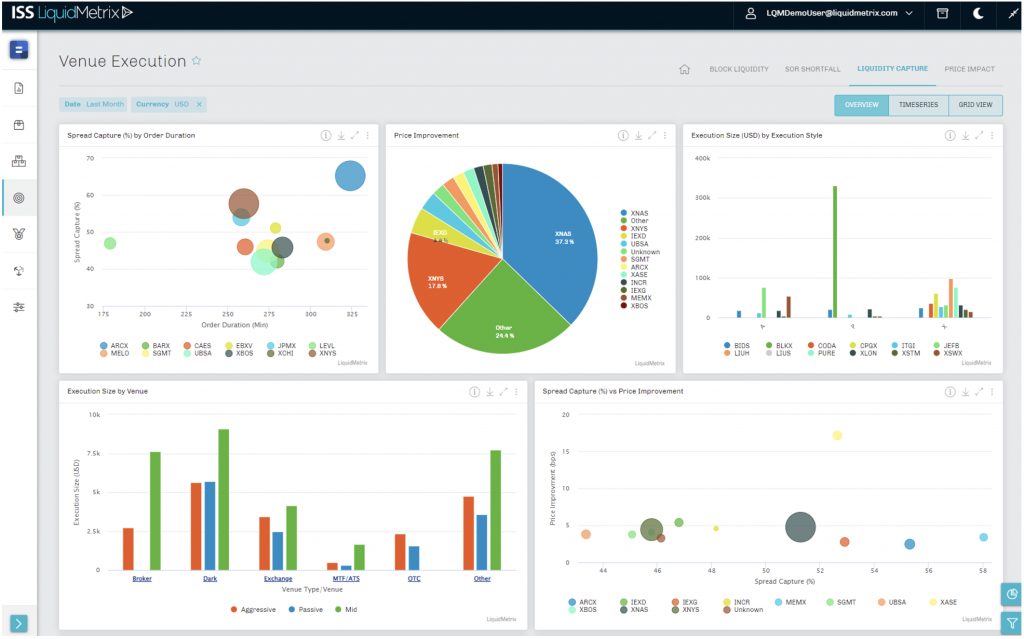

Be prepared to answer any question from your clients with information on fill rates, price improvement, speed of execution, leakage and other metrics critical for creating a strong best execution process. Leveraging robust reporting and visualization tools like those supplied by ISS LiquidMetrix can help asset owners to effectively surveil trading activity downstream and help mitigate reputational risk associated with non-compliance on the part of their counterparties.

By: Henry Yegerman, Associate Director, ISS LiquidMetrix

For more information, please reach out at: